[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

NEW DELHI

NOTIFICATION NO

07/2023, Dated: February 21, 2023

G.S.R. 118(E).- In exercise of the powers conferred by clause (b) of the tenth proviso to clause (23C) of section 10, sub-clause (ii) of clause (b) of sub-section (1) of section 12A read with section 295 of the Income-tax Act, 1961 (43 of 1961)(hereinafter referred to as the Act), the Central Board of Direct taxes hereby makes the following rules further to amend the Income-tax Rules,1962, namely:─

1. Short title and commencement. - (1) These rules may be called the Income-tax Amendment (3rd Amendment) Rules, 2023.

(2) They shall come into force from the 1st day of April, 2023.

2. In the Income-tax Rules, 1962 hereinafter referred to as the principal Rules, for rule 16CC, the following rule shall be substituted, namely:-

'16CC.Form of report of audit prescribed under tenth proviso to section 10(23C).-The report of audit of the accounts of a fund or institution or trust or any university or other educational institution or any hospital or other medical institution which is required to be furnished under clause (b) of the tenth proviso to clause (23C) of section 10 shall be in-

(a) Form No. 10B where-

(I) the total income of such fund or institution or trust or university or other educational institution or hospital or other medical institution, without giving effect to the provisions of the sub-clauses (iv), (v), (vi) and (via) of the said clause, exceeds rupees five crores during the previous year; or

(II) such fund or institution or trust or university or other educational institution or hospital or other medical institution has received any foreign contribution during the previous year; or

(III) such fund or institution or trust or university or other educational institution or hospital or other medical institution has applied any part of its income outside India during the previous year;

(b) Form No. 10BB in other cases.

Explanation.- For the purposes of sub-clause (II) of clause (a), the expression "foreign contribution" shall have the same meaning assigned to it in clause (h) of sub-section (1) of section 2 of the Foreign Contribution (Regulation) Act, 2010 (42 of 2010).’.

3. In the principal Rules, for rule 17B, the following rule shall be substituted, namely:-

'17B.Audit report in the case of charitable or religious trusts, etc.- The report of audit of the accounts of a trust or institution which is required to be furnished under sub-clause (ii) of clause (b) of sub-section (1) of section 12A, shall be in-

(a) Form No. 10B where-

(I) the total income of such trust or institution, without giving effect to the provisions of sections 11 and 12 of the Act, exceeds rupees five crores during the previous year; or

(II) such trust or institution has received any foreign contribution during the previous year; or

(III) such trust or institution has applied any part of its income outside India during the previous year;

(b) Form No. 10BB in other cases.

Explanation.- For the purposes of sub-clause (II) of clause (a), the expression foreign contribution shall have the same meaning assigned to it in clause (h) of sub-section (1) of section 2 of the Foreign Contribution (Regulation) Act, 2010 (42 of 2010).’.

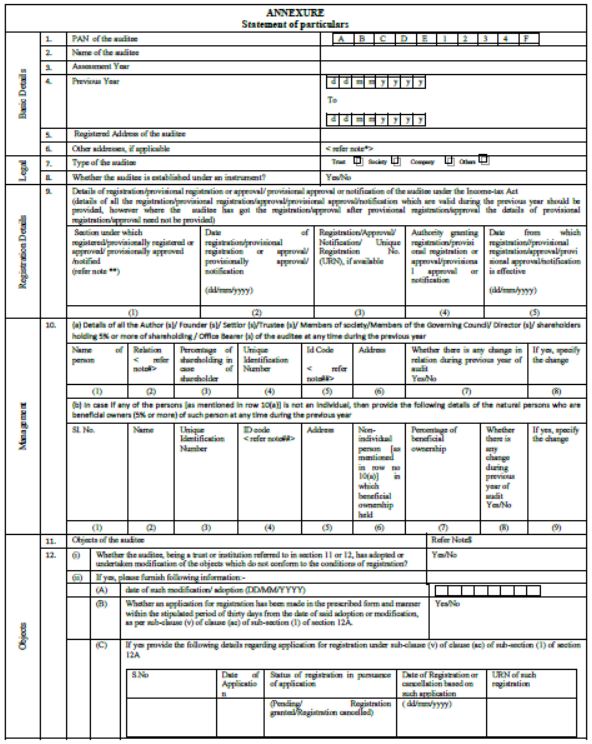

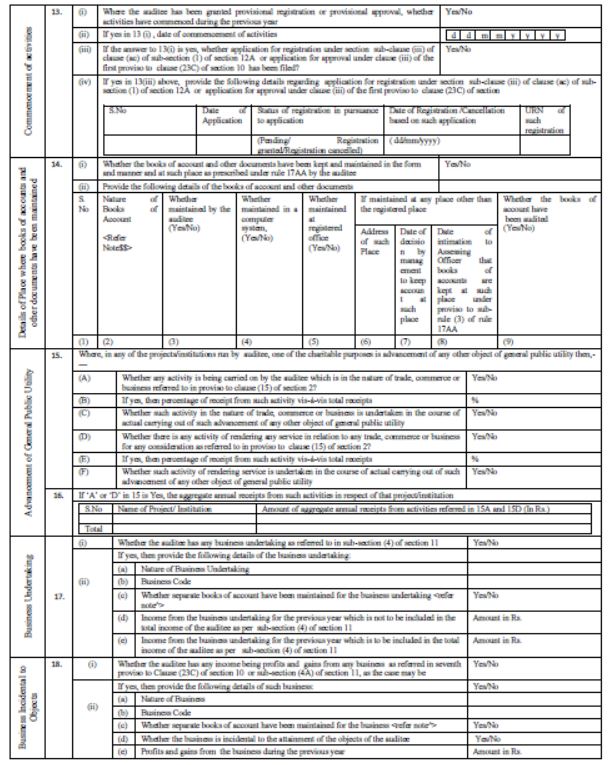

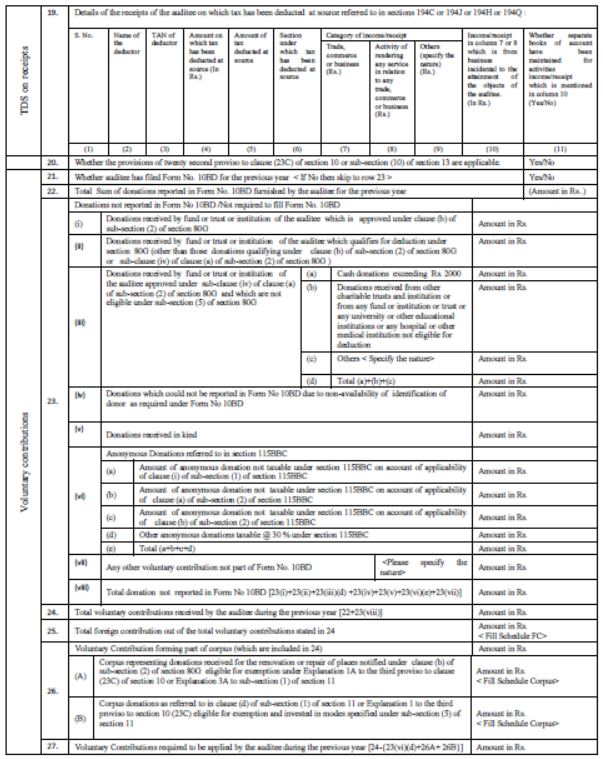

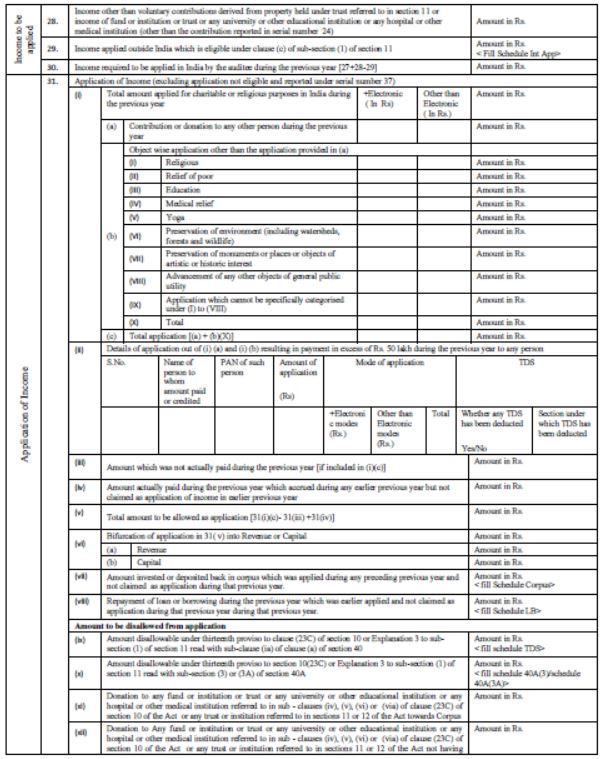

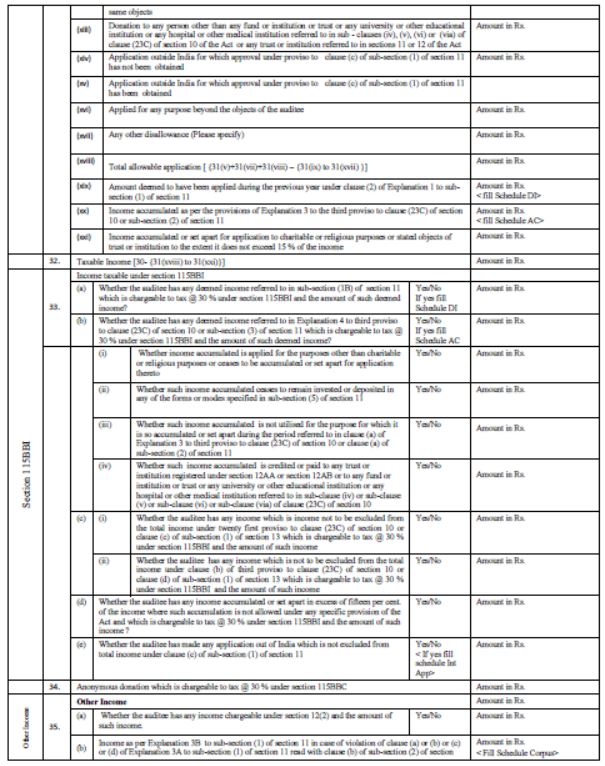

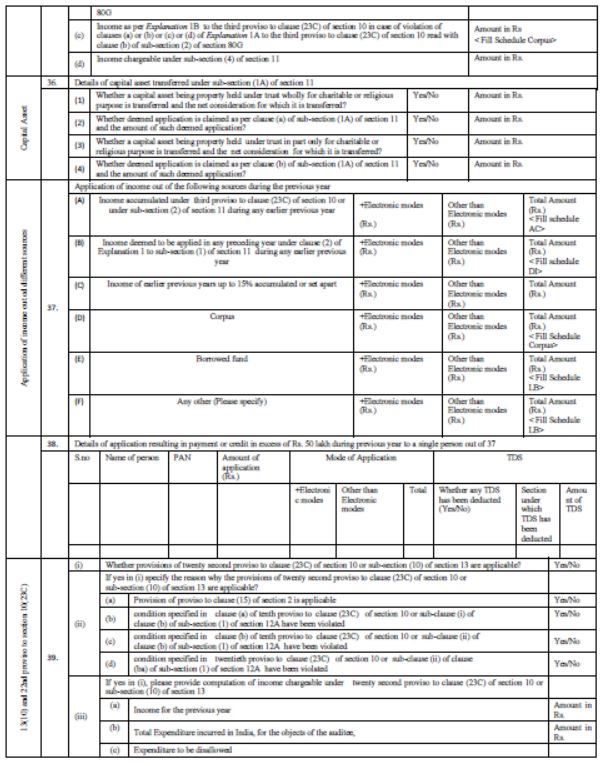

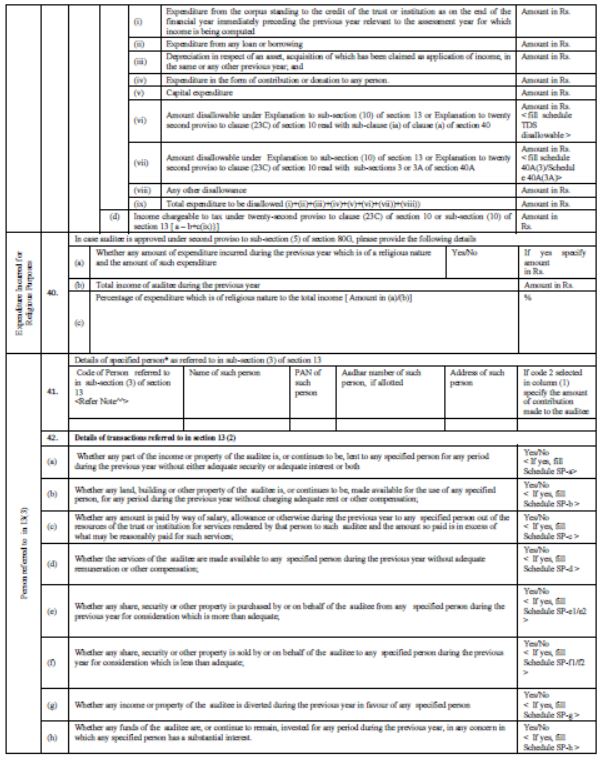

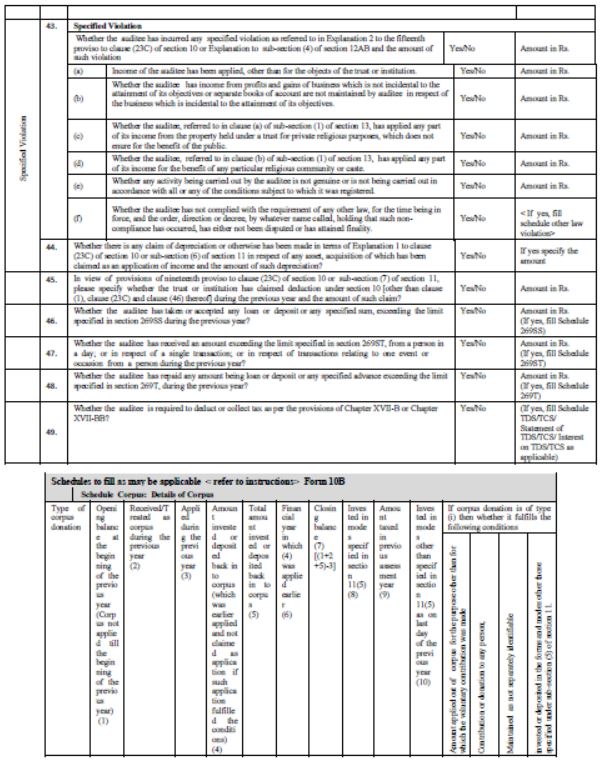

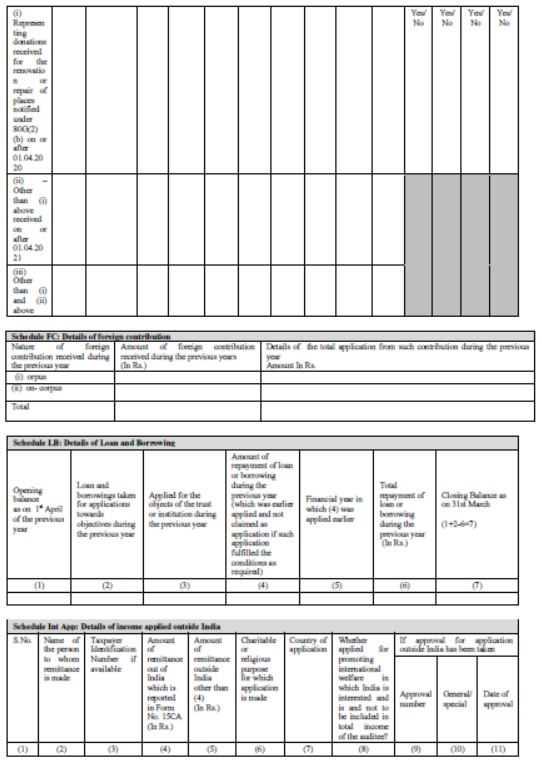

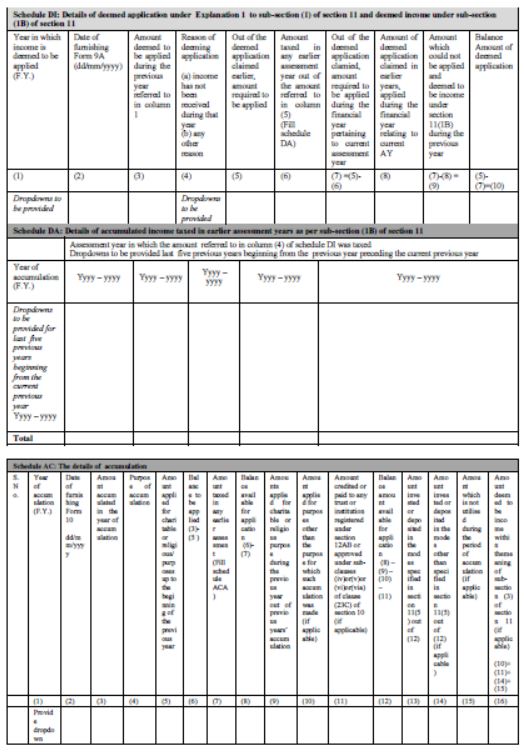

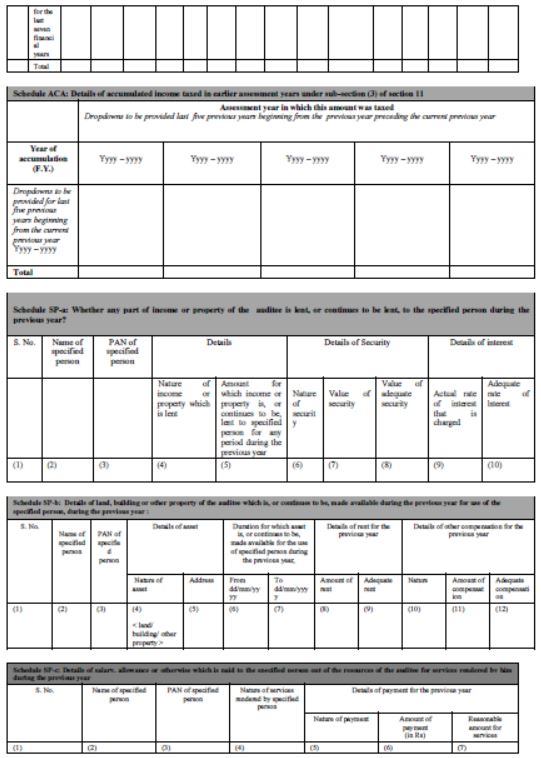

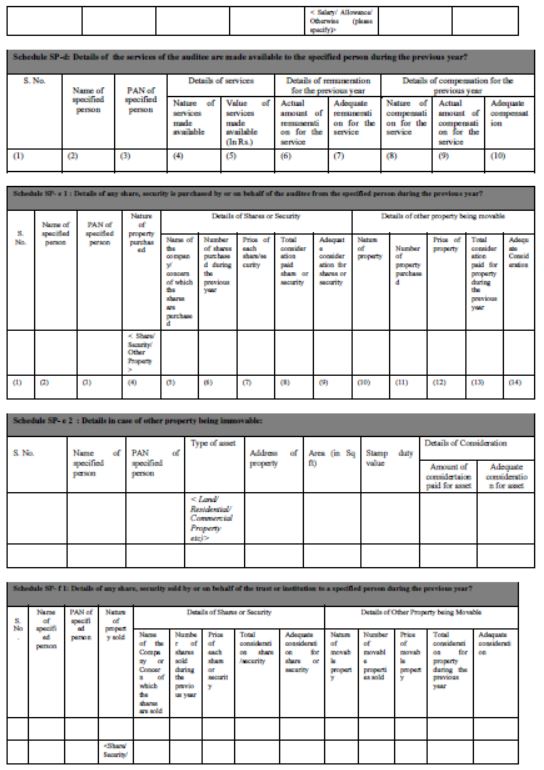

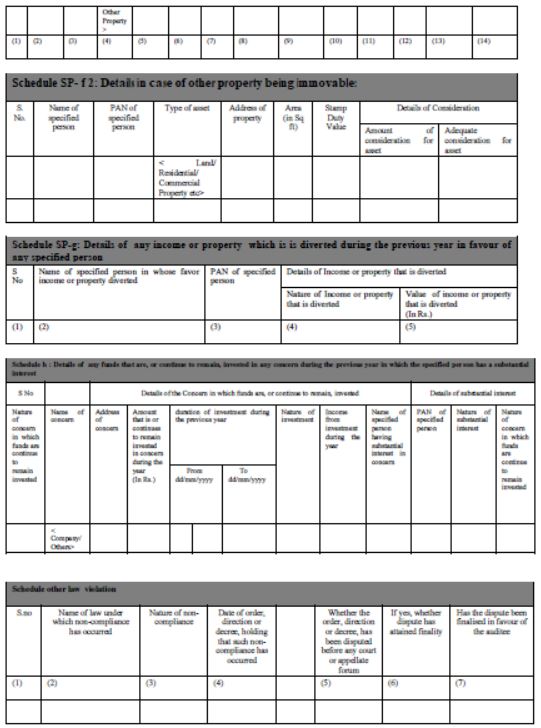

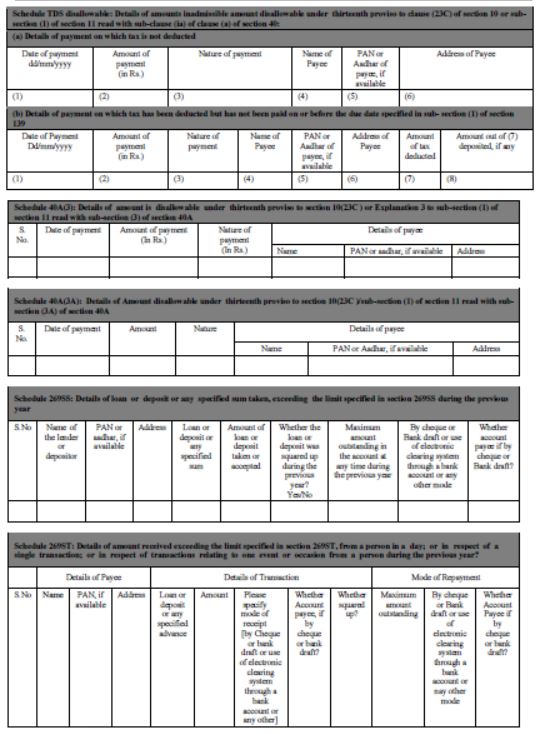

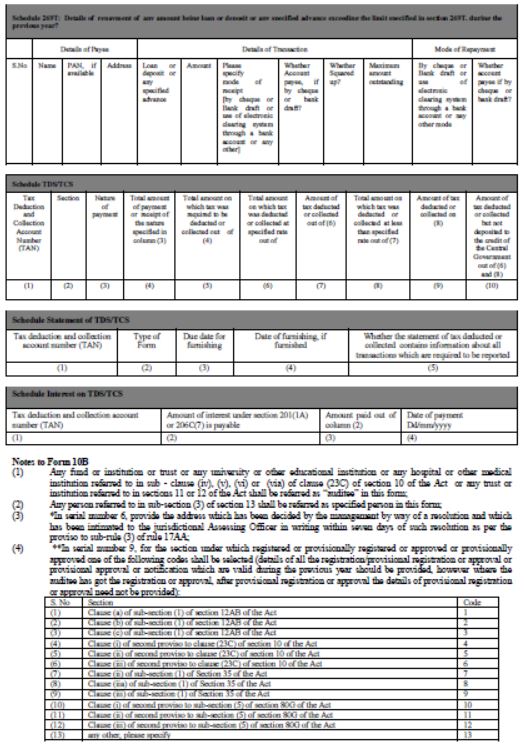

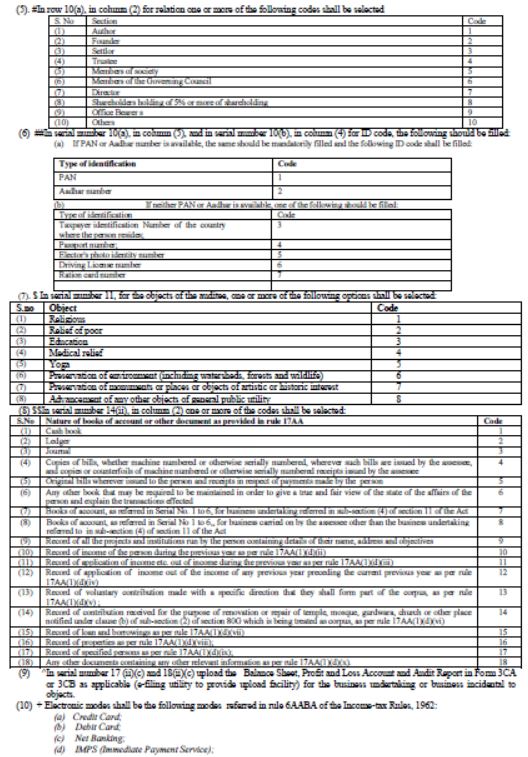

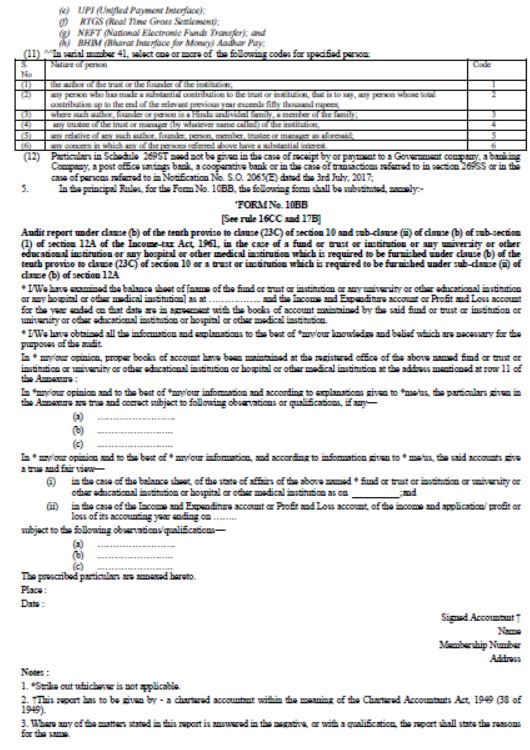

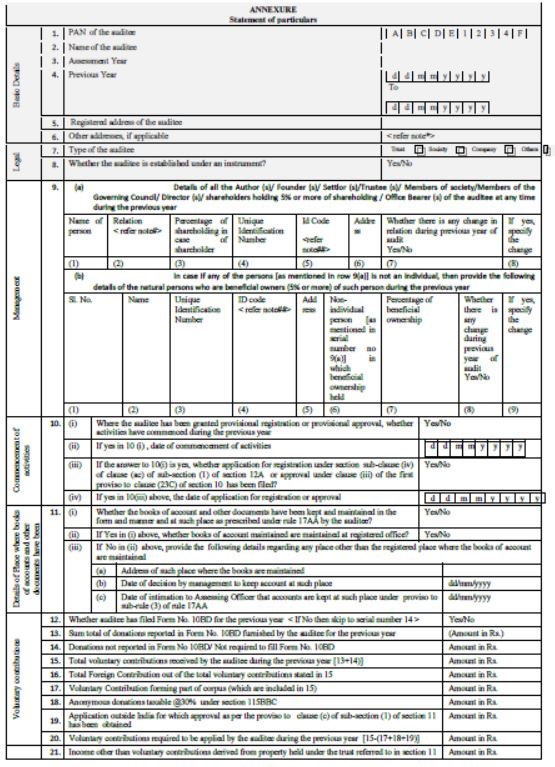

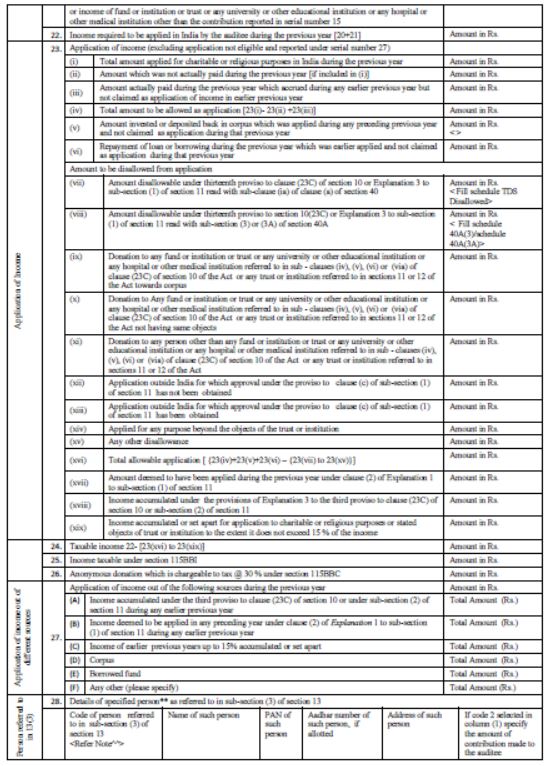

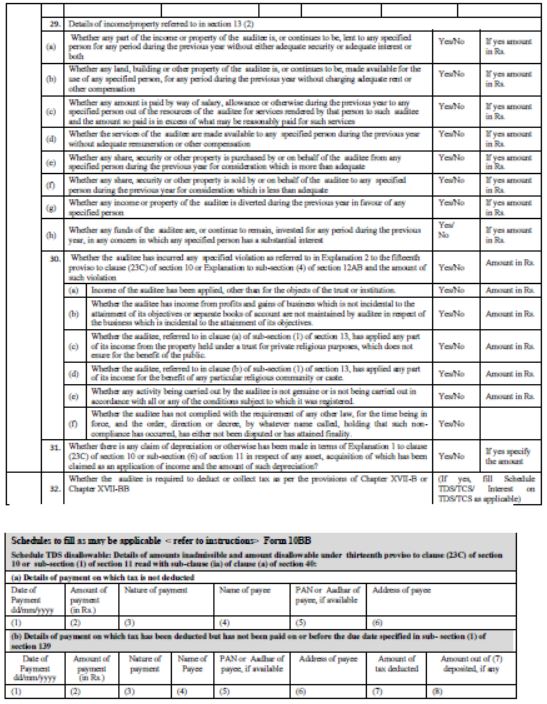

4. In the principal Rules, for Form no. 10B, the following form shall be substituted, namely:-

'FORM No. 10B

[See rule 16CC and 17B]

Audit report under clause (b) of the tenth proviso to clause (23C) of section 10 and sub-clause (ii) of clause (b) of subsection (1) of section 12A of the Income-tax Act, 1961, in the case of a fund or trust or institution or any university or other educational institution or any hospital or other medical institution.

* I/We have examined the balance sheet of [name of the fund or trust or institution or any university or other educational institution or any hospital or other medical institution] as at …………….. and the Income and Expenditure account or Profit and Loss account for the year ended on that date are in agreement with the books of account maintained by the said fund or trust or institution or university or other educational institution or hospital or other medical institution.

* I/We have obtained all the information and explanations to the best of *my/our knowledge and belief which are necessary for the purposes of the audit.

In * my/our opinion, proper books of account have been maintained at the registered office of the above named fund or trust or institution or university or other educational institution or hospital or other medical institution at the address mentioned at serial number 14 of the Annexure:

In *my/our opinion and to the best of *my/our information and according to explanations given to *me/us, the particulars given in the Annexure are true and correct subject to following observations or qualifications-

(a) …………………….

(b)..…………………..

(c)..…………………..

In * my/our opinion and to the best of * my/our information, and according to information given to * me/us, the said accounts give a true and fair view-

(i) in the case of the balance sheet, of the state of affairs of the above named * fund or trust or institution or university or other educational institution or hospital or other medical institution as on __________;and

(ii) in the case of the Income and Expenditure account or Profit and Loss account, of the income and application or profit or loss of its accounting year ending on ……..

subject to the following observations/qualifications-

(a) …………………….

(b)..…………………..

(c)..…………………..

The prescribed particulars are annexed hereto.

Place.

Date.

Signed Accountant †

Name

Membership Number

Address

Notes:

1. *Strike out whichever is not applicable.

2. †This report has to be given by - a chartered accountant within the meaning of the Chartered Accountants Act, 1949 (38 of 1949).

3. Where any of the matters stated in this report is answered in the negative, or with a qualification, the report shall state the reasons for the same.

[F. No.370142/47/2023-TPL]

(Vipul Agarwal) Director

(Tax Policy and Legislation Division)

Note. - The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide notification number S.O. 969(E), dated the 26th March, 1962 and was last amended vide notification number G.S.R. 95 (E), dated 14th February, 2023.

Download Form |