1. Setting up a unit linked life insurance policy Is usually quite straightforward, simple and unproblematic. It is similar to opening an overseas bank account, which for most countries has been getting progressively easier as the world opens up and becomes more transparent. For some countries, things have been heading in the other direction. The USA most recently with the imposition of the Foreign Account Tax Compliance Act (FATCA) and the Dodd Frank Act.

A good way to achieve opening an account, keep things private at the same time and gain many other advantages, including tax deferral through to tax exemption on gains, is through life insurance.

To open a bank account, traditionally, the client has come to Switzerland to open an account. Or a bank relationship manager goes to the clients country and identifies him there. In some countries this can have disadvantages. In China for example where the client can be filmed going into a bank. Often the best way is to meet in a relatively neutral 3rd country, where the necessary documentation can be filled out.

Using insurance, we open the account indirectly. The client is not opening an account, he is purchasing an insurance policy. This policy is:

- A product

- A legally enforceable contract

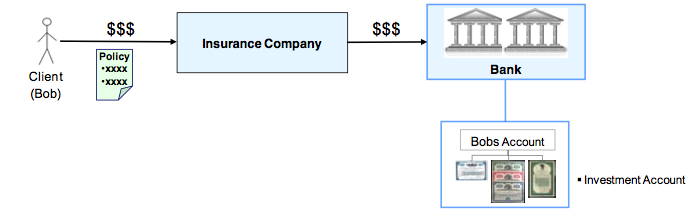

The client becomes the policyholder, he owns the contract. The contract retains rights to the underlying assets. These rights are enforceable in the courts of the jurisdiction in which the policy was issued. When the policy is purchased, the insurance company opens the bank account for the client. Ie., the client does not have a bank account, he owns an insurance policy, which is an enforceable contract. The figure below shows how it works.

Figure 1: Purchasing the policy and setting up the account

To set up the account, the client – “Bob” – pays money across to the insurance company, purchasing an insurance policy. Bob now owns that insurance policy, which in turn has the right to the money in the account.

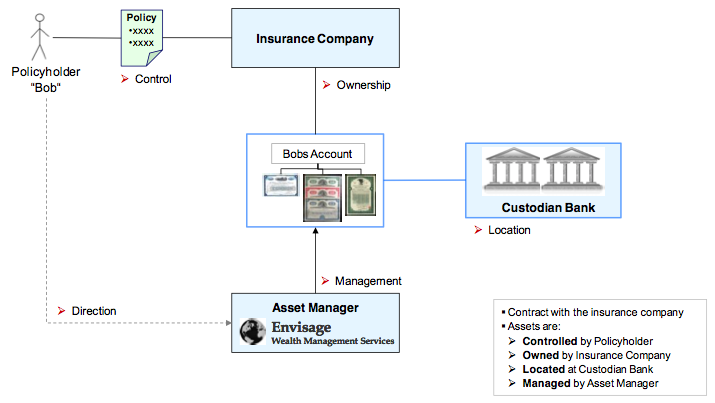

Bob nominates an asset manager – Envisage – to manage the account. Figure 2 below shows how this works.

Figure 2: Set up, participants involved and separation of control and ownership

Bob chooses an investment strategy, Envisage manages the account - buying and selling securities according to the guidelines in that strategy - over the term of the policy. Ie., Envisage buys securities – stock, bonds, mutual funds, precious metals, hedge fund units, etc. according to the asset allocation guidelines in the investment strategy Bob has chosen for the insurance contract. I.e., Bobs wishes are carried out.

In this way:

- Bob is not the account owner

- The insurance company is the account owner

- Control, ownership, location and management of the assets are separated.

The point:

Bob - the client - can keep control over the assets, even though he does not own the account.

If Bob is sued, divorced, goes bankrupt, etc, there is full protection of the assets. As Bob does not own the assets, the creditor cannot access the assets. It is the same in divorce cases. Because the assets are removed from the estate, the ex-spouse cannot get at the assets in the policy. Nor can any other plaintiff. The insurance company is not obliged to follow a foreign court order or judgement. Assuming the jurisdiction has strong asset protection laws and the policy was set up properly, Bob has full asset protection, no matter what.

Note that for the asset protection to hold, the policy must be set up at least 12 months before the start of any bankruptcy proceedings. If the policyholder files for bankruptcy within 12 months of setting up the policy, a creditor may be able to claim on the grounds of fraudulent conveyance.

2. What is unit linked life insurance?

It comes in three main flavours:

| Type |

Characteristics |

| Deferred Variable Annuities (DVA) |

Assets are primarily held for use by client in his or her retirement |

| Variable Unit Linked Life Insurance (VUL) |

Assets are primarily held for the next generation and significant extra liquidity is needed |

| Frozen Cash Value (FCV) |

Assets are primarily held for the next generation and extra liquidity is not the main need, or client may not be eligible for significant extra death cover |

With the DVA and VUL, the cash value is dependent on or linked to the value of the securities underlying or “wrapped” in the policy. In substance it is usually a segregated managed account "wrapped" in an insurance policy, with the insurance structure conferring certain benefits to the investor.

With the Frozen Cash Value (FCV) policy, the reportable value of the policy remains frozen, or constant. I.e., if CHF 1 Mio. is paid in, after 10 years, the value will still be CHF 1 Mio. Returns however accumulate tax free as with the DVA and VUL. On the death of the insured person, the beneficiary receives the death benefit – the value of the policy plus the returns - tax free. Surrender of the paid in premium is possible at any time. You have to wait until the death of the insured person however to receive the gains on the policy.

For the DVA and VUL, the value of the policy follows the increase and decrease in the value of the investments underlying the policy. I.e., the policy cash surrender value as well as the payout in the event of death vary according to the value of the underlying assets. There may or may not be a risk component (biometric risk) to the policy. The policyholder may choose periodically (e.g., annually) the investment strategy (conservative, balanced, aggressive, etc). The policyholder generally nominates the asset manager of the underlying assets. A DVA is purchased with a defined maturity or accumulation period, whereas VUL tends to be whole life or have a long accumulation period.

3. Benefits of Life Insurance Solutions

Life insurance can be used to preserve and increase wealth as well as pass it on to the next generation in a very tax-efficient manner. The main benefits are taken in turn.

3.1. Tax planning and optimisation

In general, a life insurance policy enjoys full tax deferral during buildup. I.e., there is no tax on income or capital gains on assets in the portfolio during the accumulation period.

On maturity of the policy, the payout is split into two; principal and gain. On payout. the gain is generally taxed at either the beneficiaries marginal rate or a reduced rate. In many jurisdictions, if the benefit is paid upon the death of the insured person, the beneficiaries receive the full payout (principal and gain) tax-free. This is one of the main attractions of life insurance; for succession planning, properly set up, the entire payout when the insured event takes place can be completely free of tax.

Every jurisdiction has its own rules and varying treatments on taxation of life insurance. One more source of variation that can make this so confusing and competent tax counsel is essential.

Insurance can offer significant relief from income and inheritance taxes. In order to benefit from tax advantages, the life insurance policy must comply with the tax regulations in the policyholders country of residence. For example, a certain minimum term may be required or the insurance must include a certain amount of life cover (risk shift) with the investment component. Income (dividends, interest, etc.) and capital gains on assets placed in a life insurance policy are generally tax-free. Often the policy proceeds are tax free, i.e., the proceeds are paid net to the beneficiary. The assets paid into a life insurance policy do not constitute a gift as they are generally treated as a premium payment. Furthermore, these assets do not generally form part of the policyholder’s estate for inheritance or wealth tax purposes, since the nature of the policyholders interest in the assets is not that of an owner but the holder of an insurance policy. On maturity of the policy, capital gains may be tax-free in many countries, or taxed at a very low rate.

3.2. Asset Protection

The key is that legal title to the assets – ownership – passes from the policyholder to the insurance company. Essentially, the assets underlying the policy cannot be attached or accessed by a creditor or other claimant in a legal process. I.e., if the policyholder is sued, the plaintiff cannot get at the assets wrapped in the policy. An insurance policy may give an extraordinary level of asset protection if it meets certain conditions.

- The policyholder designates his spouse or descendants (i.e. children) as beneficiaries, or

- The policyholder designates anyone as an irrevocable beneficiary, and

- Designation of beneficiary occurred more than 12 months prior to bankruptcy proceedings or the seizure of assets, and;

- The designation of beneficiary was not made with the intent to damage creditors.

There are three main cases:

1. Asset Protection in case of bankruptcy

- The insurance policy will generally be protected by law against any debt collection procedures instituted by the creditors of the policy owner and will also not be included in bankruptcy proceedings.

2. Protection in case of a foreign judgment

- Even where a foreign judgment or court order expressly decrees the seizure of such policy, or its inclusion in the estate in bankruptcy, such an insurance policy may generally not be seized or included in the estate in bankruptcy.

3. Protection under duress

- If an insurer receives a letter from the policyholder revoking the beneficiary designation, the insurer may come to the conclusion that the instruction received from the policyholder does not express the policyholders true intent and was forced upon him by the foreign judge or court.

3.3. Inheritance and succession planning

Life insurance can enable the tax-efficient transfer of wealth from the older generation to the younger without the need for estate executors. It can under certain circumstances bypass forced heirship laws by removing the assets from the policyholders estate (the assets become the property of the insurer), though this depends on jurisdiction. Furthermore, legal disputes are rarer, it is exceedingly difficult to attack a life insurance policy and done properly it can be very cost-efficient.

Circumvention of forced heirship laws is possible in some jurisdictions as the policy is not included in the estate. For a European citizen with US Assets, this means no estate tax payable on US situs asset on the death of the insured person. For a US person, a trust owned life insurance policy can eliminate probate, both simplifying the process and saving on associated costs. Furthermore insurance solutions can substantially reduce the impact of estate tax up to complete circumvention.

3.4. Investment tool and control – investment direction

The policy holder has a very flexible choice of investments, virtually any bankable asset (and an astonishing range of non-bankable assets) can be “wrapped”. Essentially:

- The policyholder selects a broad investment strategy

- Asset manager has a discretionary mandate to manage the assets

- The asset manager is usually designated by policyholder but actually hired by the insurer

- A "Chinese Wall" to prevent direct communication between policyholder and investment manager is typically contractually agreed

Swiss and Liechtenstein insurance laws stipulate that contracts in which the policyholder bears the investment risk, the insurance company can in principle make use of any investment for which the policy holder is willing to accept the risk. The policyholder thus participates directly in the development of the investment. The insurance carrier sets up a depot account with the custodian bank for each individual policy, allowing individual assets to be assigned directly to individual policies. The policyholder can determine the investment strategy, designate the asset manager to implement the strategy. The asset manager implements the desired investment strategy in the account, the policyholders wishes may range from:

- A conservative fixed income portfolio

- 100% listed equity

- A private equity portfolio

- Hedge funds

- Structured products

- Alternative investments

- Real estate

and virtually any combination of the above.

Properly planned and set up (best case), life insurance is an extraordinarily efficient and effective wealth management planning tool.

4. Appendix

Some explanatory notes.

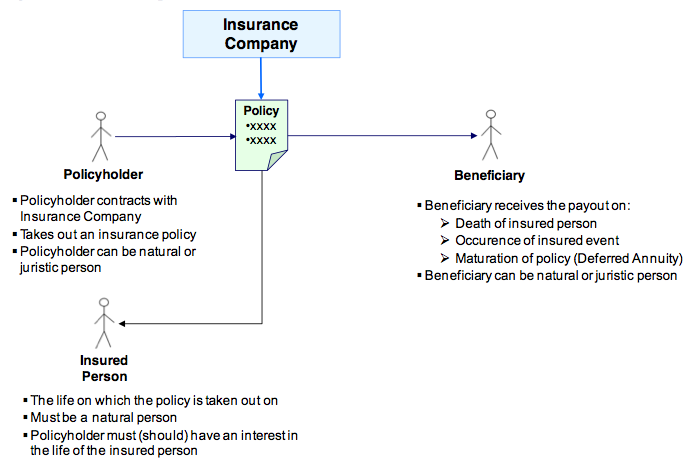

4.1. People involved in setting up a life insurance policy

It is set up in the same way as a normal life insurance policy. This is one of the big advantages, it is a life insurance policy – it’s non-controversial. The big difference is the segregated managed account holding the assets. Figure 3 shows the involved parties to the life insurance contract.

Figure 3: The involved parties to a life insurance contract

When the policy is set up, the client/policyholder must nominate a beneficiary. The beneficiary receives the assets should the insured person die. The policyholder must nominate an insured person. Should the insured person die, the beneficiary receives the assets.

4.2. Explanatory Notes

In Switzerland, a life insurance policy generally directly involves four parties:

1. The Insurance Company: which issues the policy and provides coverage to the policyholder in return for payment of the insurance premium, which may be a lump sum or a series of regular payments.

2. The Policyholder: who takes out the policy enters into a contract with the insurer and receives coverage for him/herself and/or other persons (beneficiaries). A legal entity such as a company or foundation, but also a trust, can be the policyholder. As the contracting partner, the policyholder owes the insurance premiums that need to be paid to the insurer in return for providing insurance coverage.

3. The Custodian Bank where the assets are deposited for safekeeping and management

4. The Asset Manager who manages the assets – receives a Power of Attorney from the Insurance Company.

Indirectly:

1. The Insured Person: - whose life the insurance policy covers. This can, but need not be, the same person as the policyholder, but it must be a natural person.

2. The Beneficiary(s): – who receive payments from the policy on the death of insured person or occurrence of the insured event. The beneficiary(s) are those persons designated by the policyholder to receive the specified capital from the insurer at either a specified date in the future (DVA) or in the case of the insured persons death - the insured event (VUL). Also, the beneficiary can be a legal entity or a trust and must not necessarily be a natural person.

|