[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

NEW DELHI

NOTIFICATION NO

37/2023, Dated: June 12, 2023

G.S.R. 432(E).- In exercise of the powers conferred by section 245Q read with section 295 of the Incometax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend Income-tax Rules, 1962, namely: --

1. Short title and commencement.-- (1) These rules may be called the Income-tax (Ninth Amendment) Rules, 2023.

(2) They shall come into force from the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962, (hereinafter referred to as the said rules), in rule 44E, for sub-rule (2), the following sub-rule shall be substituted, namely:-

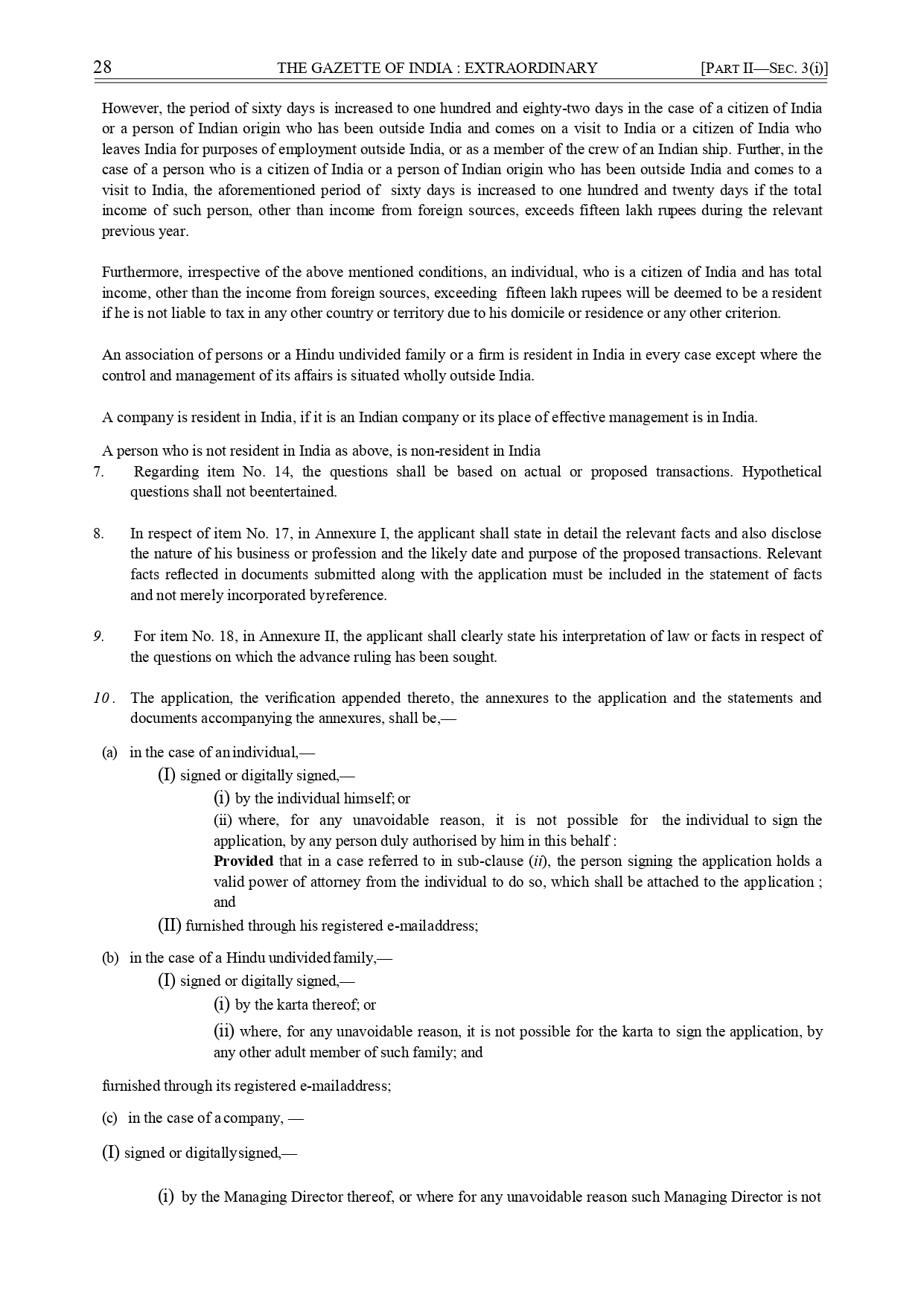

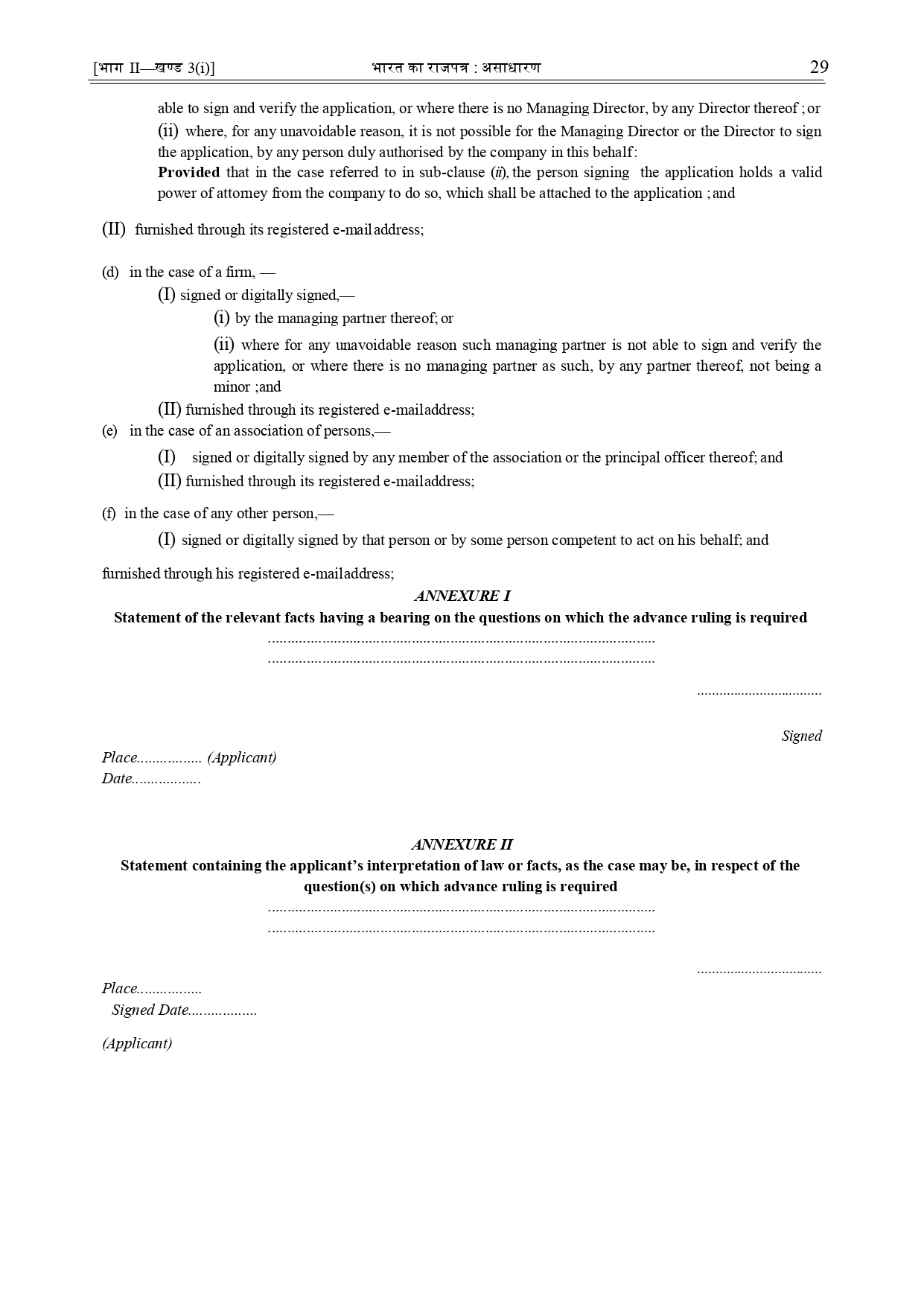

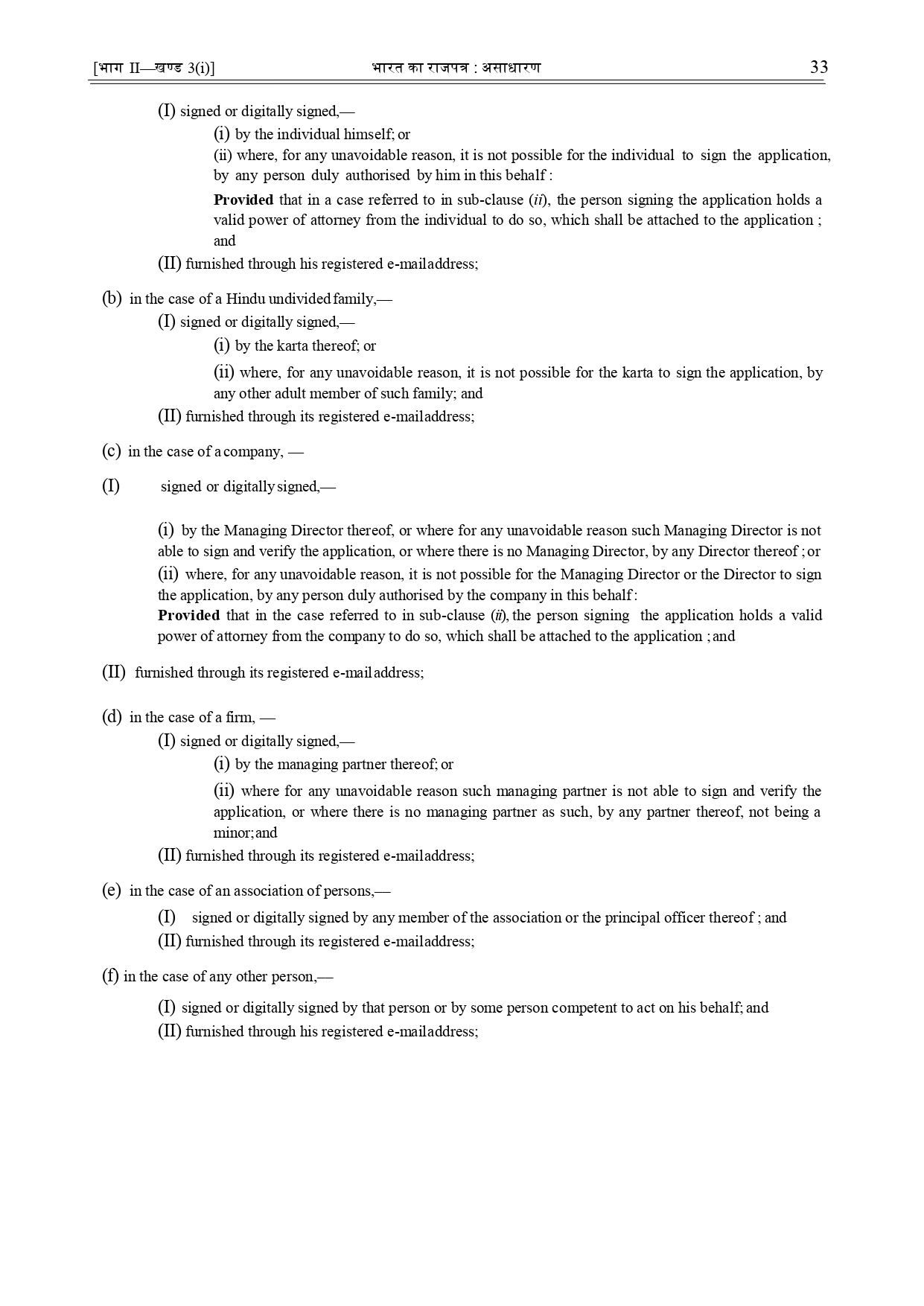

"(2) The application referred to in sub-rule (1), the verification appended thereto, the annexures to the said application and the statements and documents accompanying the annexures, shall be,- (a) in the case of an individual,-

(I) signed or digitally signed,--

(i) by the individual himself; or

(ii) where, for any unavoidable reason, it is not possible for the individual to sign the application, by any person duly authorised by him in this behalf:

Provided that in a case referred to in sub-clause (ii), the person signing the application holds a valid power of attorney from the individual to do so, which shall be attached to the application; and

(II) furnished through his registered e-mail address;

(b) in the case of a Hindu undivided family,-

(I) signed or digitally signed,--

(i) by the karta thereof; or

(ii) where, for any unavoidable reason, it is not possible for the kartato sign the application, by any other adult member of such family; and

(II) furnished through its registered e-mail address;

(c) in the case of a company, -

(I) signed or digitally signed,-

(i) by the Managing Director thereof; or where for any unavoidable reason such Managing Director is not able to sign and verify the application, or where there is no Managing Director, by any Director thereof; or

(ii) where, for any unavoidable reason, it is not possible for the Managing Director or the Director to sign the application, by any person duly authorised by the company in this behalf: Provided that in the case referred to in sub-clause (ii), the person signing the application holds a valid power of attorney from the company to do so, which shall be attached to the application; and

(II) furnished through its registered e-mail address;

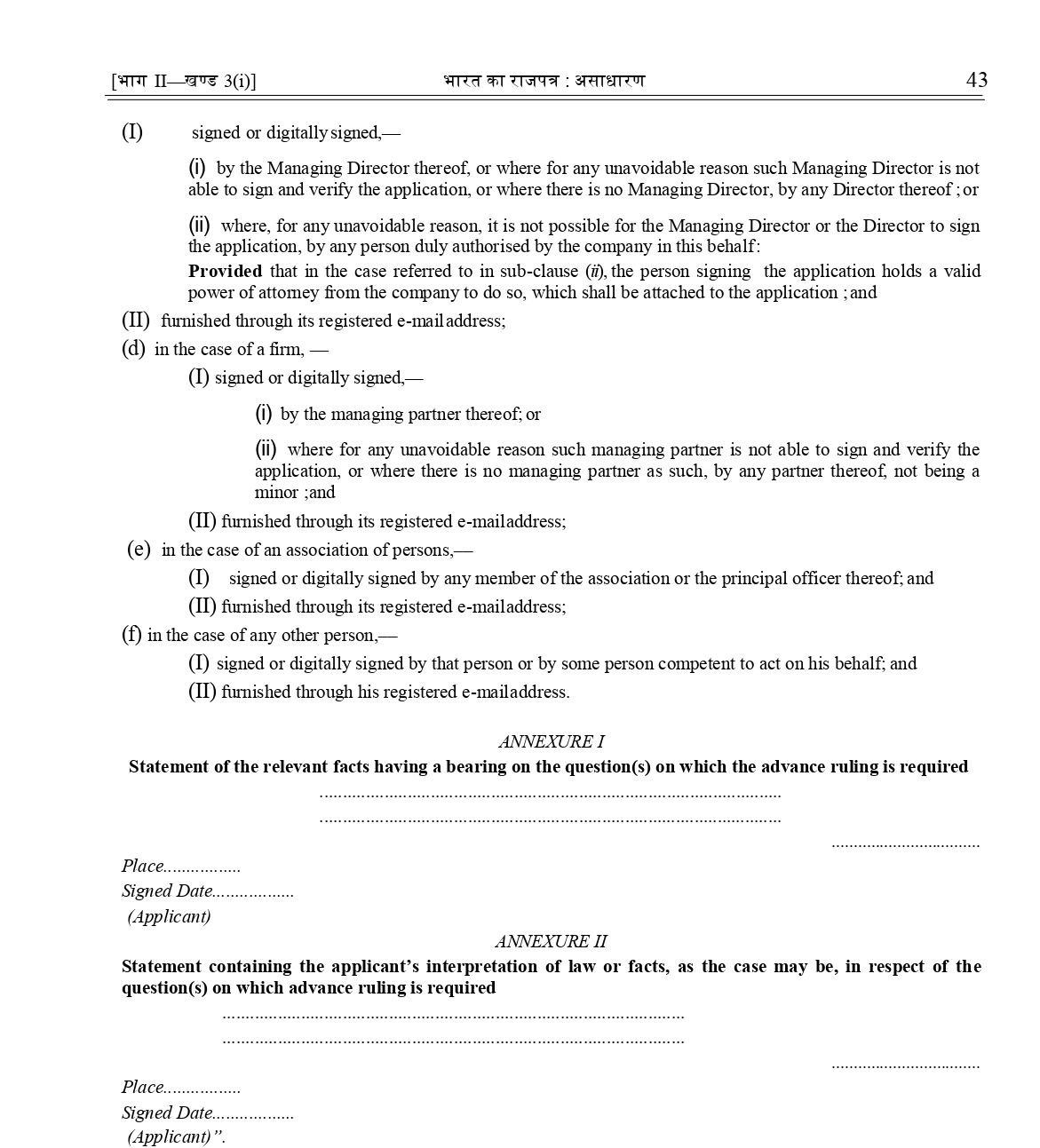

(d) in the case of a firm, -

(I) signed or digitally signed,--

(i) by the managing partner thereof; or

(ii) where for any unavoidable reason such managing partner is not able to sign and verify the application, or where there is no managing partner as such, by any partner thereof, not being a minor; and

(II) furnished through its registered e-mail address;

(e) in the case of an association of persons,--

(I) signed or digitally signed by any member of the association or the principal officer thereof; and

(II) furnished through its registered e-mail address;

(f) in the case of any other person,--

(I) signed or digitally signed by that person or by some other person competent to act on his behalf; and

(II) furnished through his registered e-mail address.

3. In the said rules, in rule 44F,-

(i) in the marginal heading, for the word "Authority", the word "Board" shall be substituted;

(ii) for the word "Authority" at both the places where they occur, the word "Board" shall be substituted, in both places.

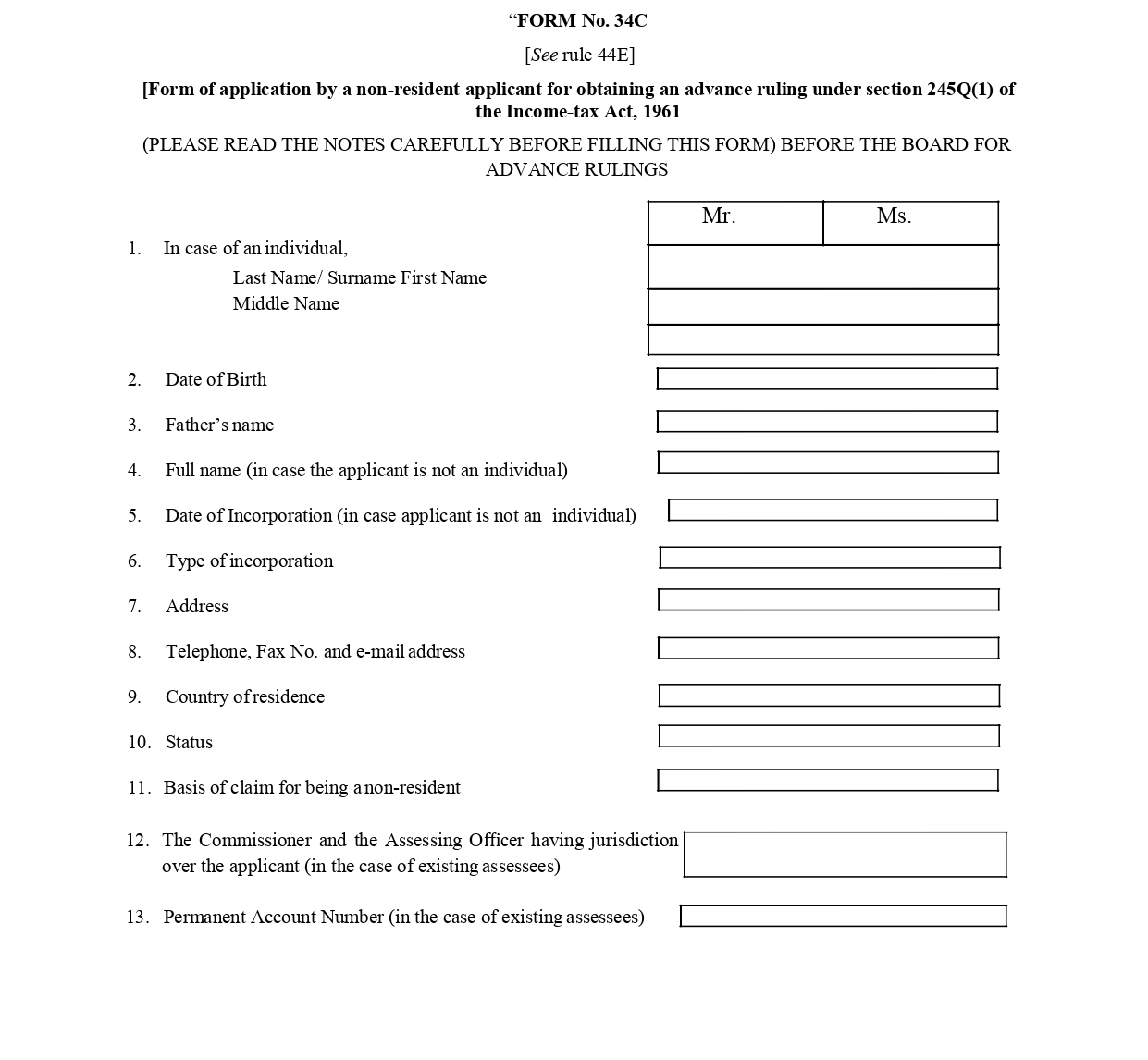

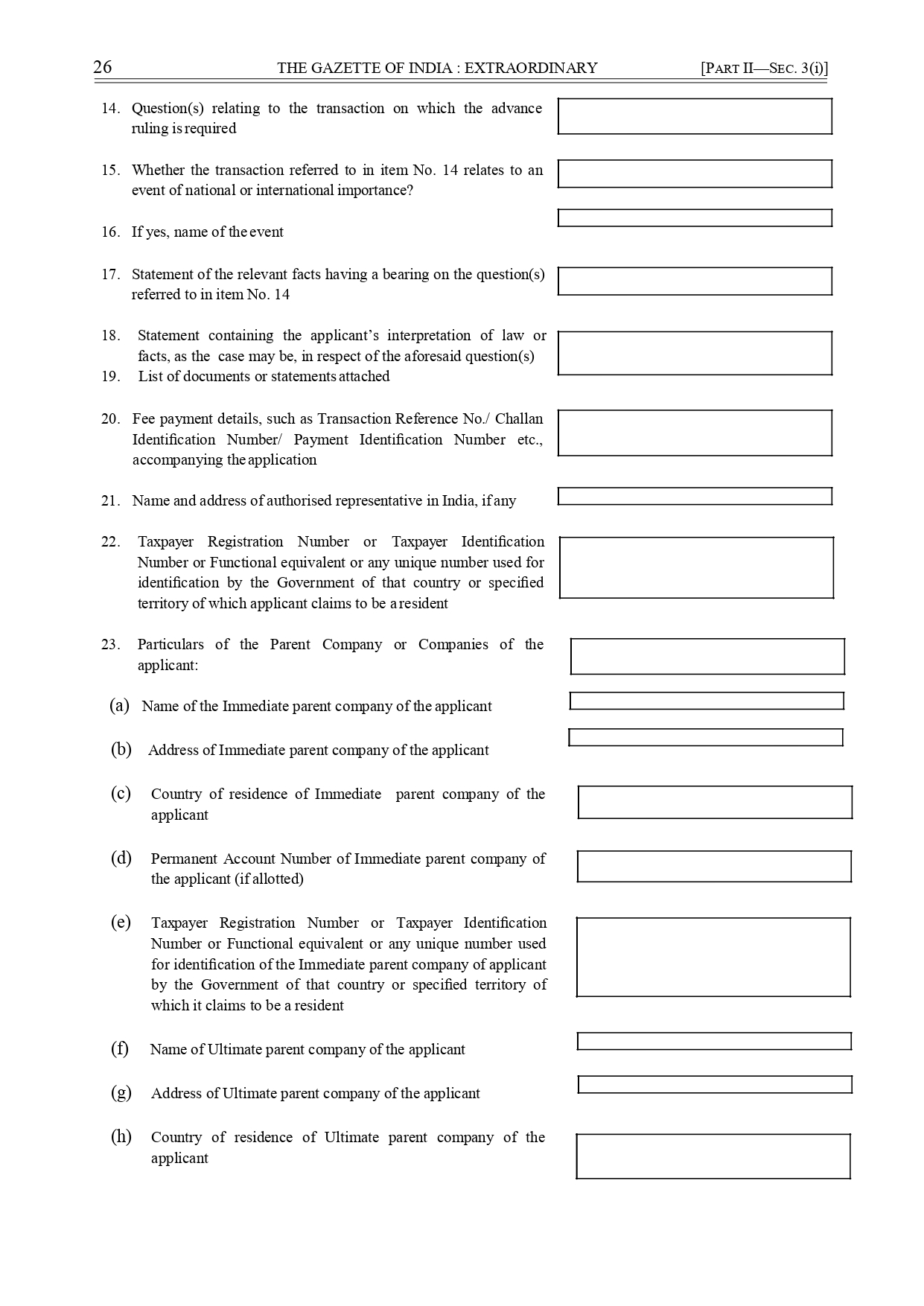

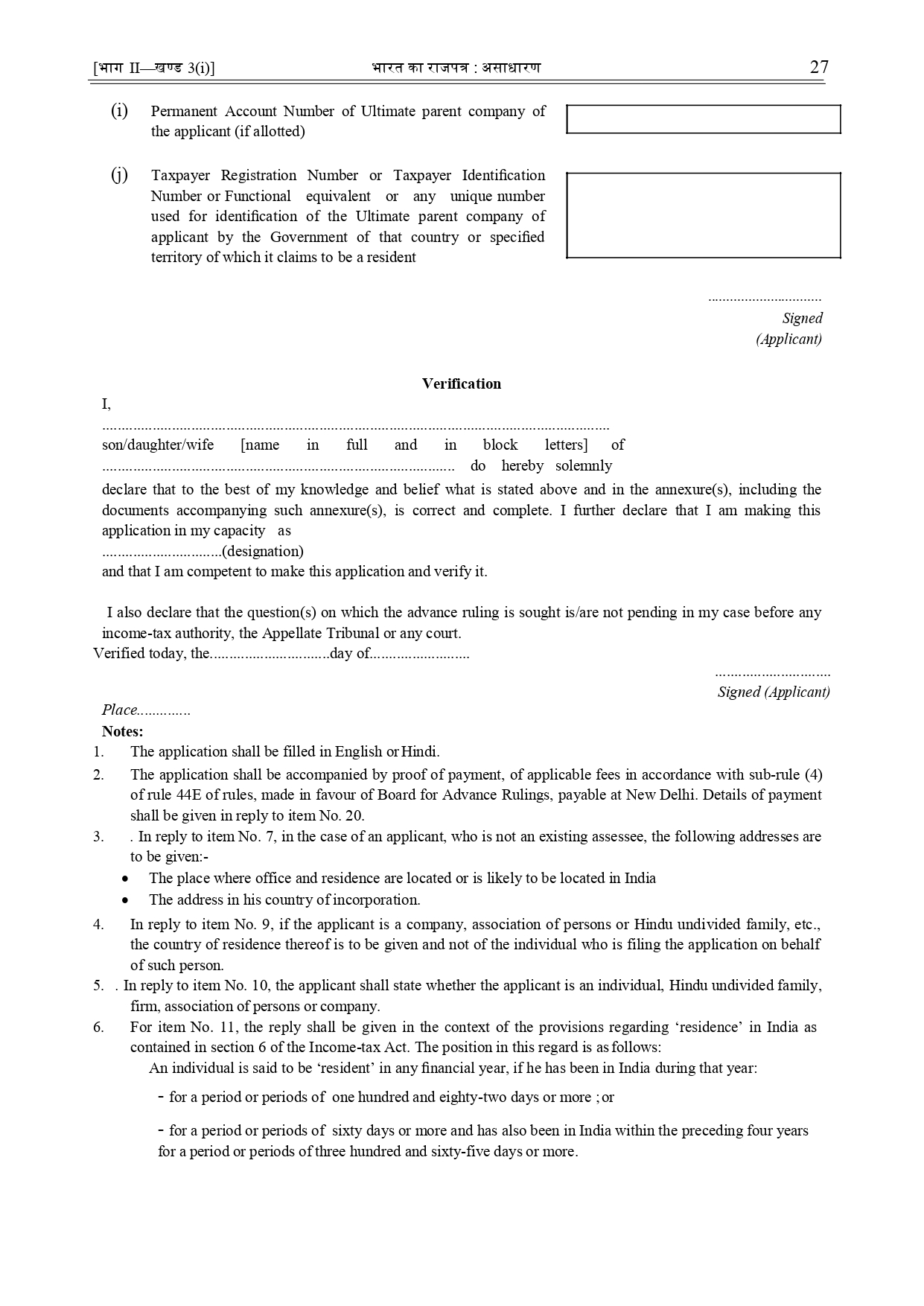

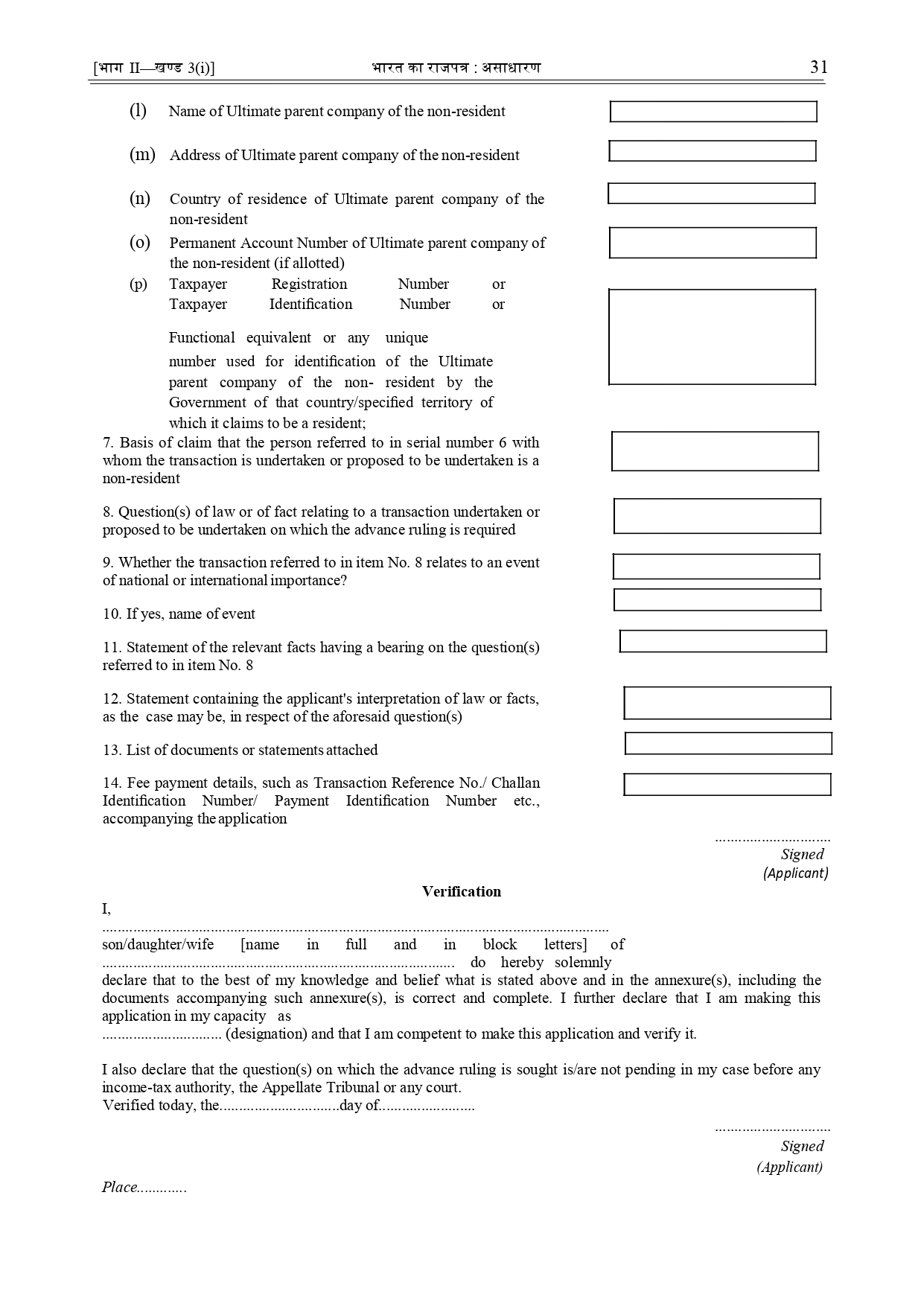

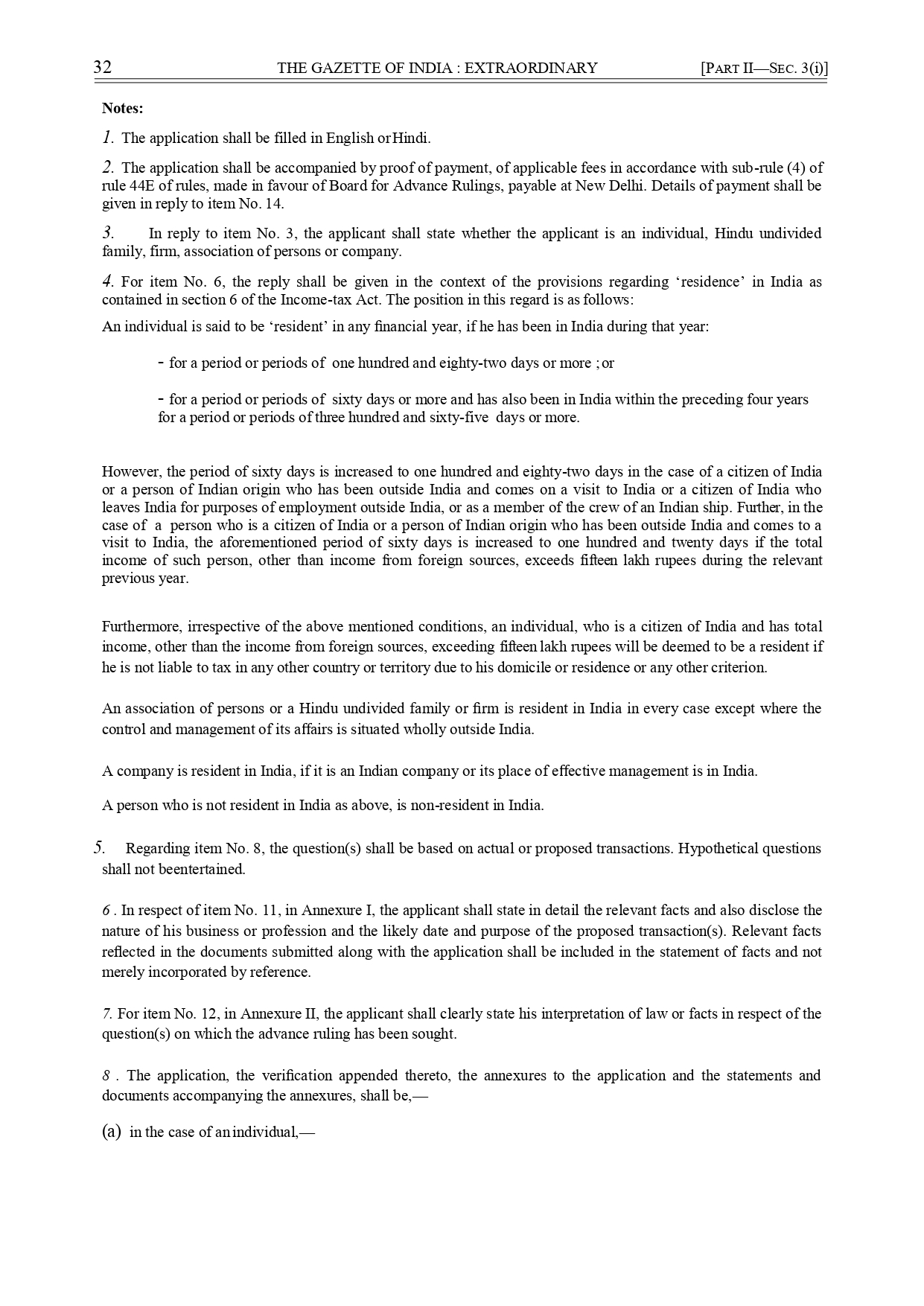

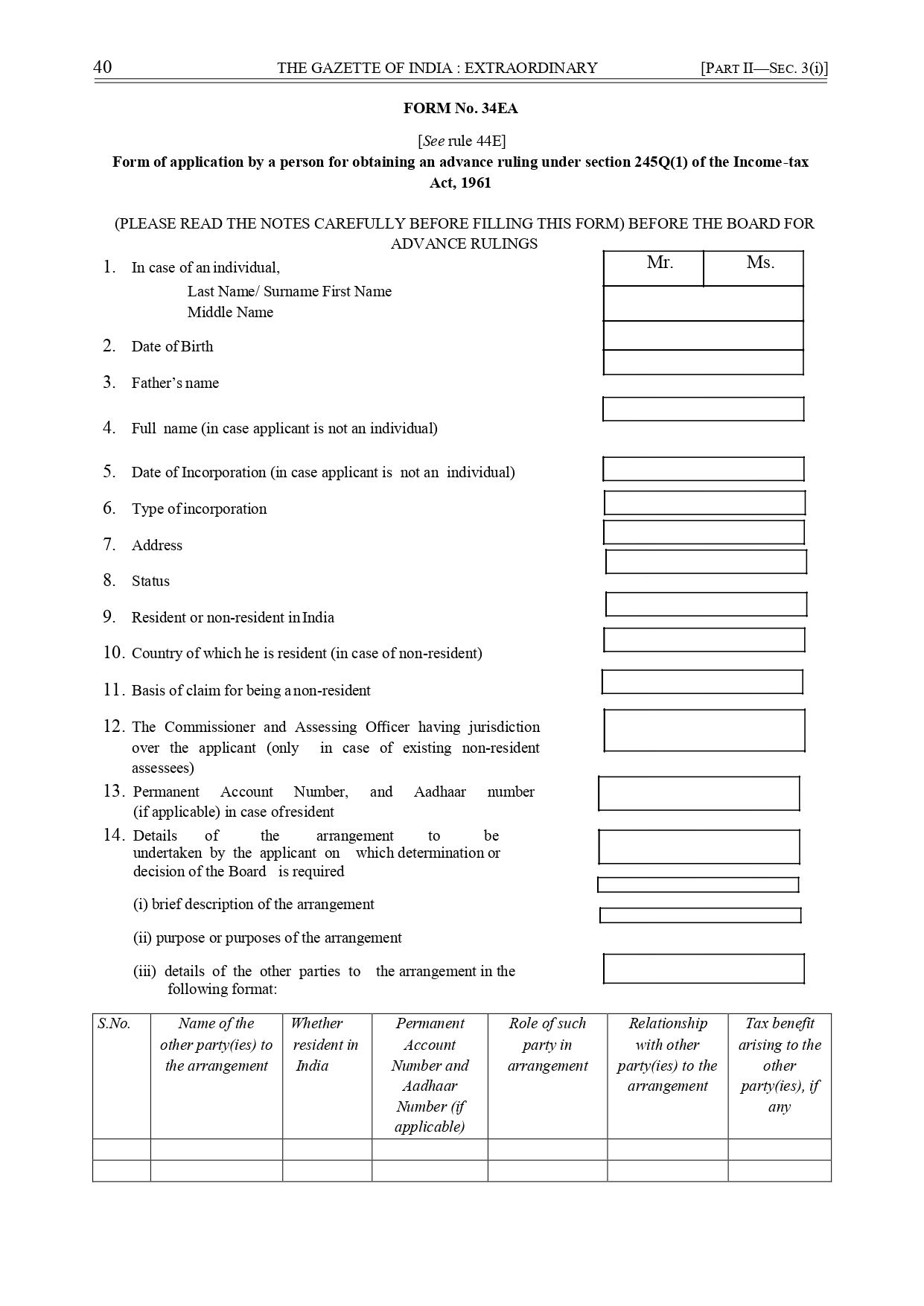

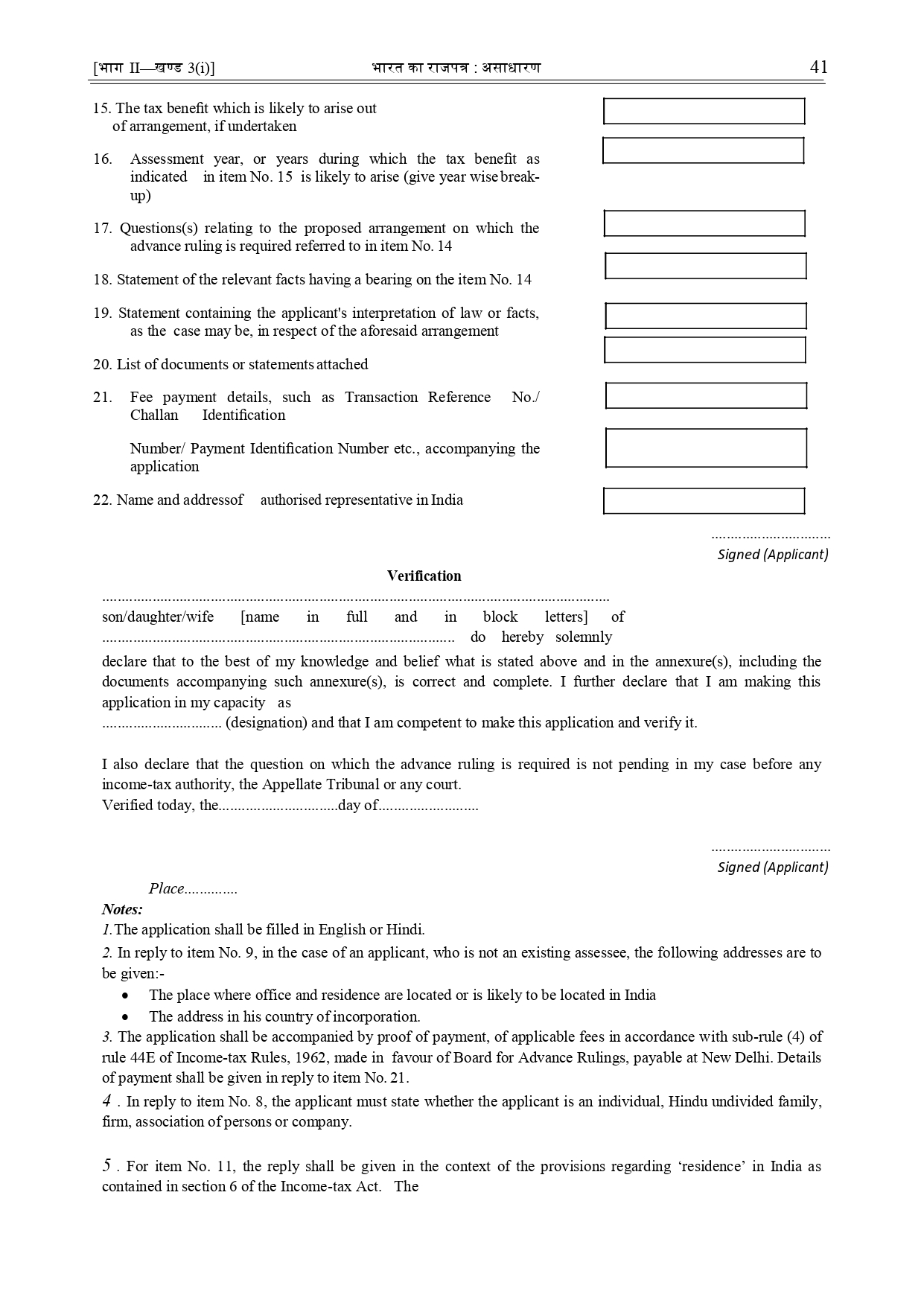

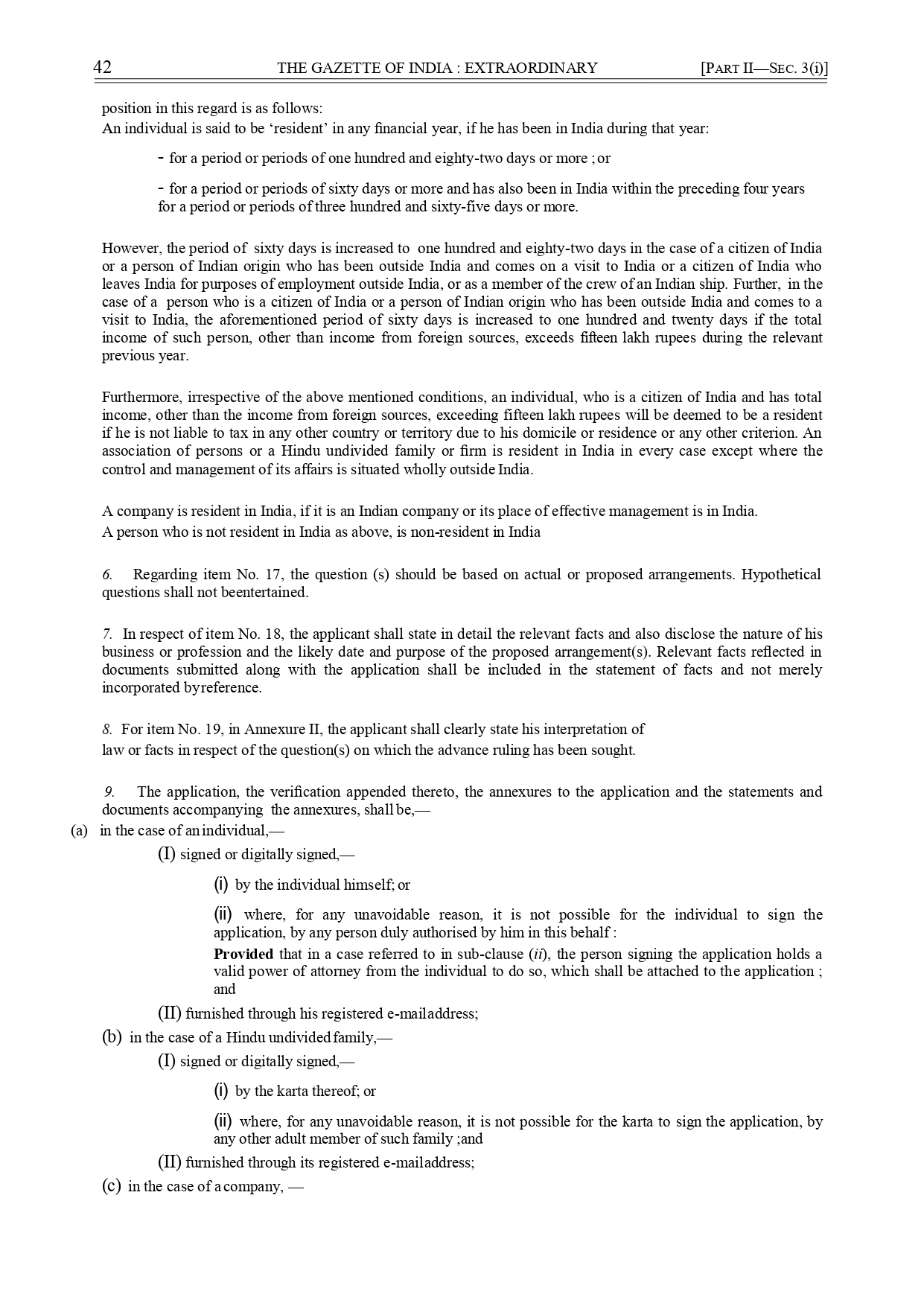

4. In the said rules, in Appendix-II, for the Forms -FORM No. 34C to FORM No. 34EA, the following Forms shall be substituted, namely:-

[F.No. 370142/62/2021-TPL(Part-III)]

(Prajna Paramita)

Director

Note: The principal rules were published in the Gazette of India, Extraordinary, Part-II Section-3, Sub-Section (ii) vide number S.O. 969(E) dated the 26th March, 1962 and were last amended vide notification No. G.S.R. 403 (E), dated the 31st May, 2023. |