GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

NEW DELHI

NOTIFICATION NO

16 of 2024; Dated: January 24, 2024

G.S.R. 64(E).- In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.- (1) These rules may be called the Income-tax (First Amendment) Rules, 2024.

(2) They shall come into force with effect from the 1st day of April, 2024.

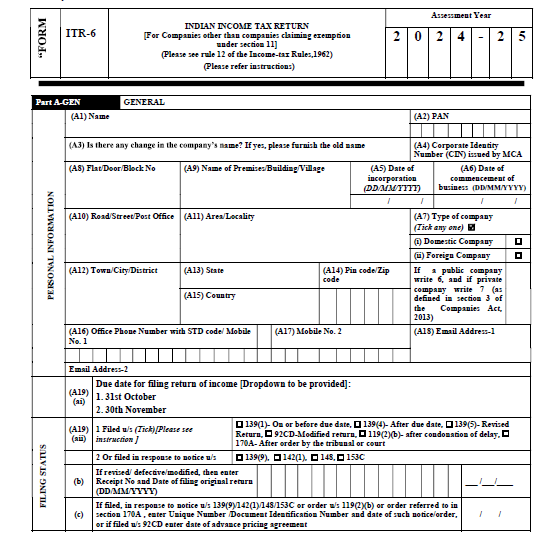

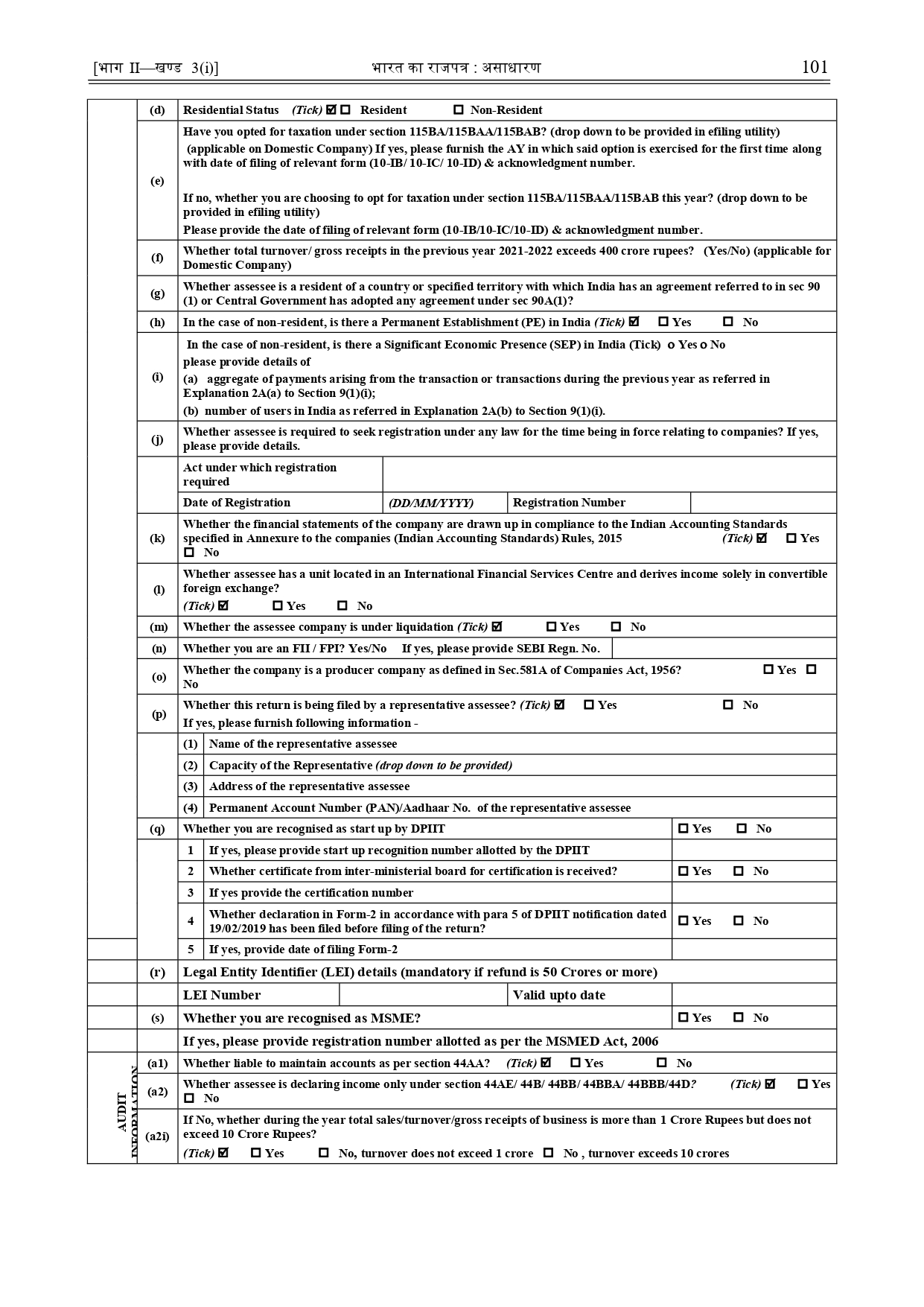

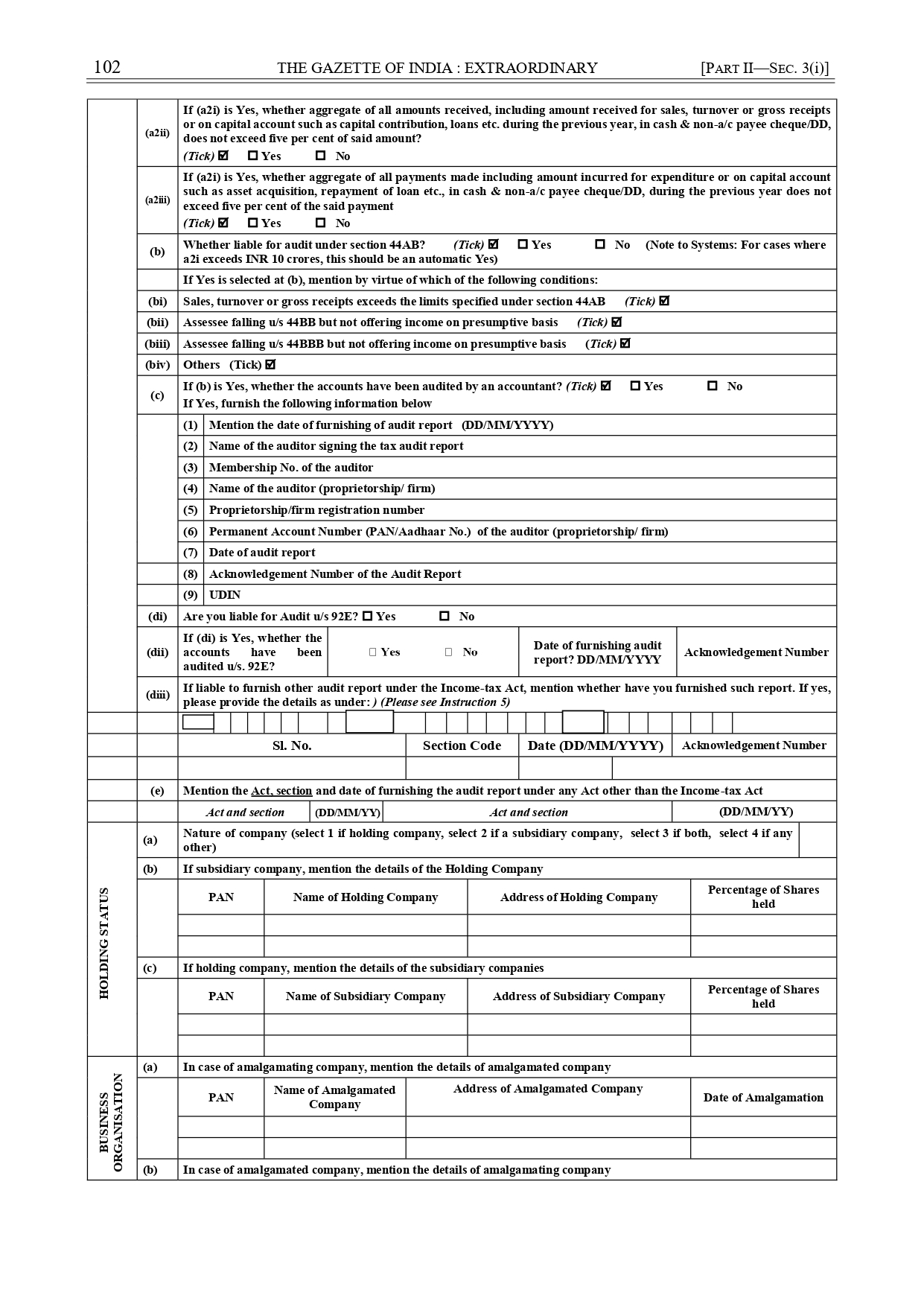

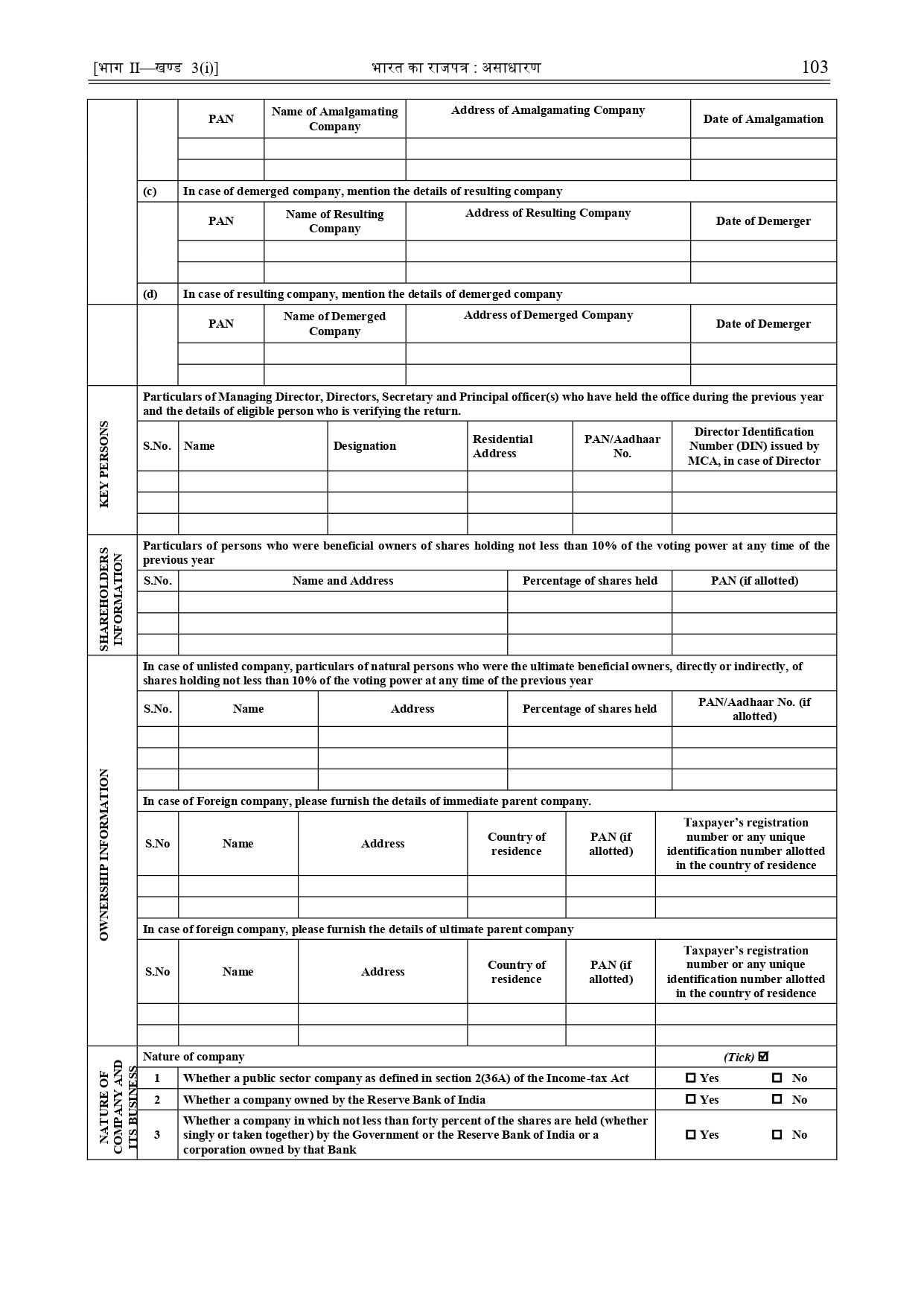

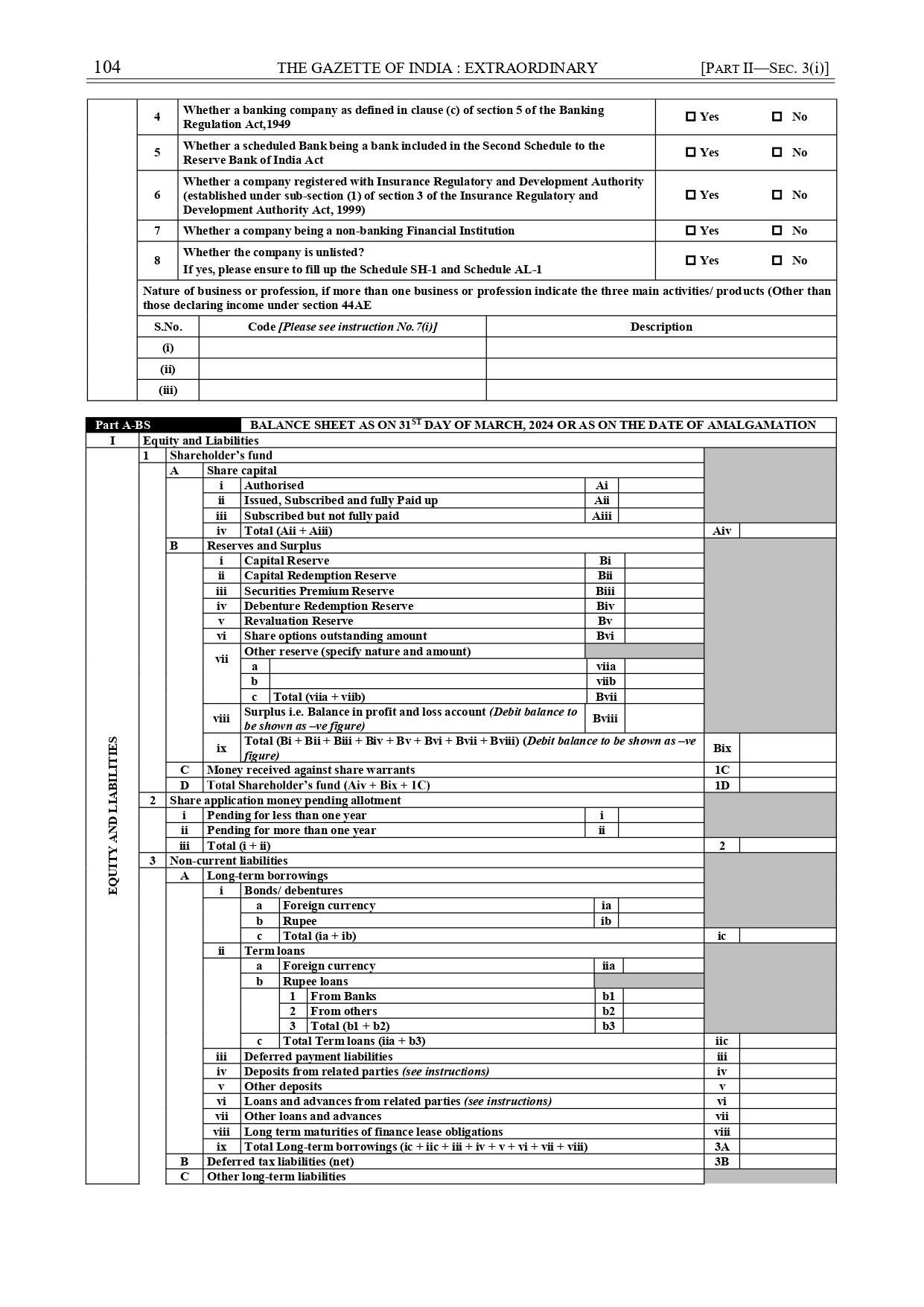

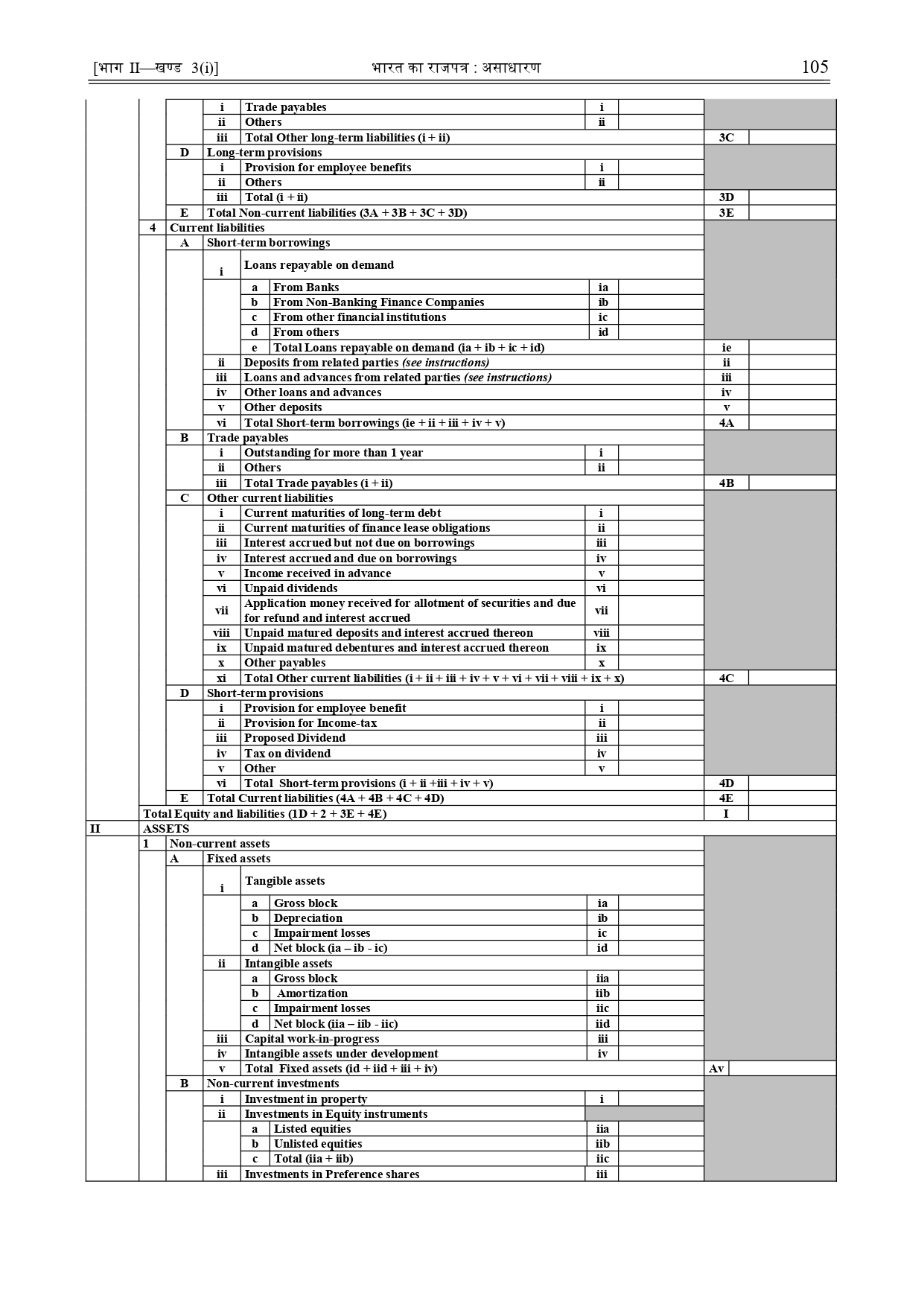

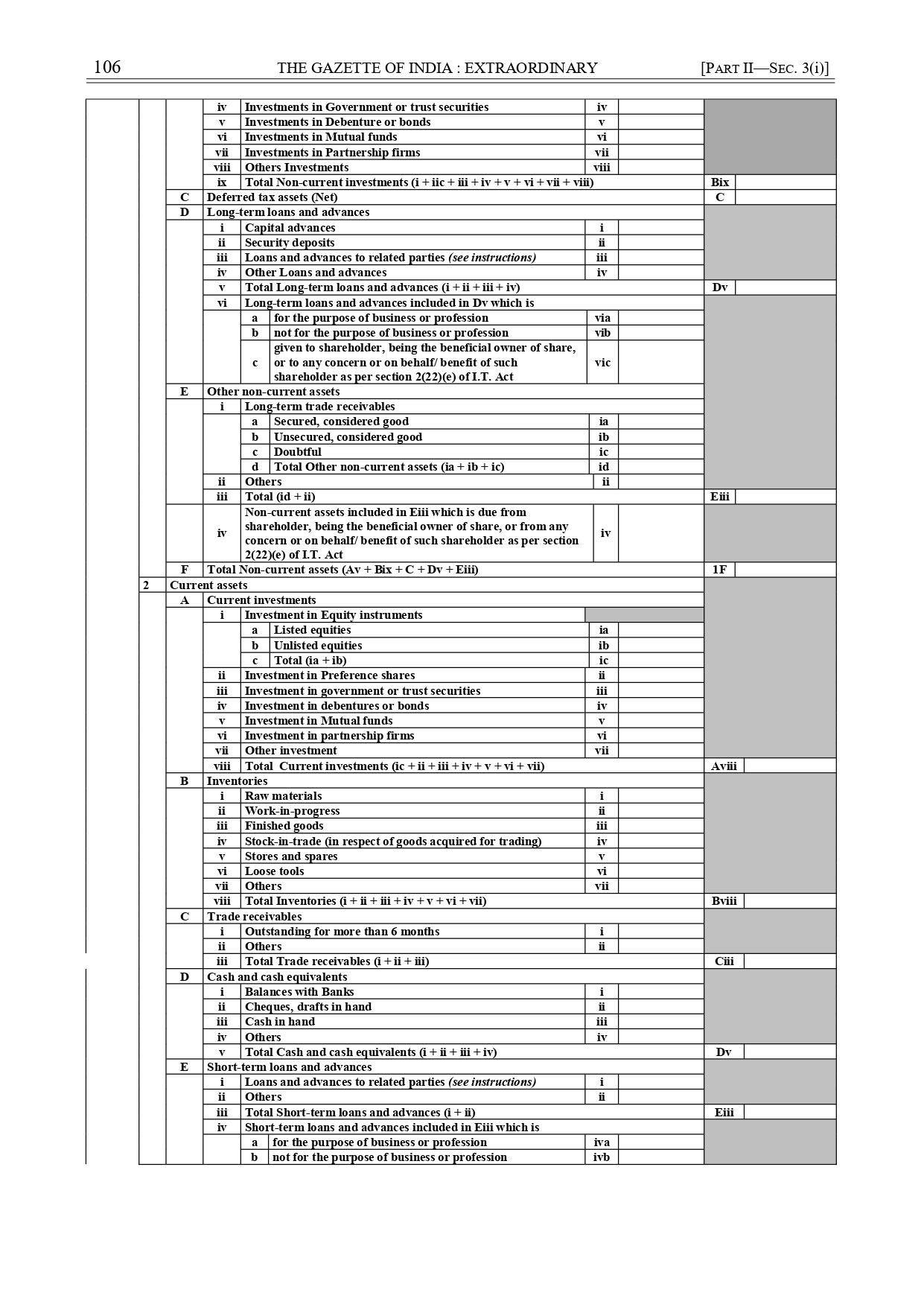

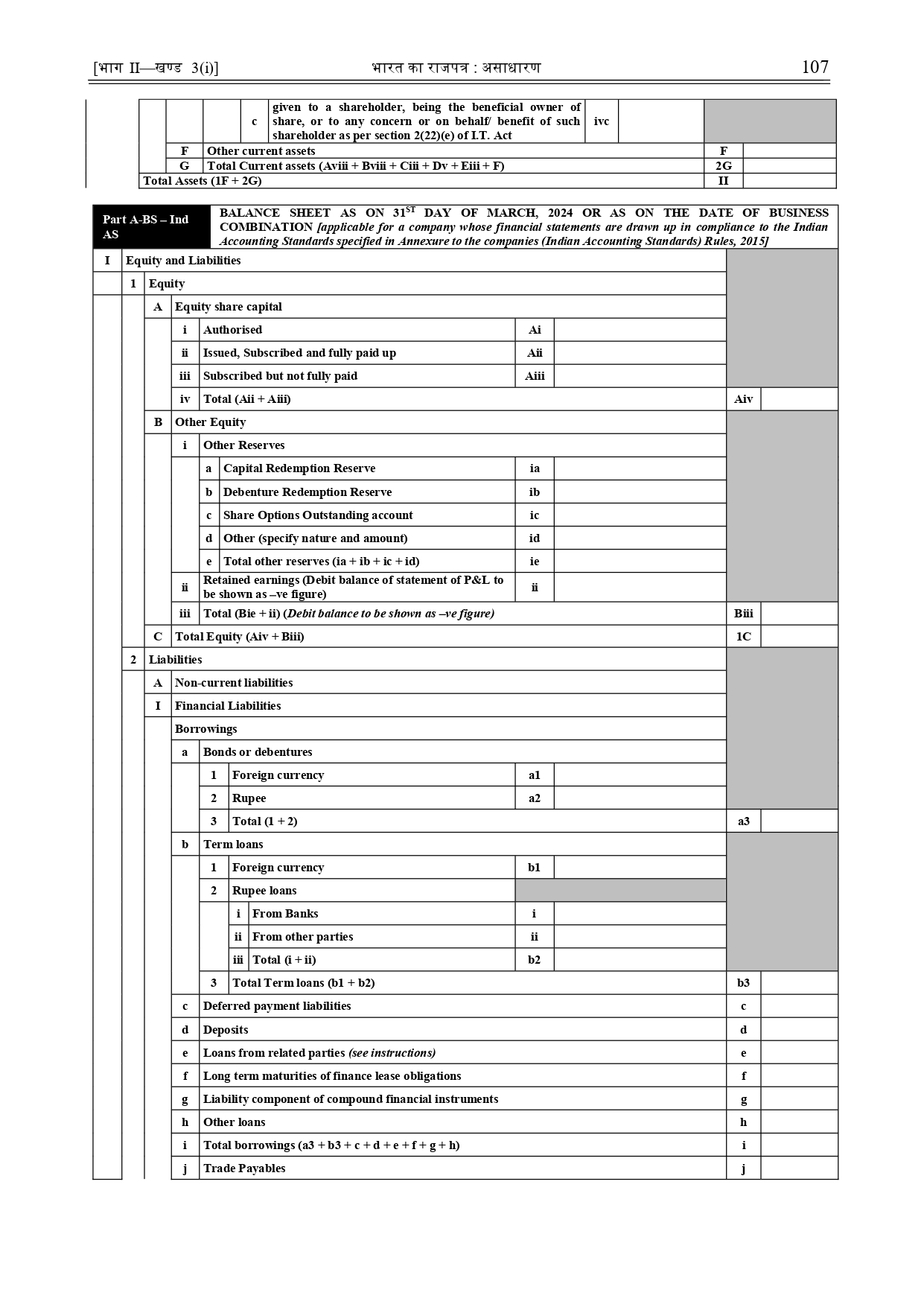

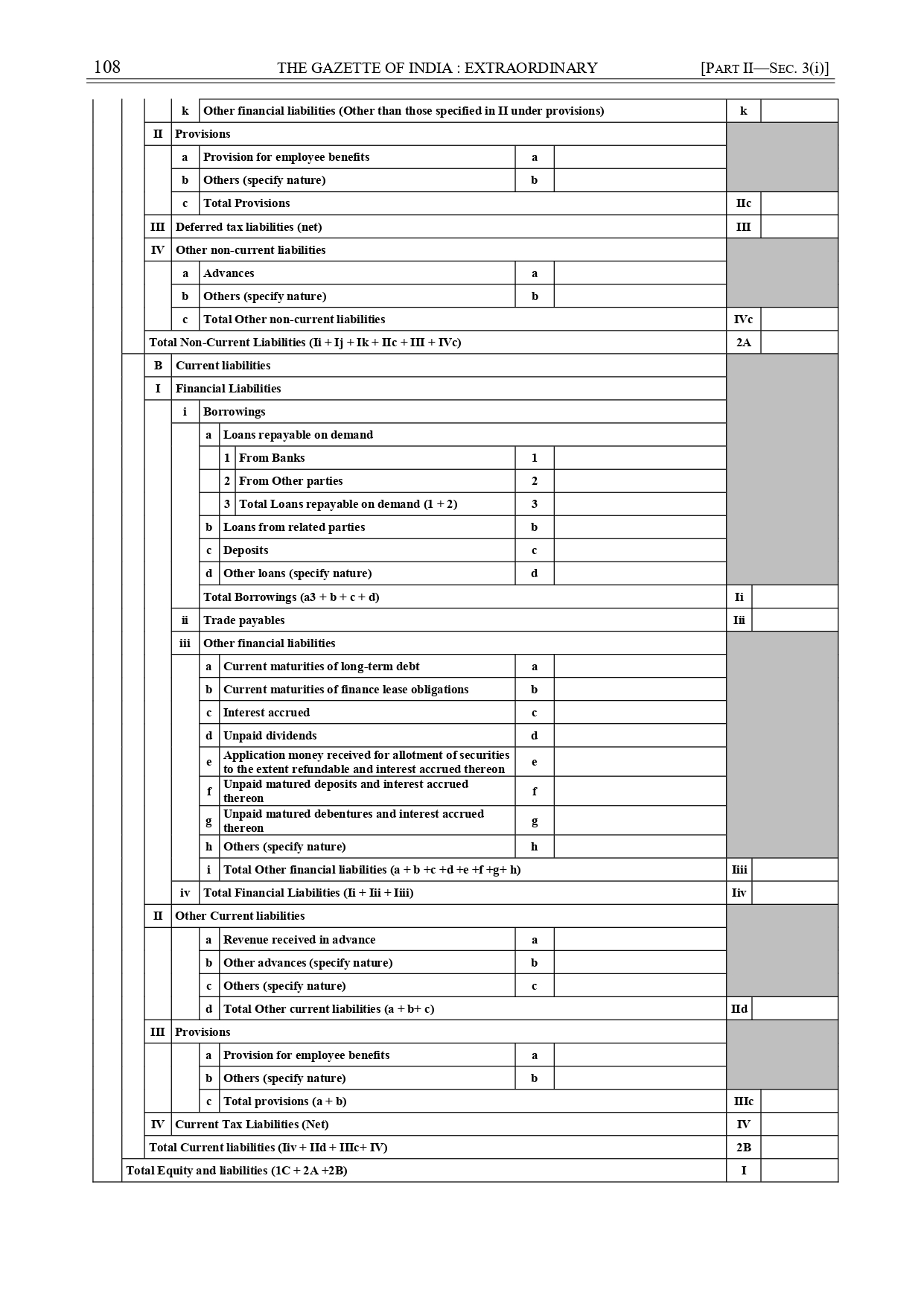

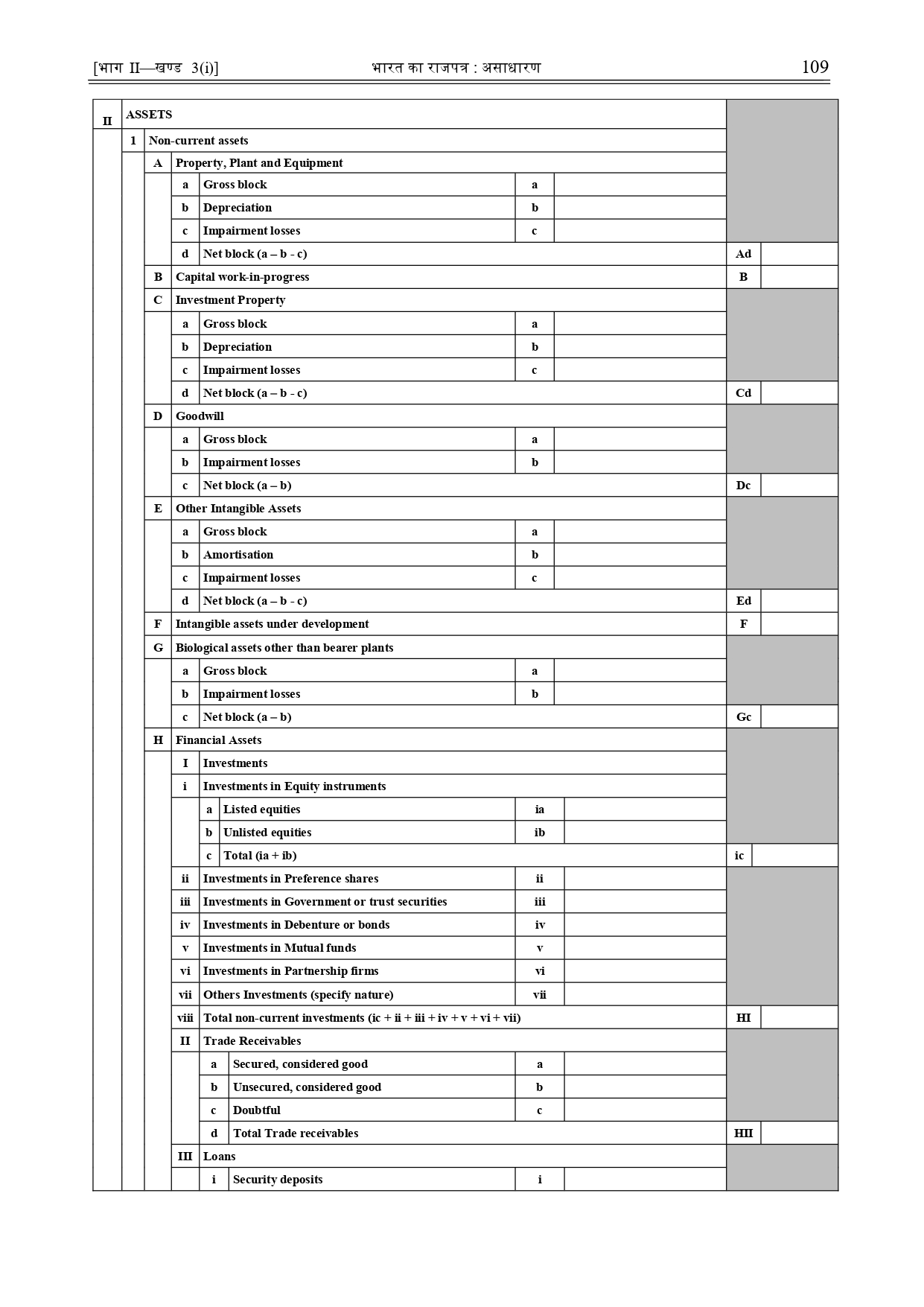

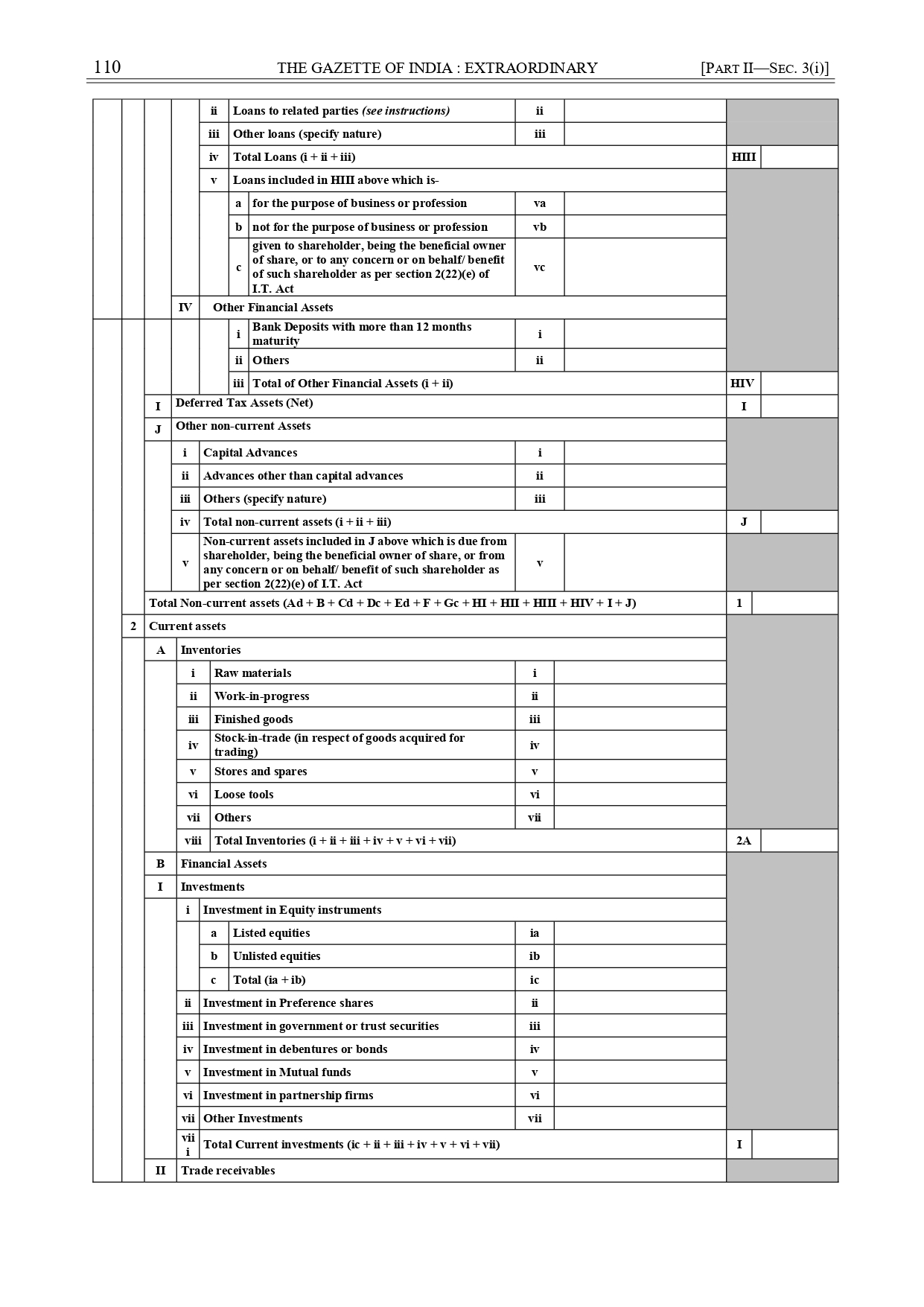

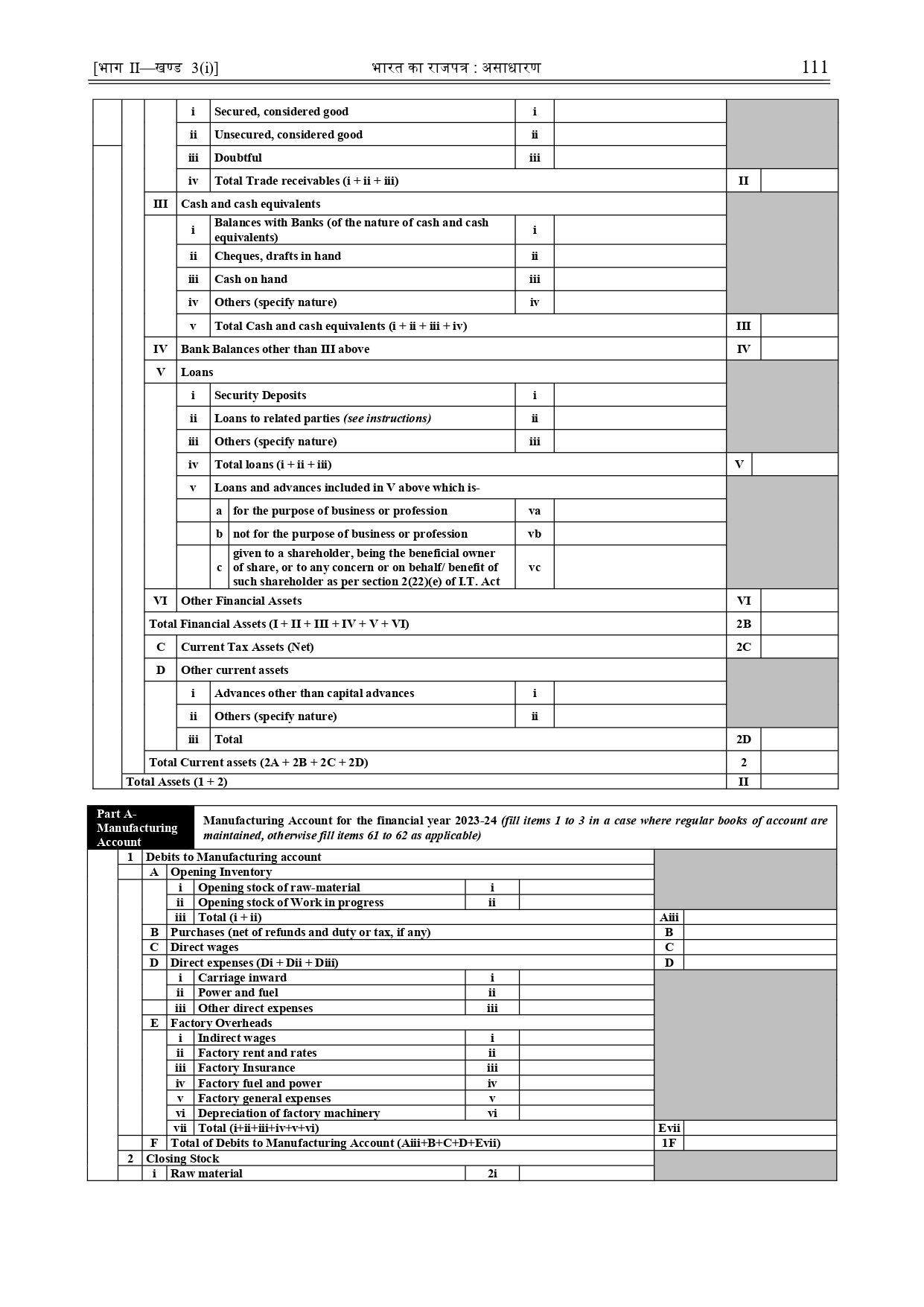

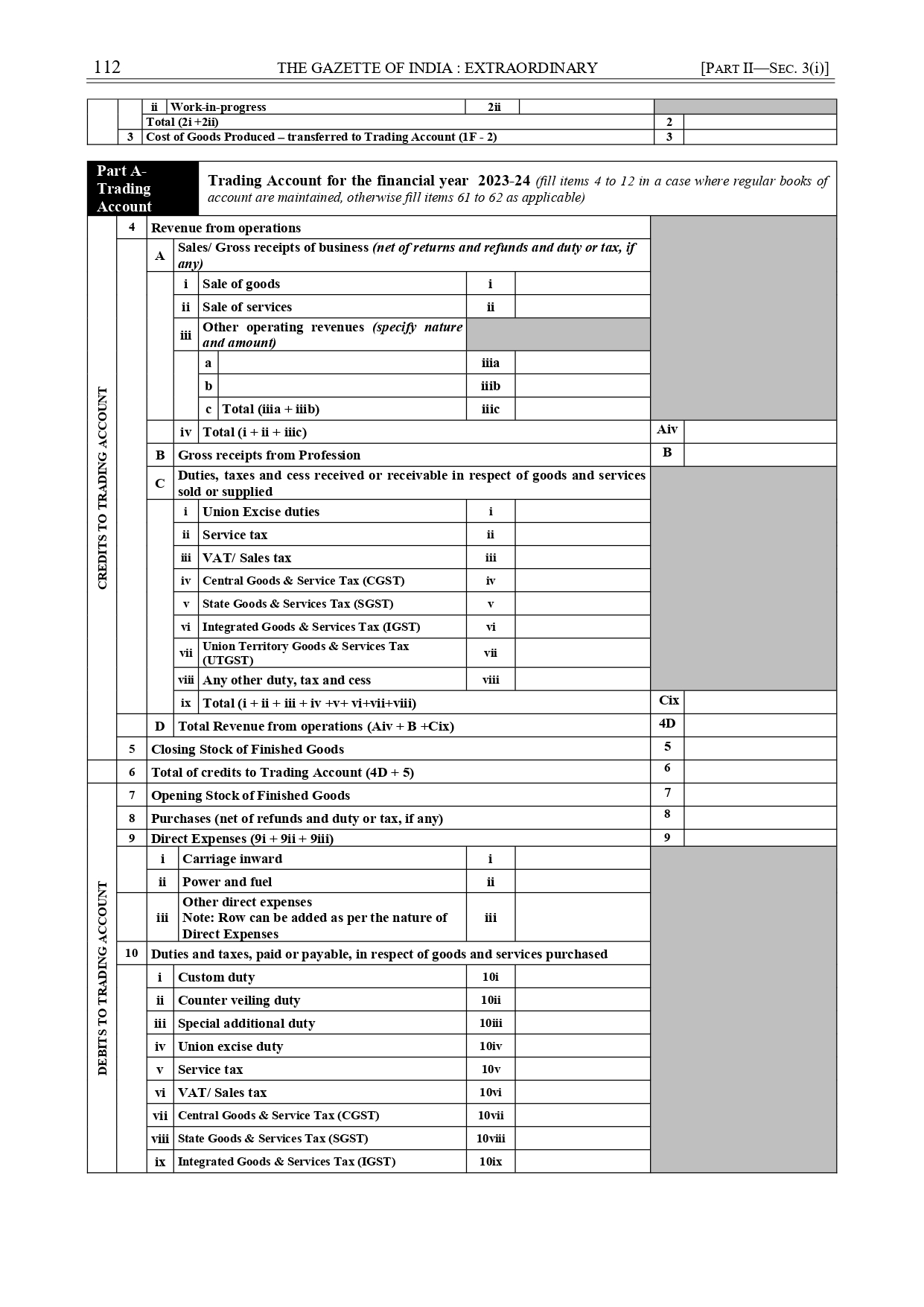

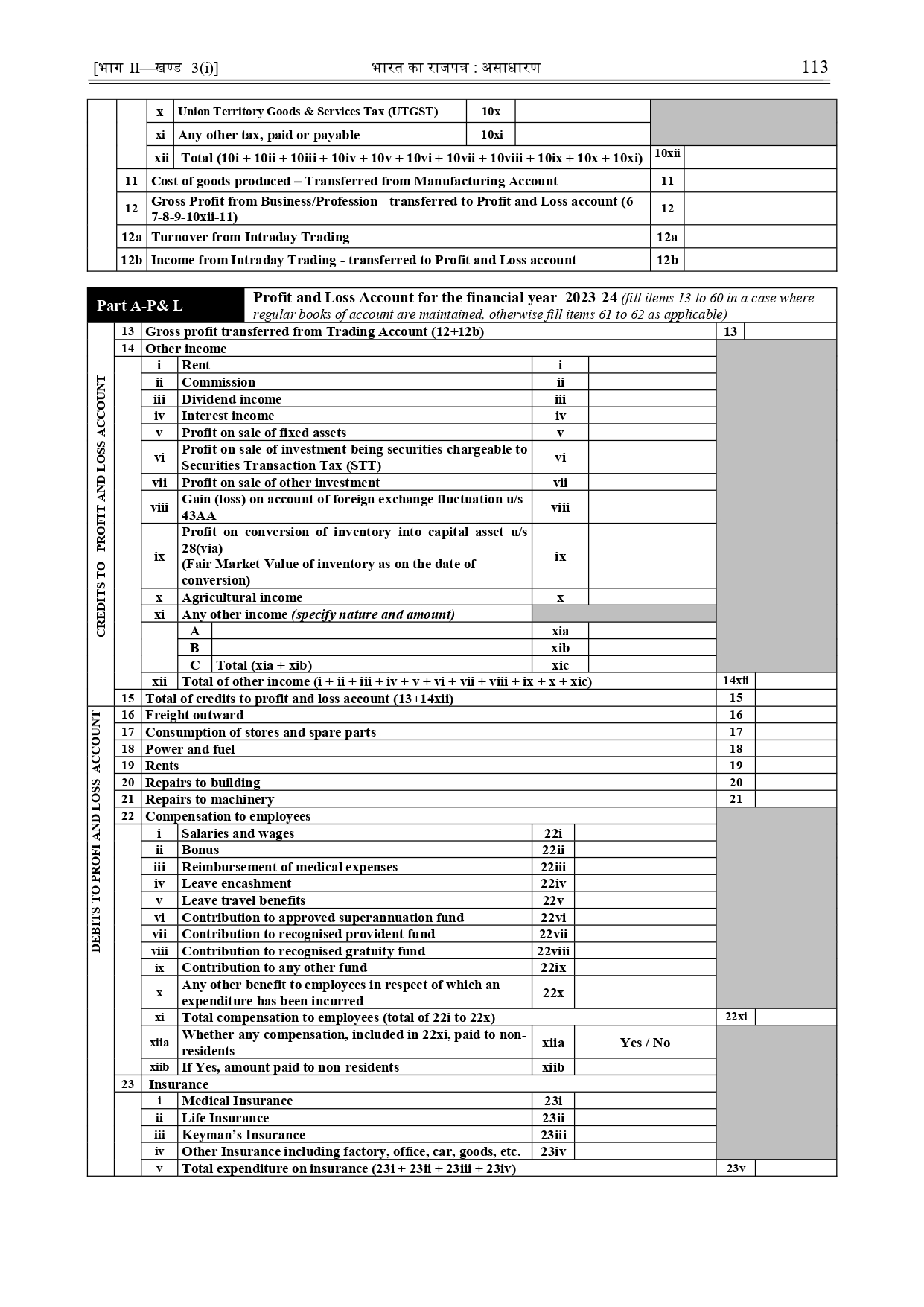

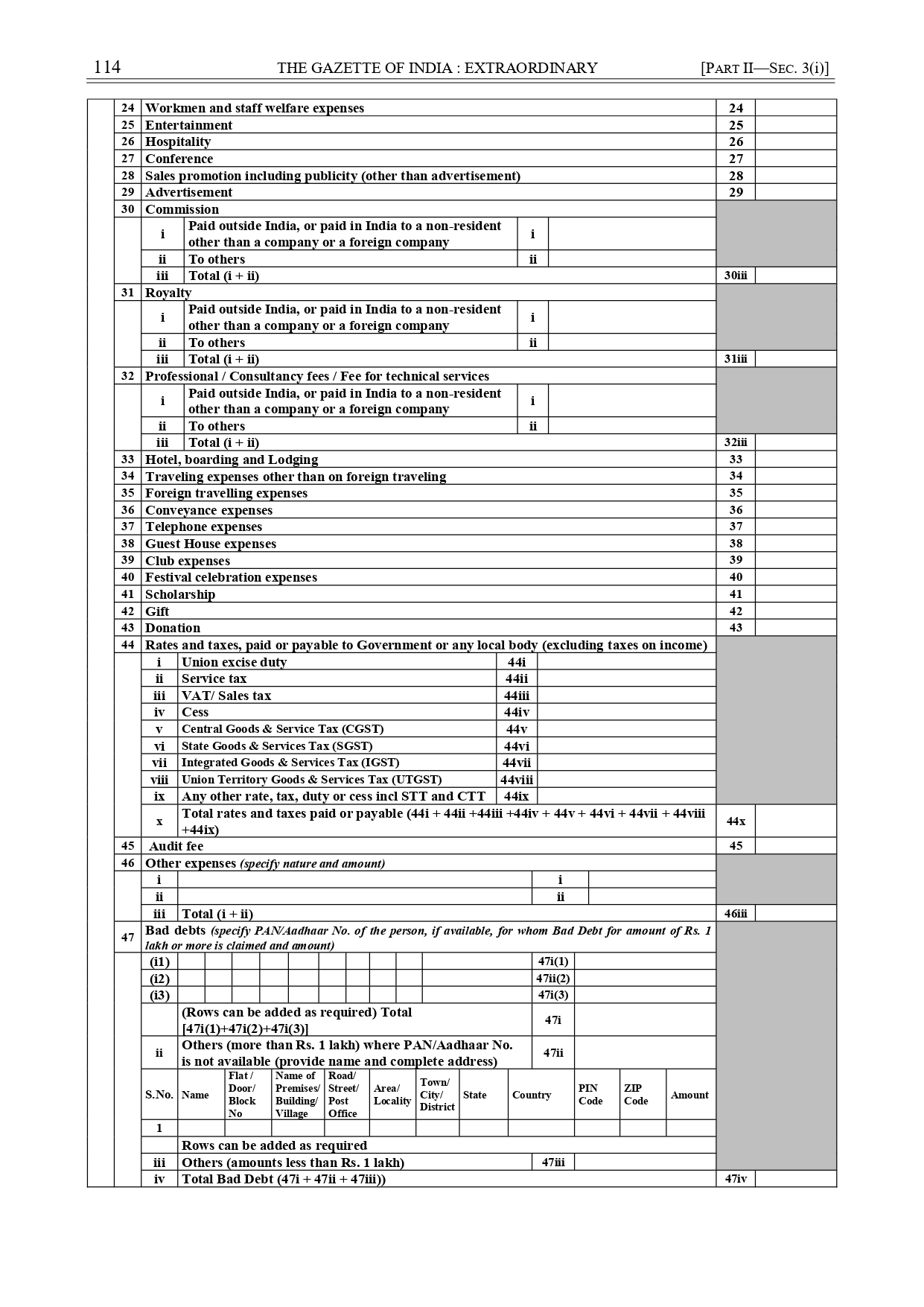

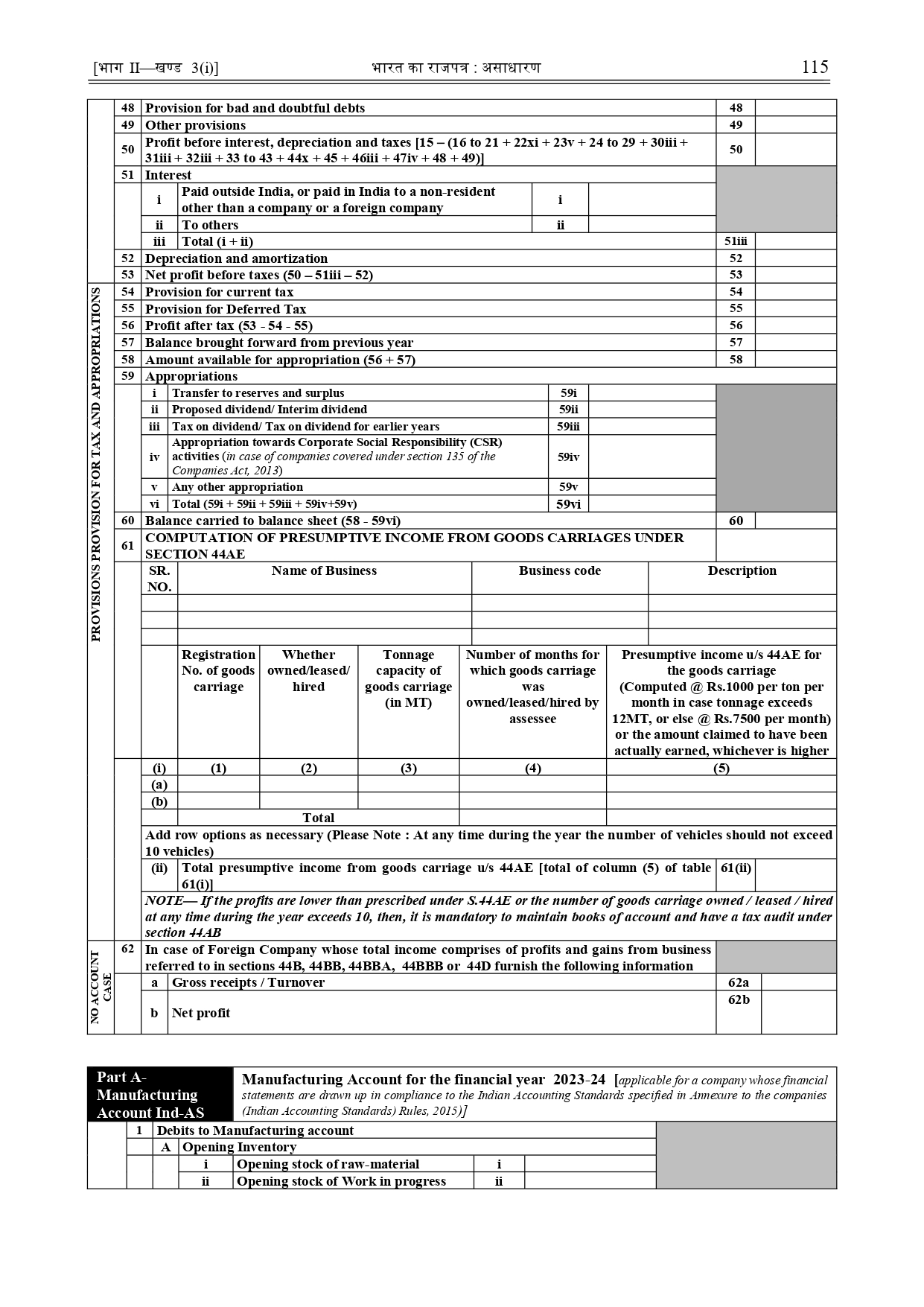

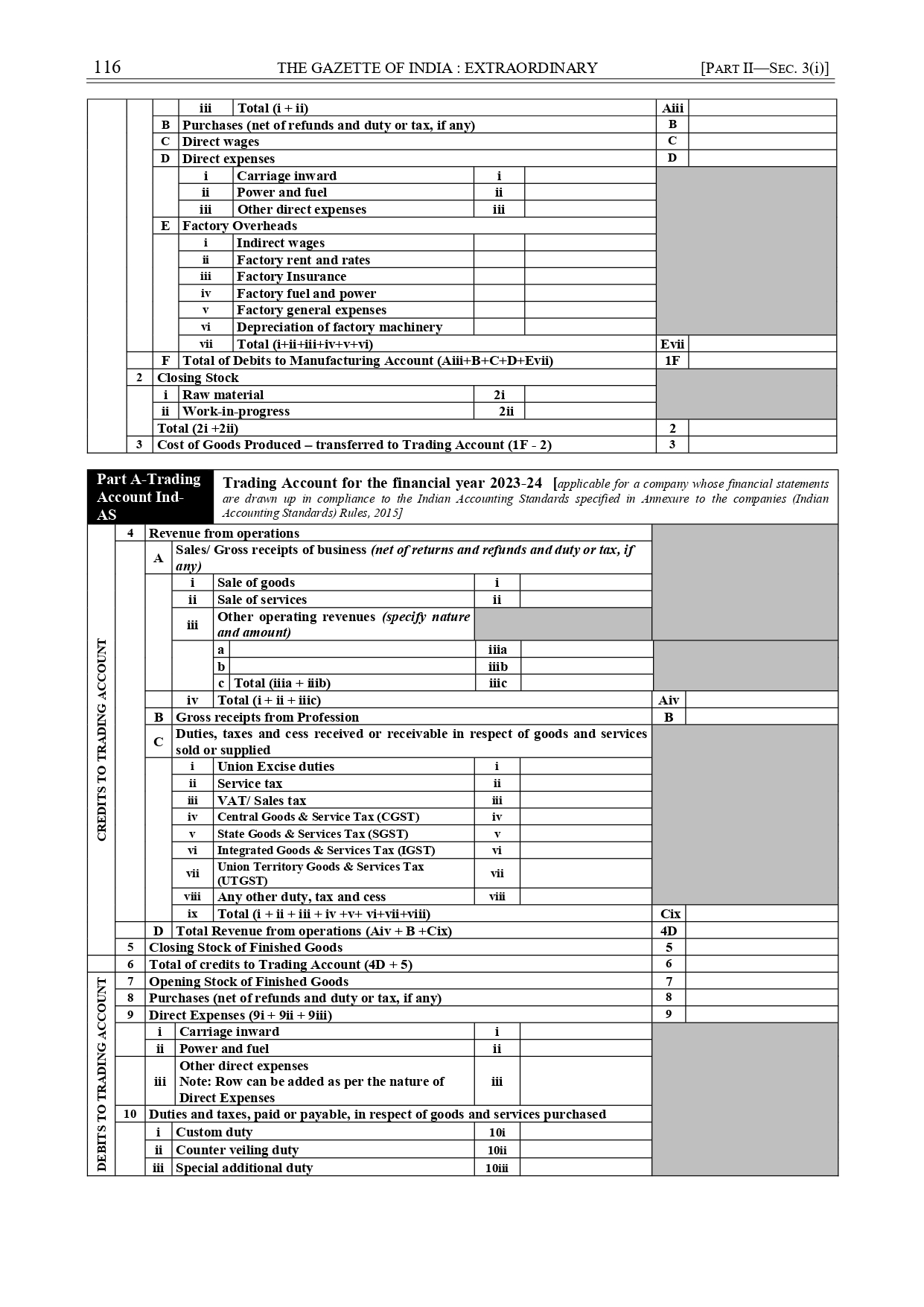

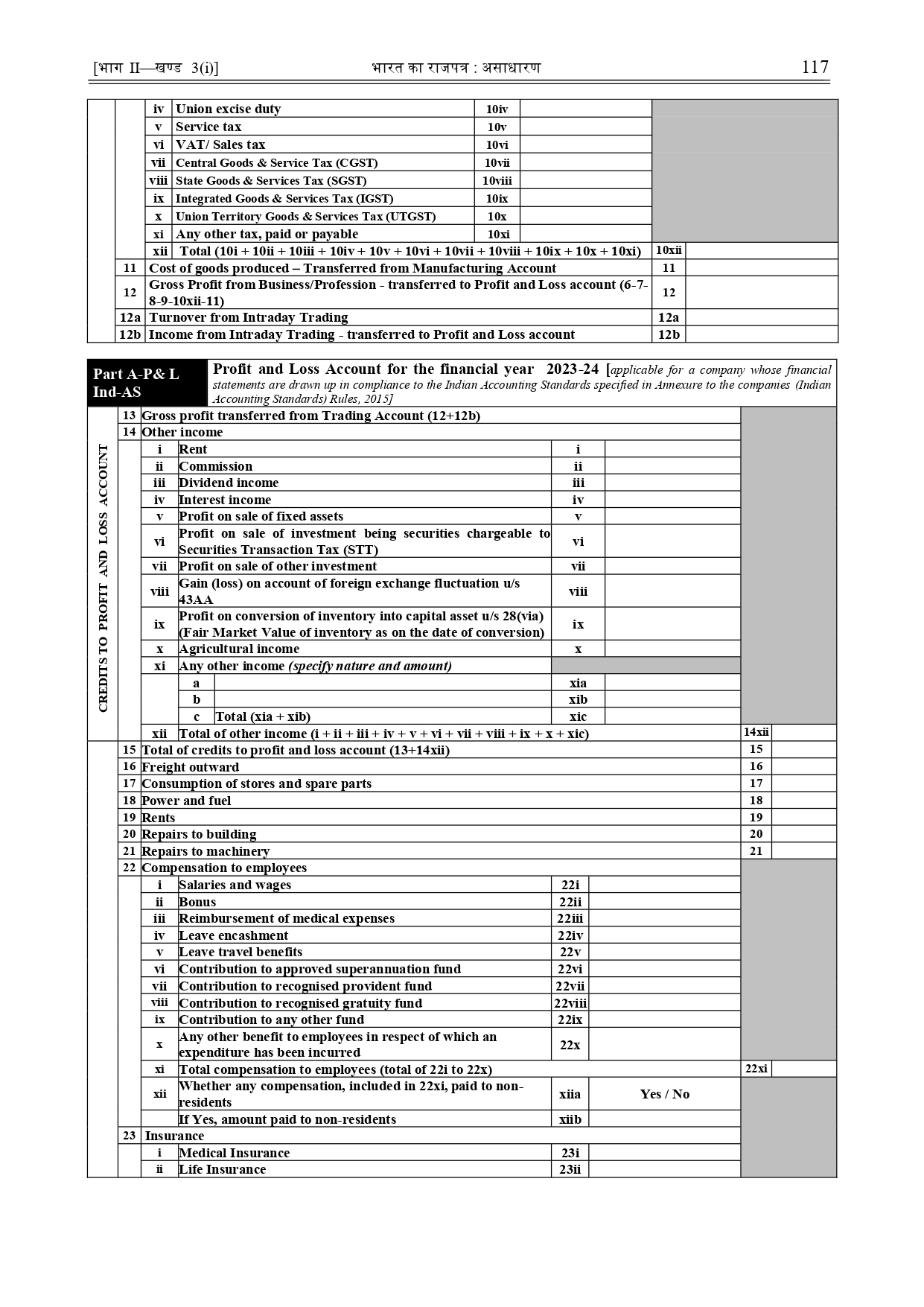

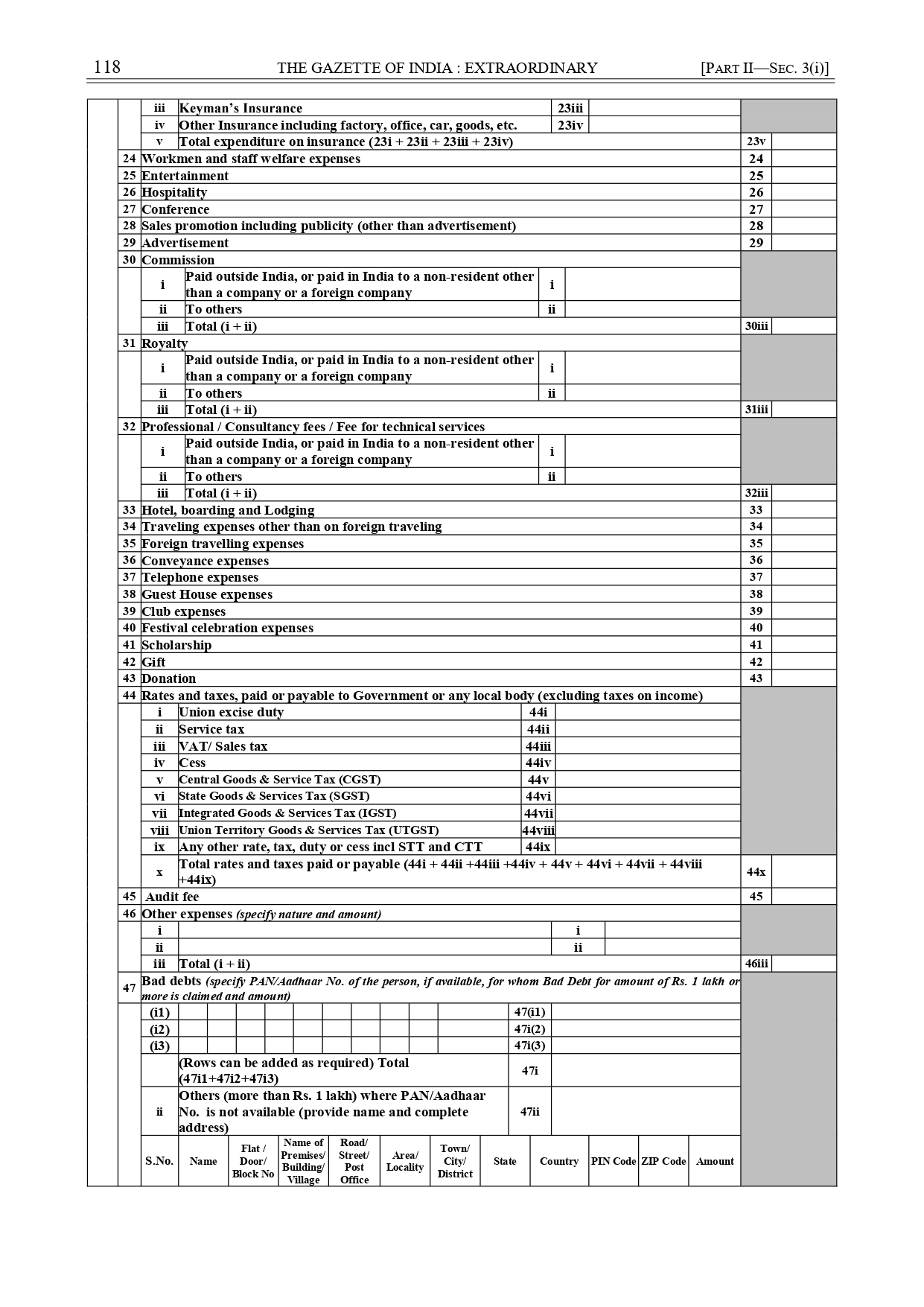

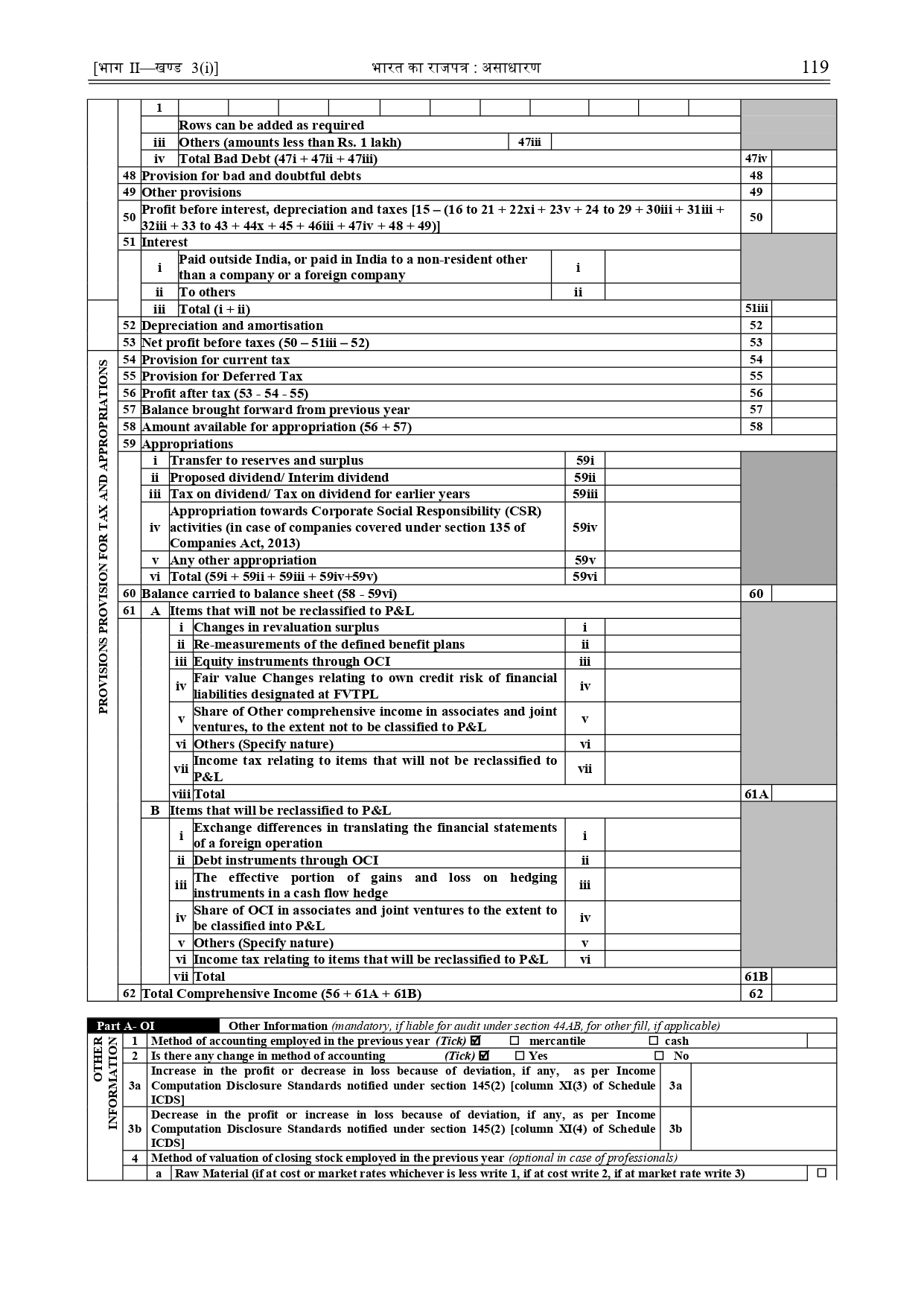

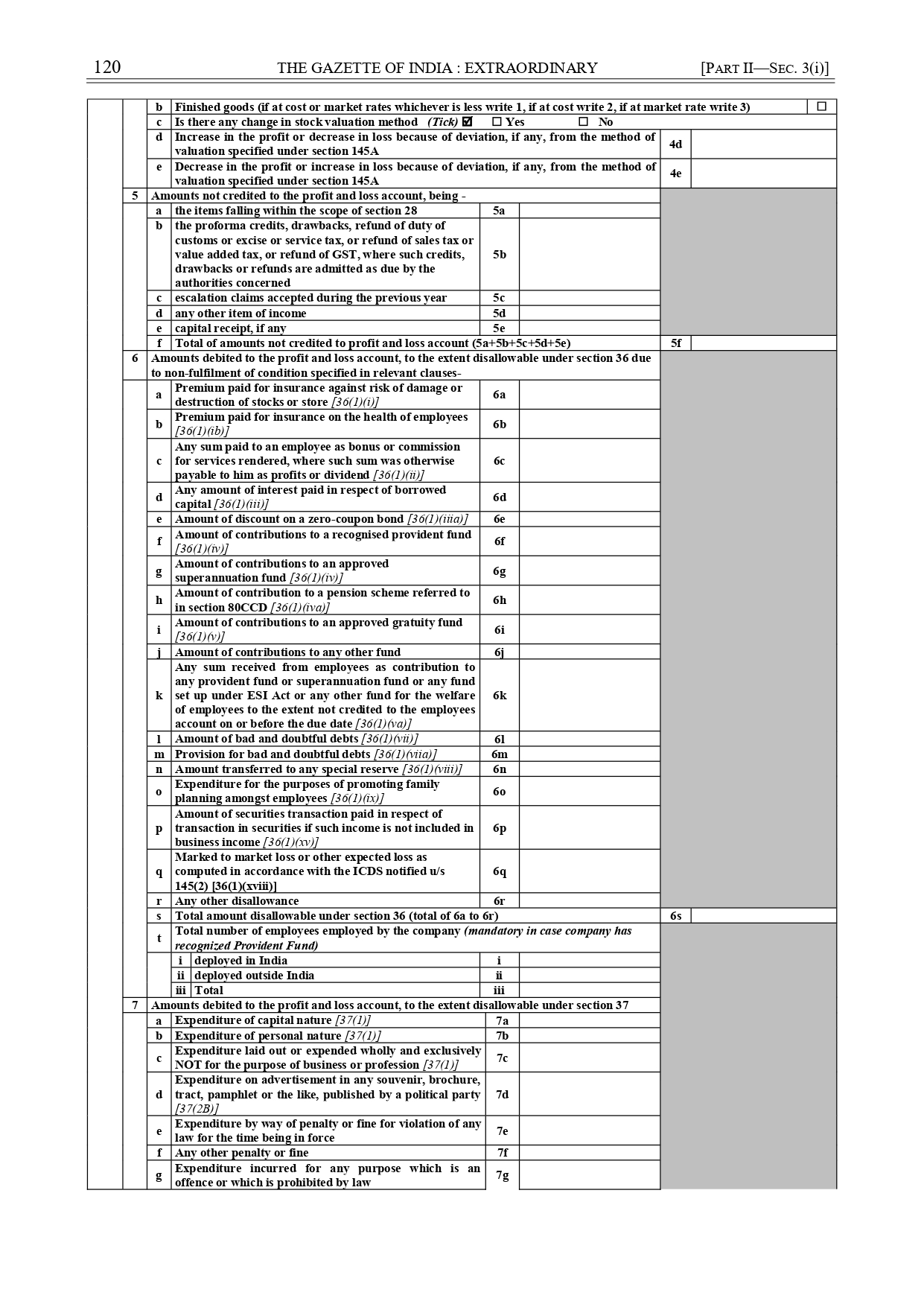

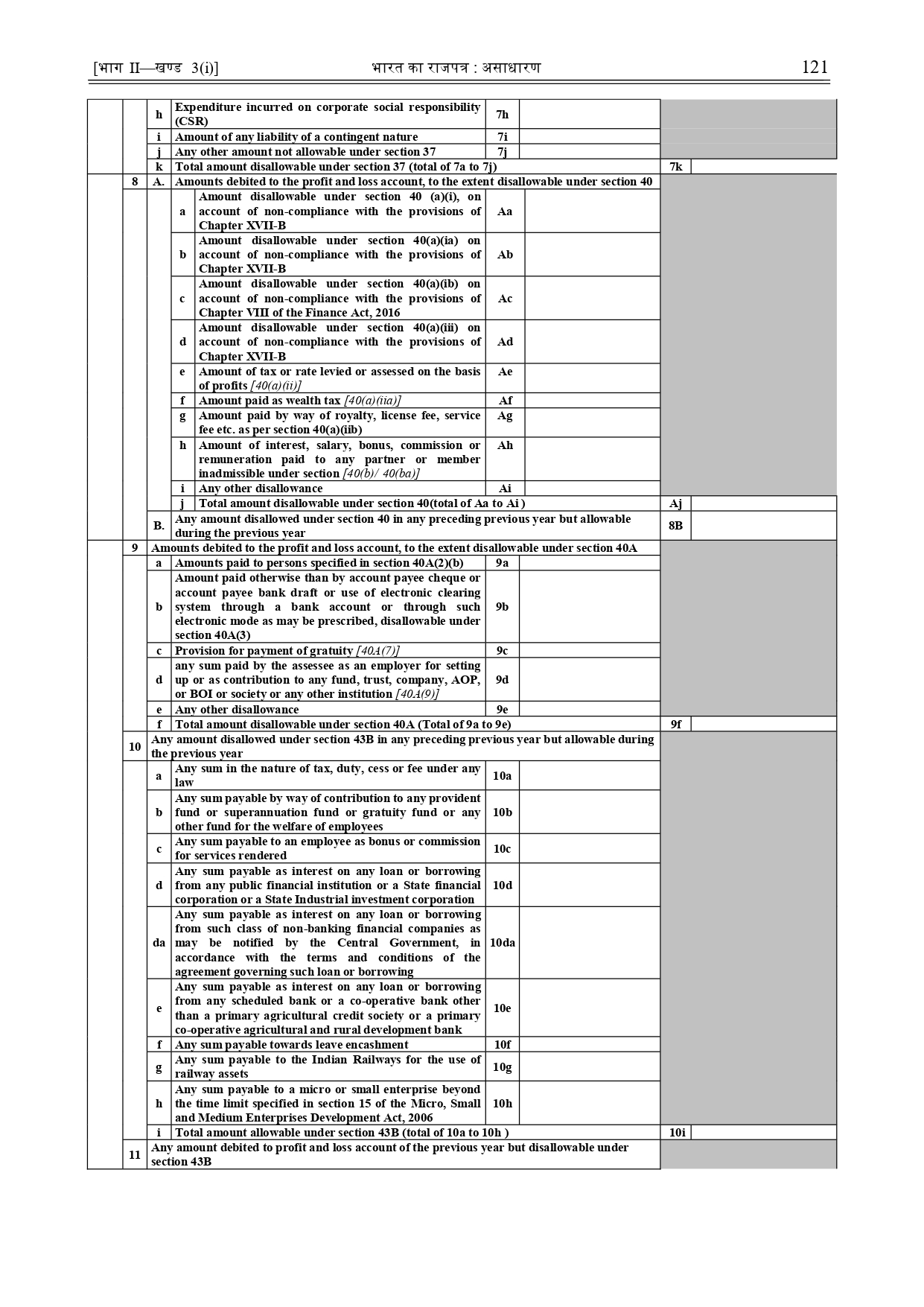

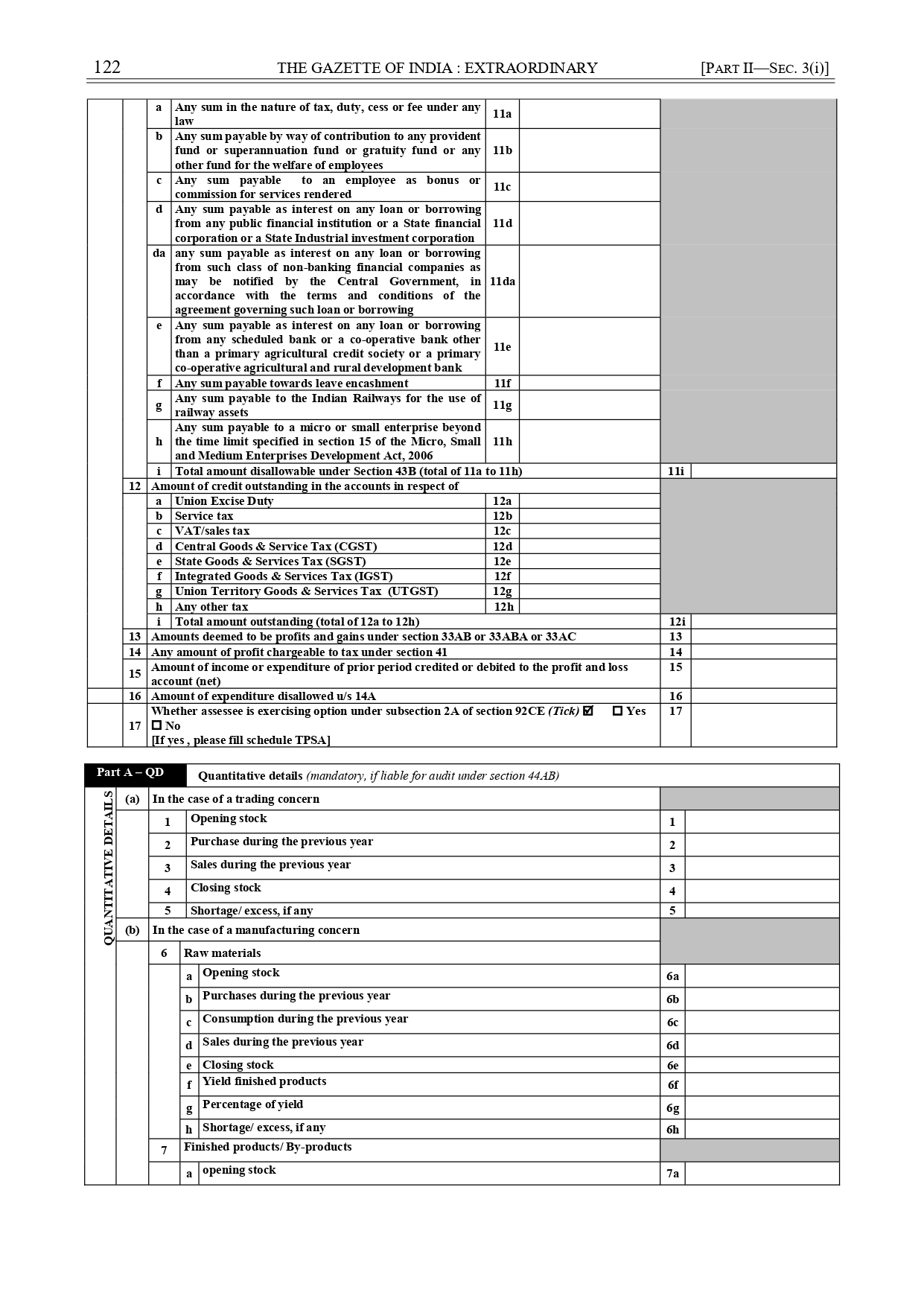

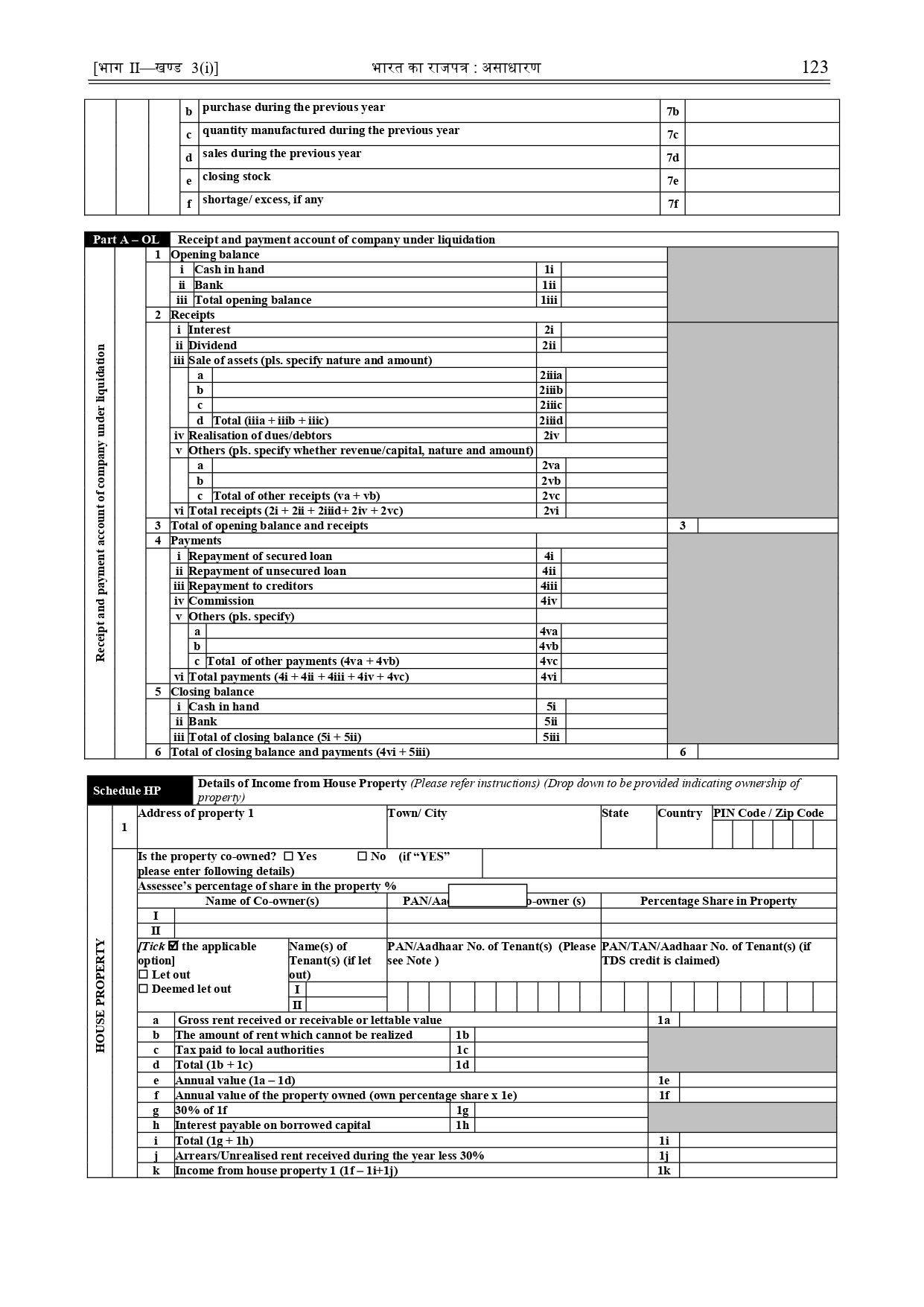

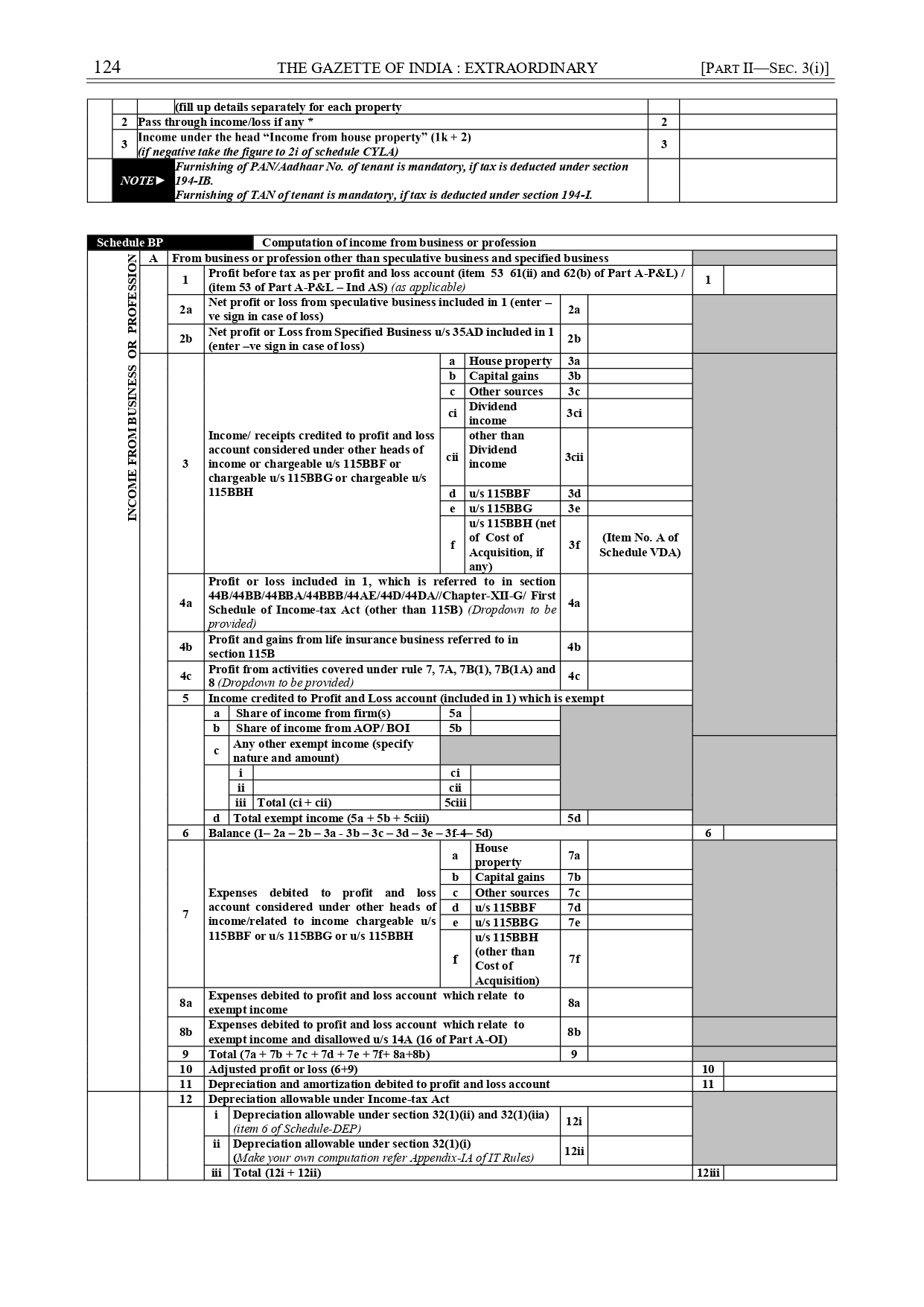

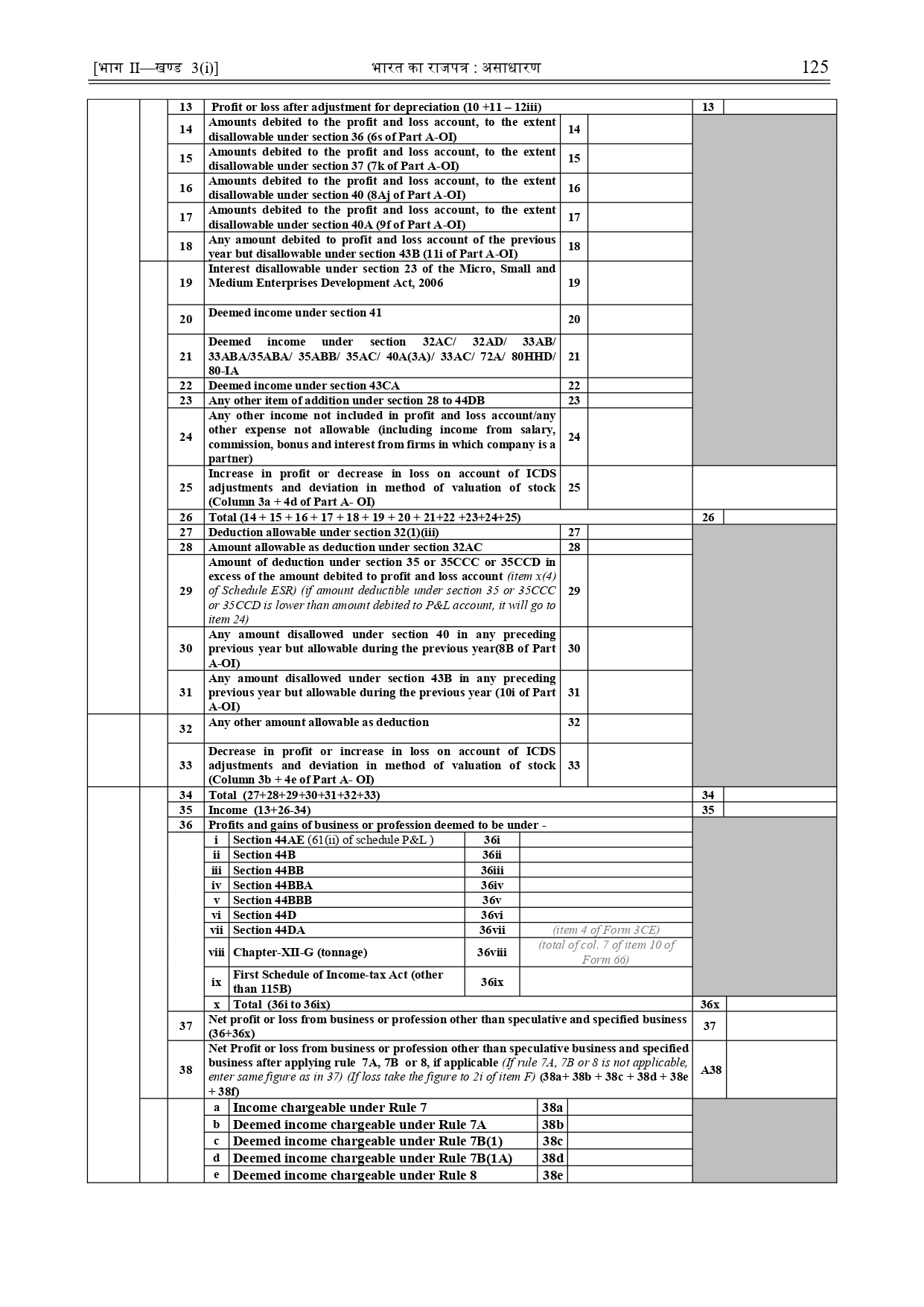

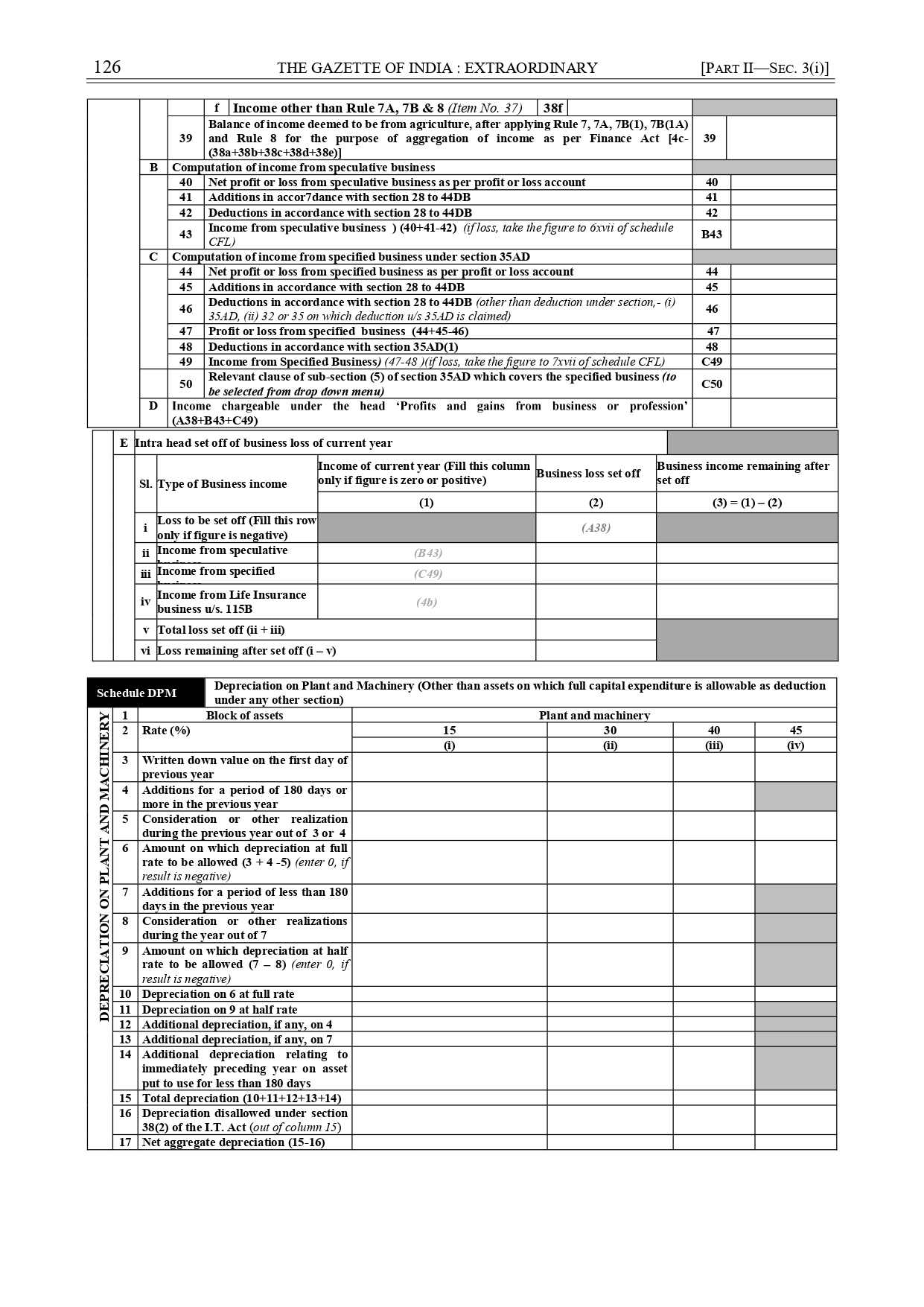

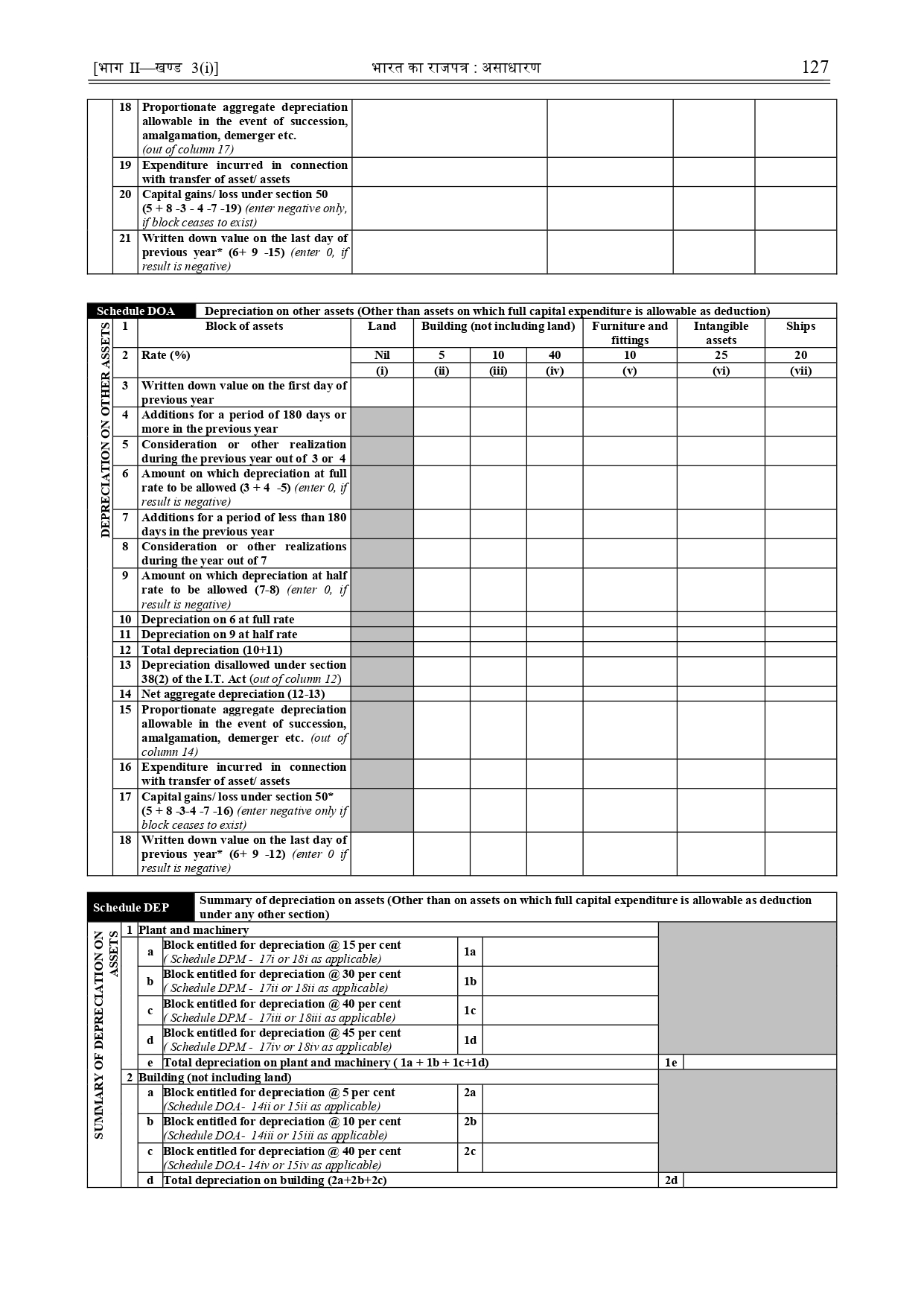

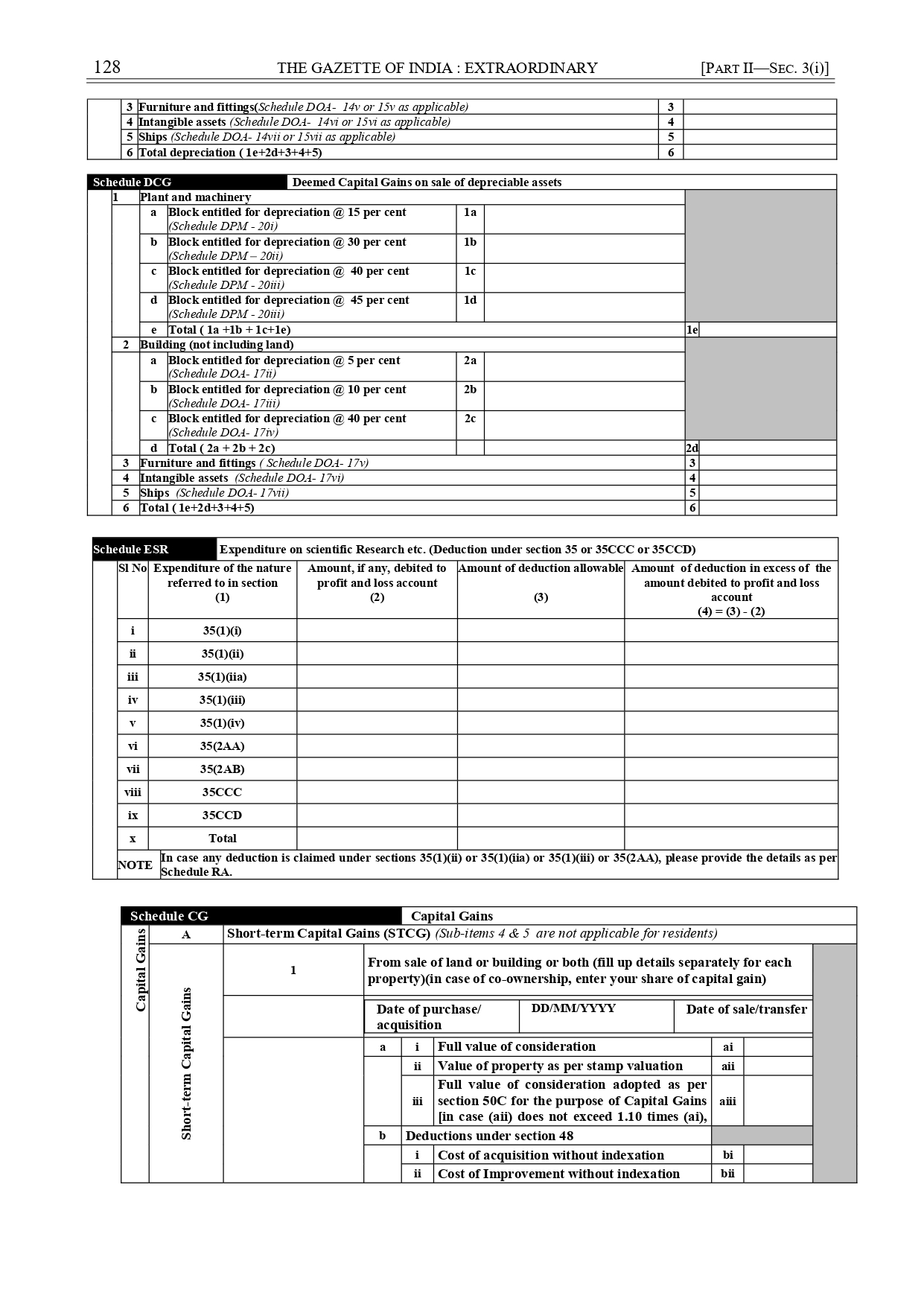

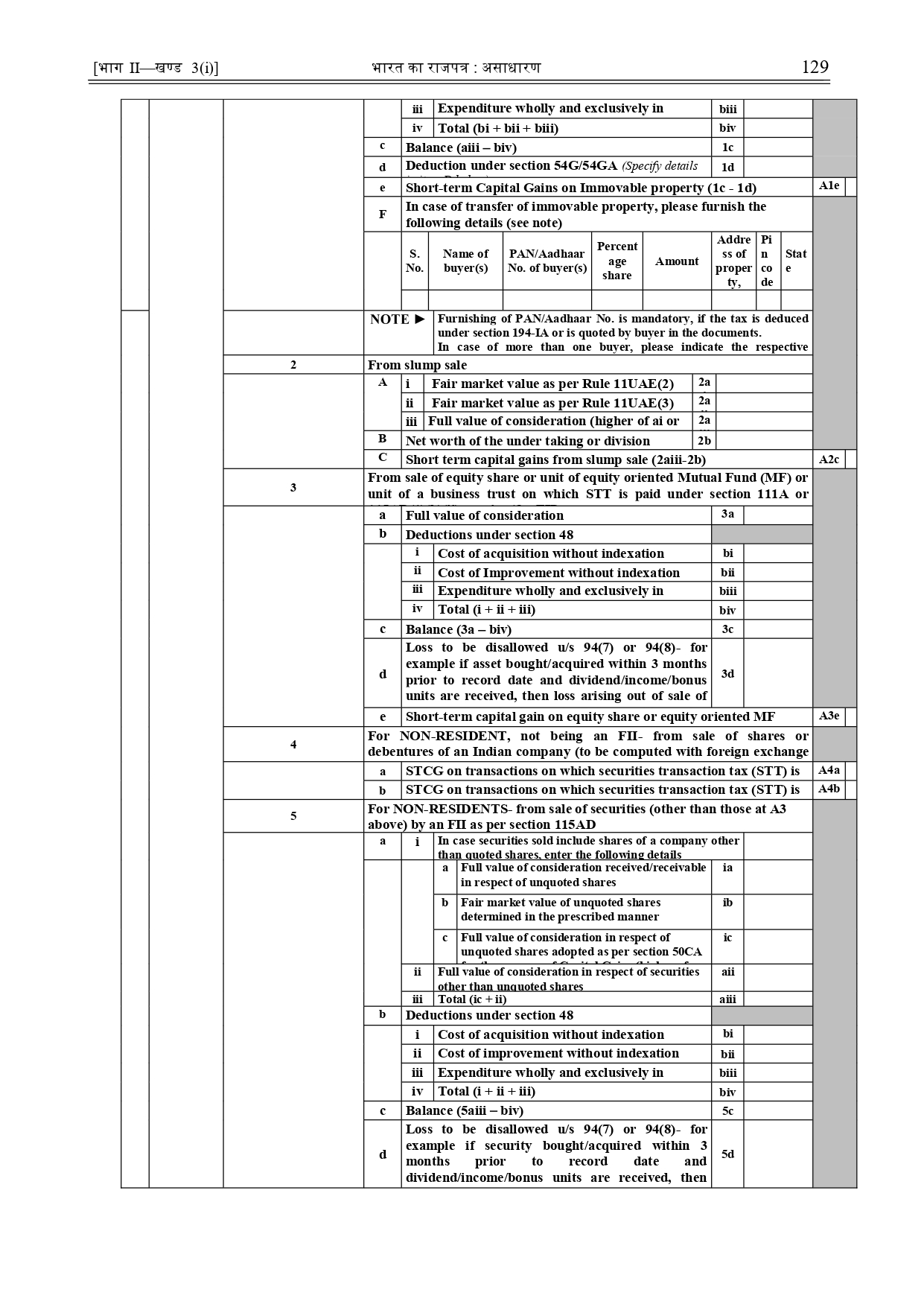

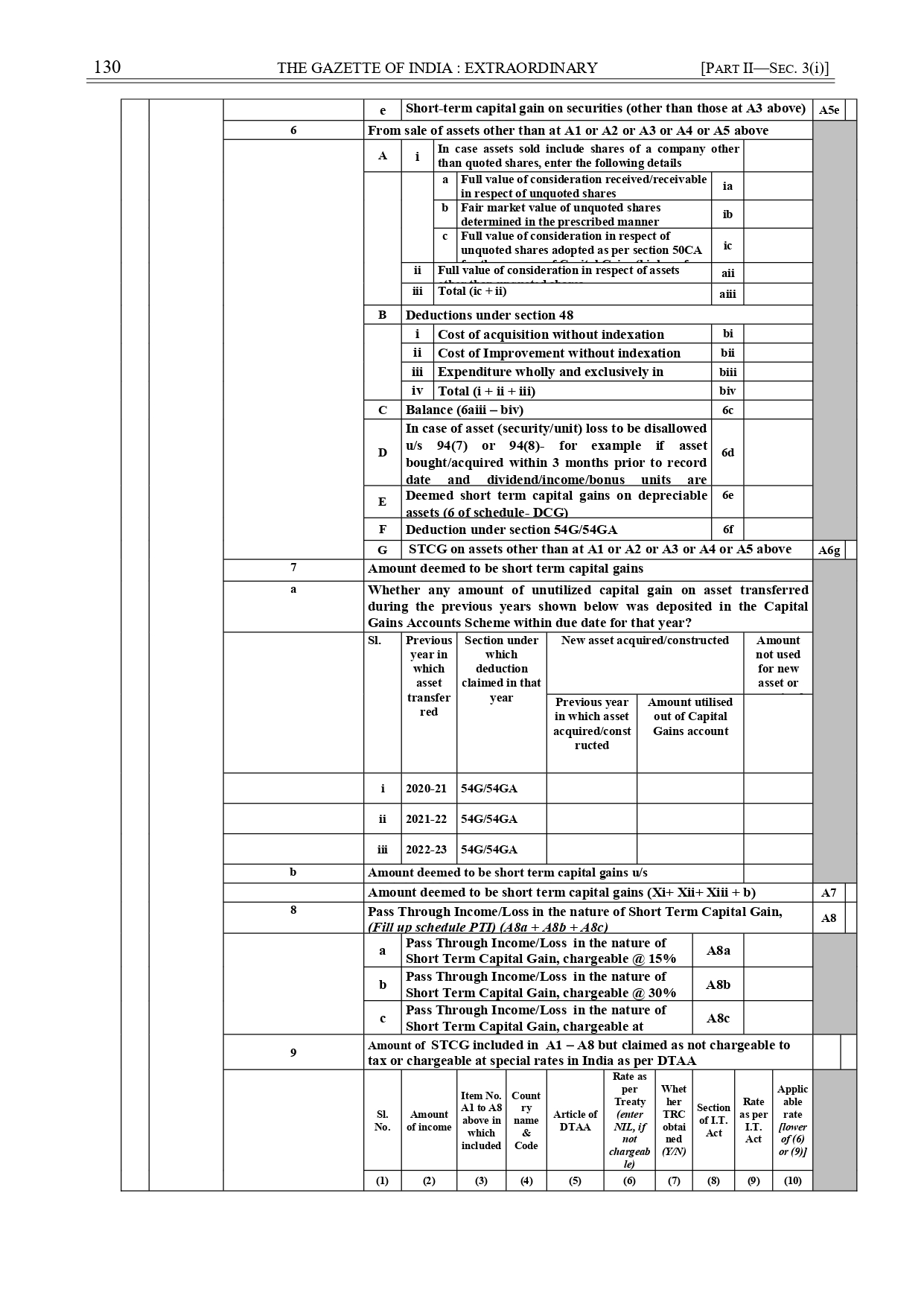

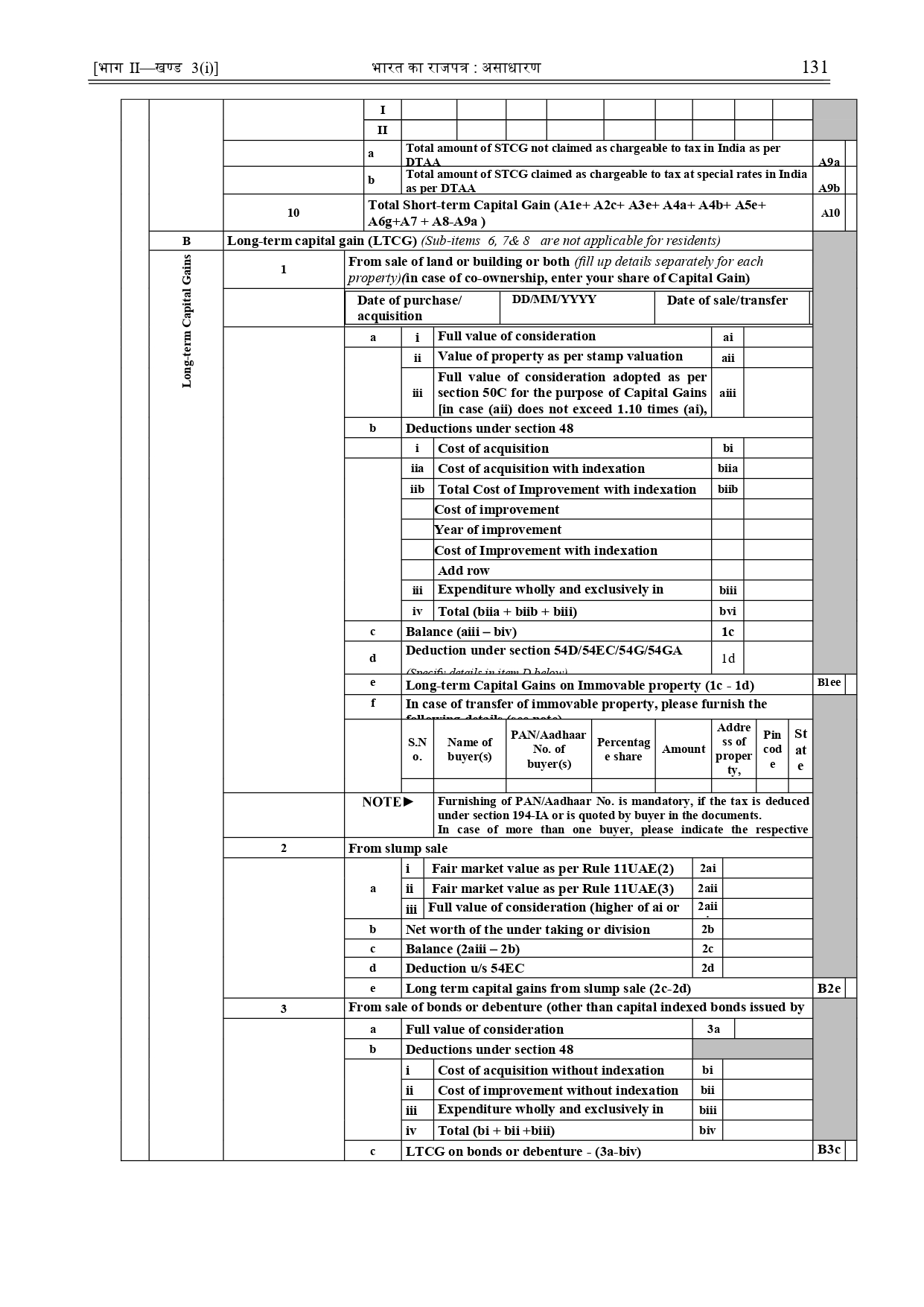

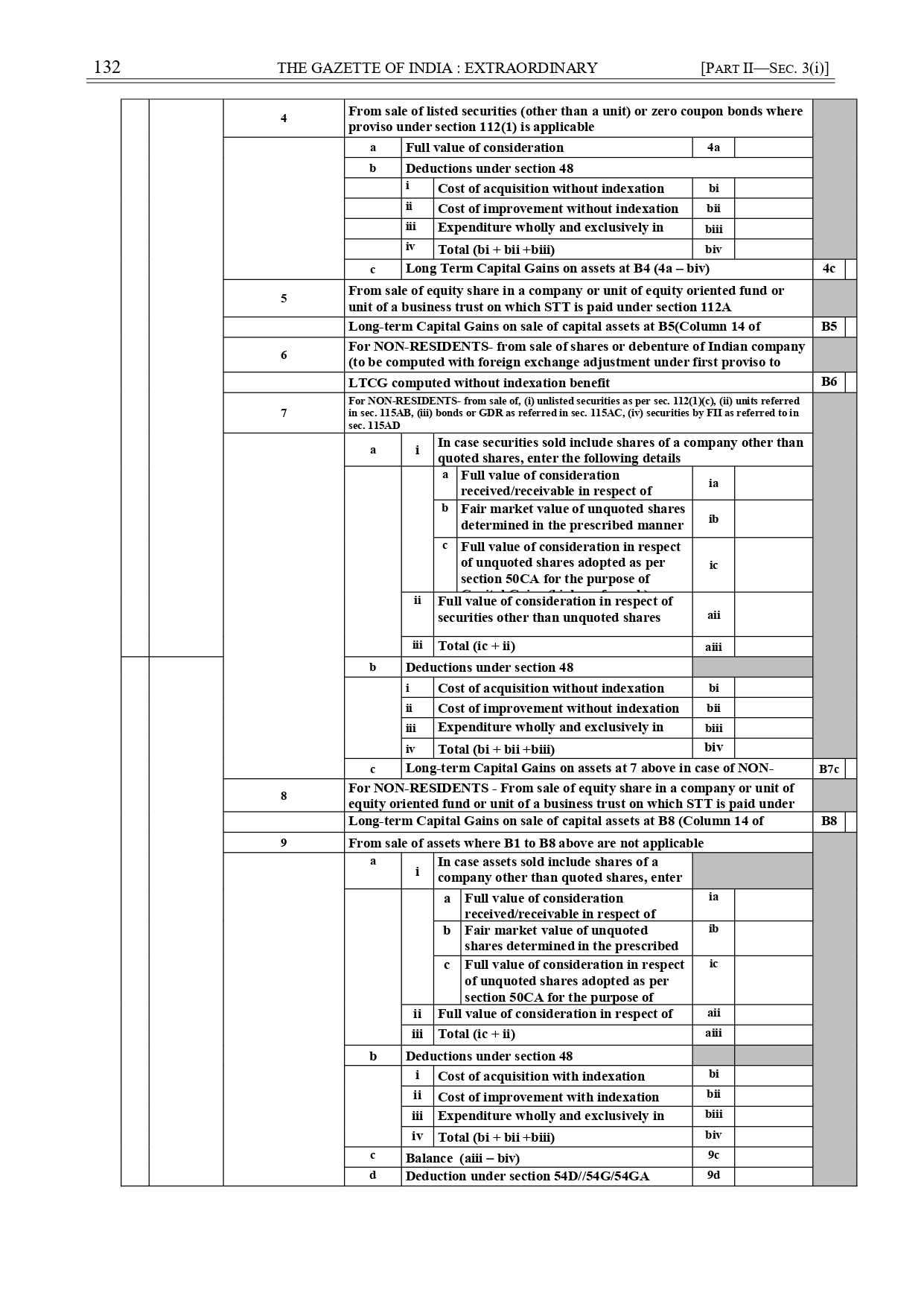

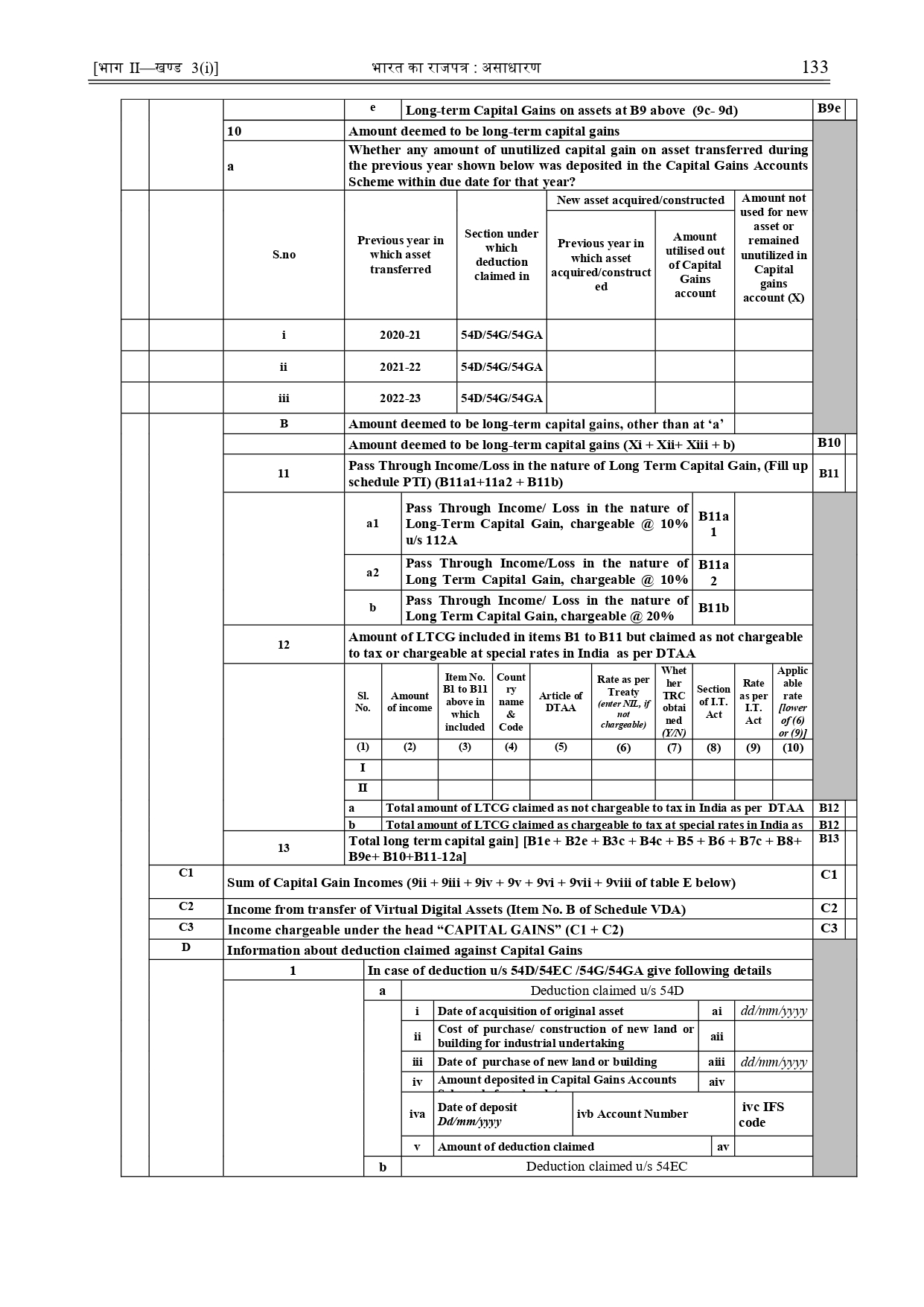

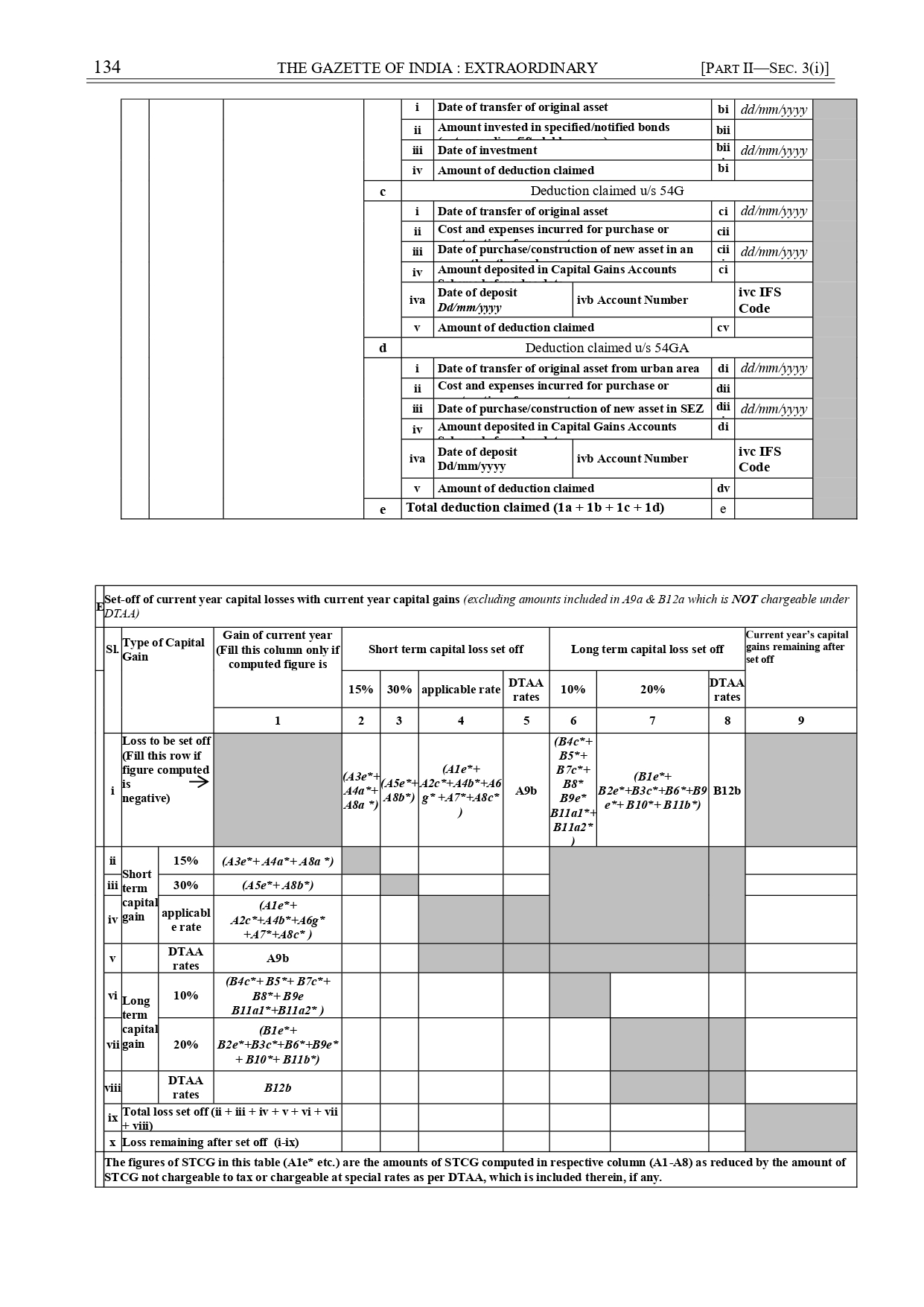

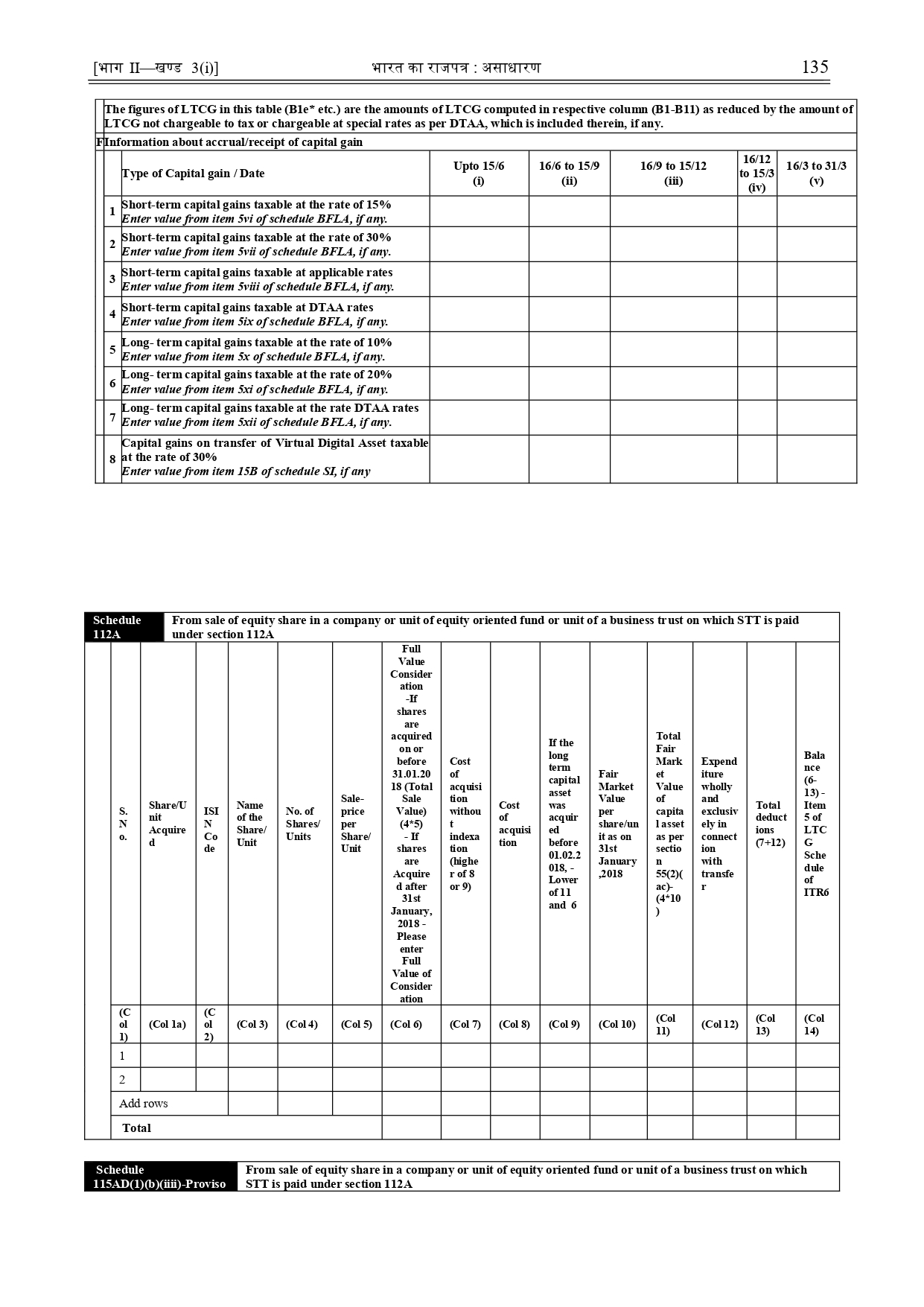

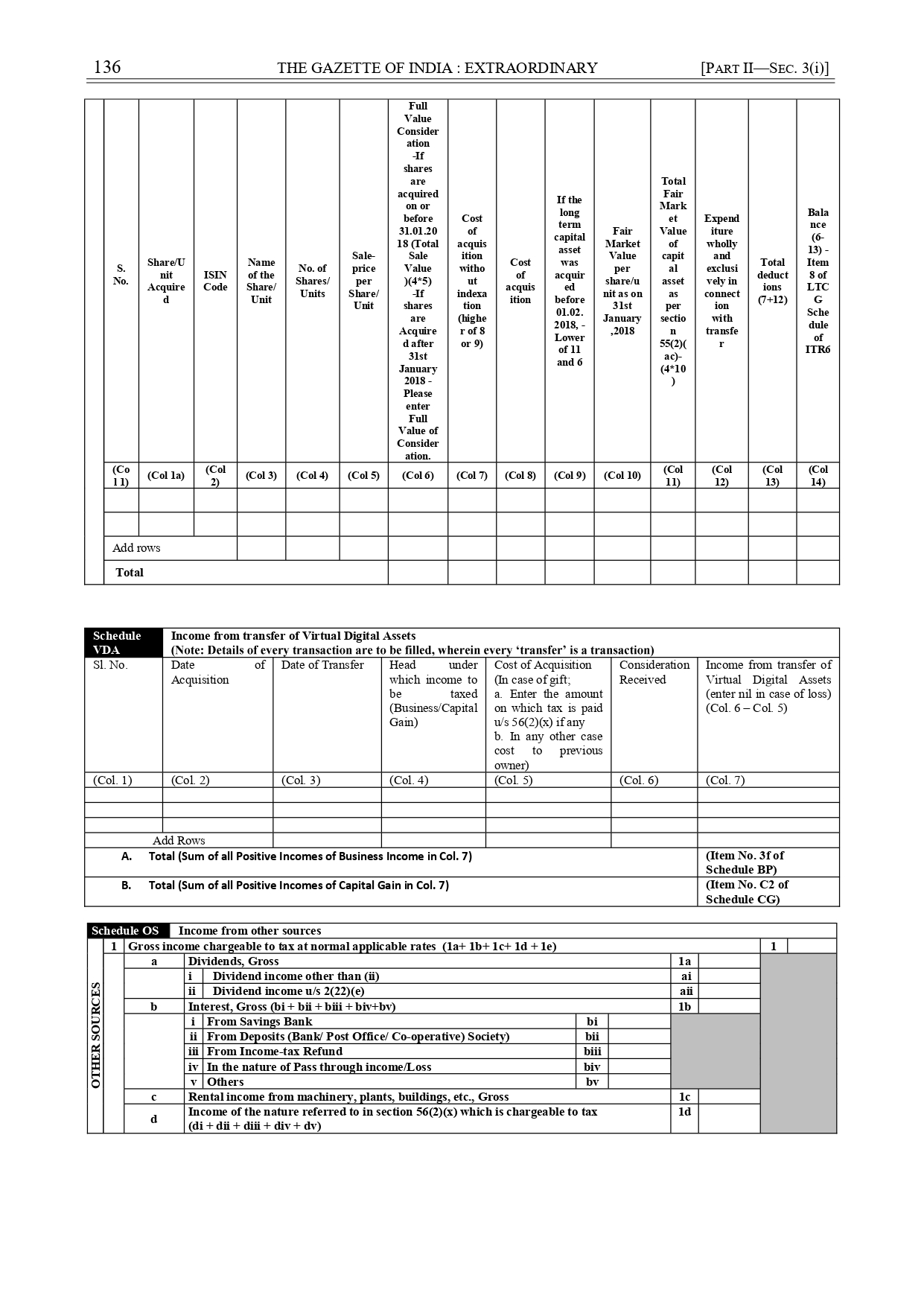

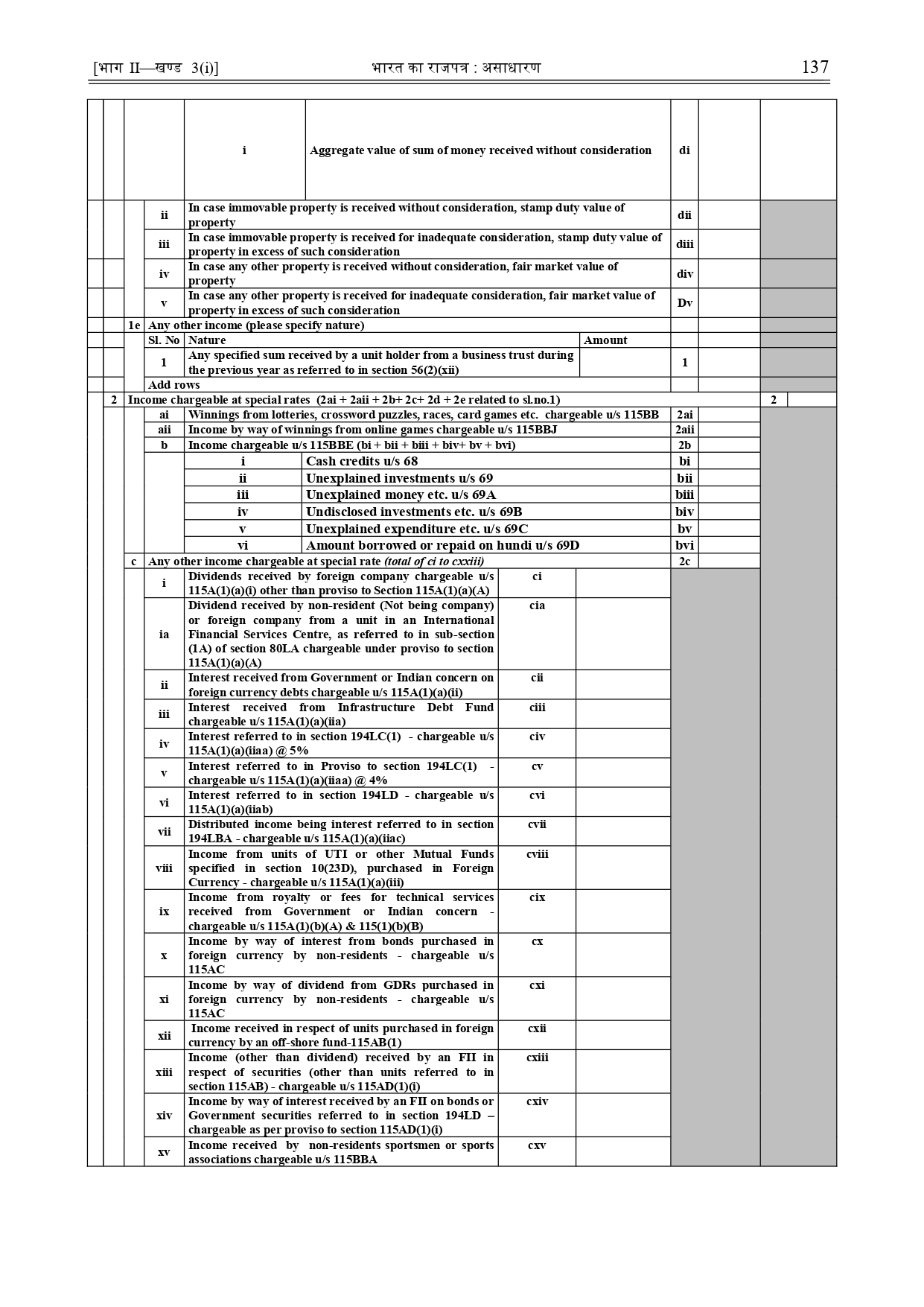

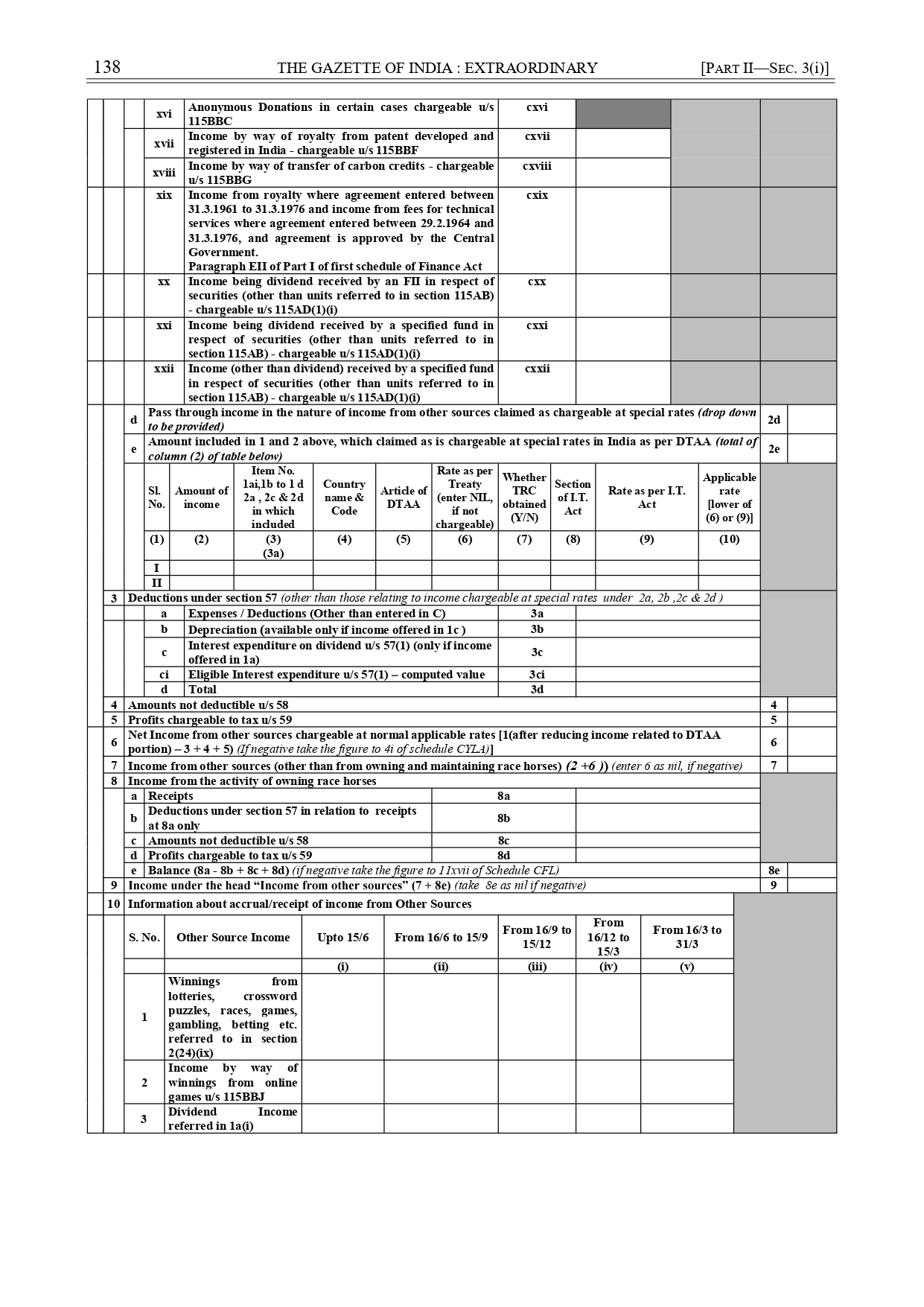

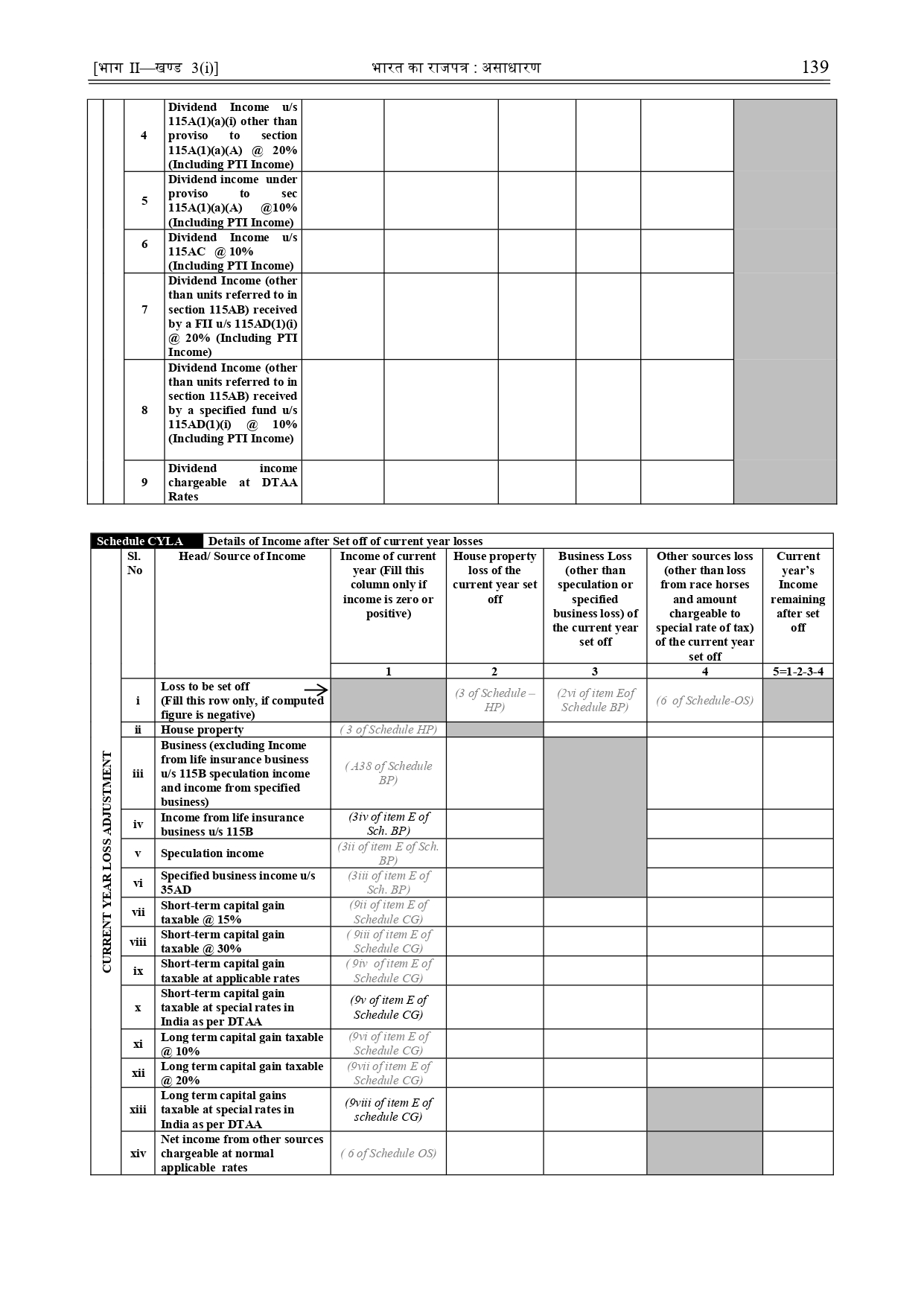

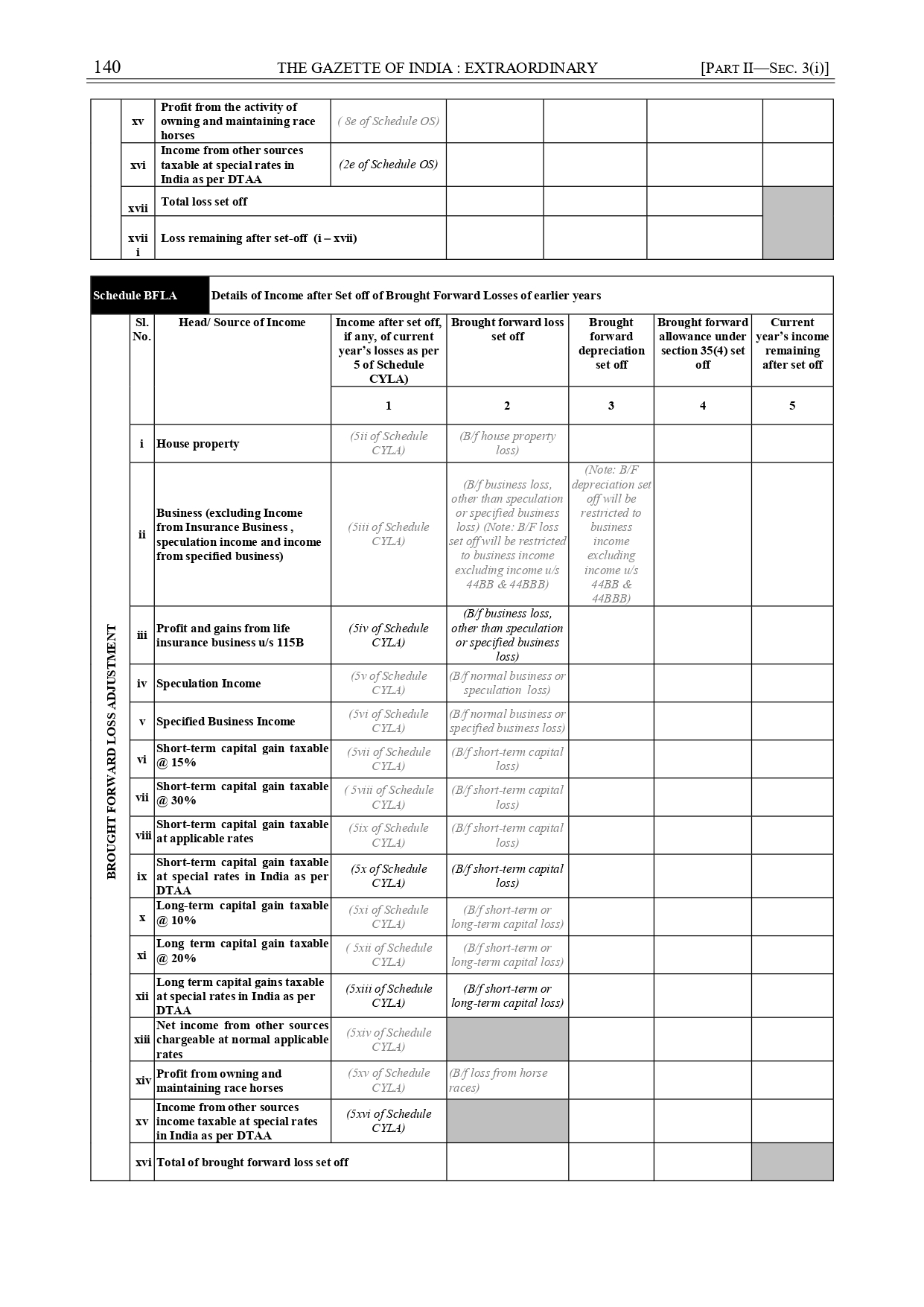

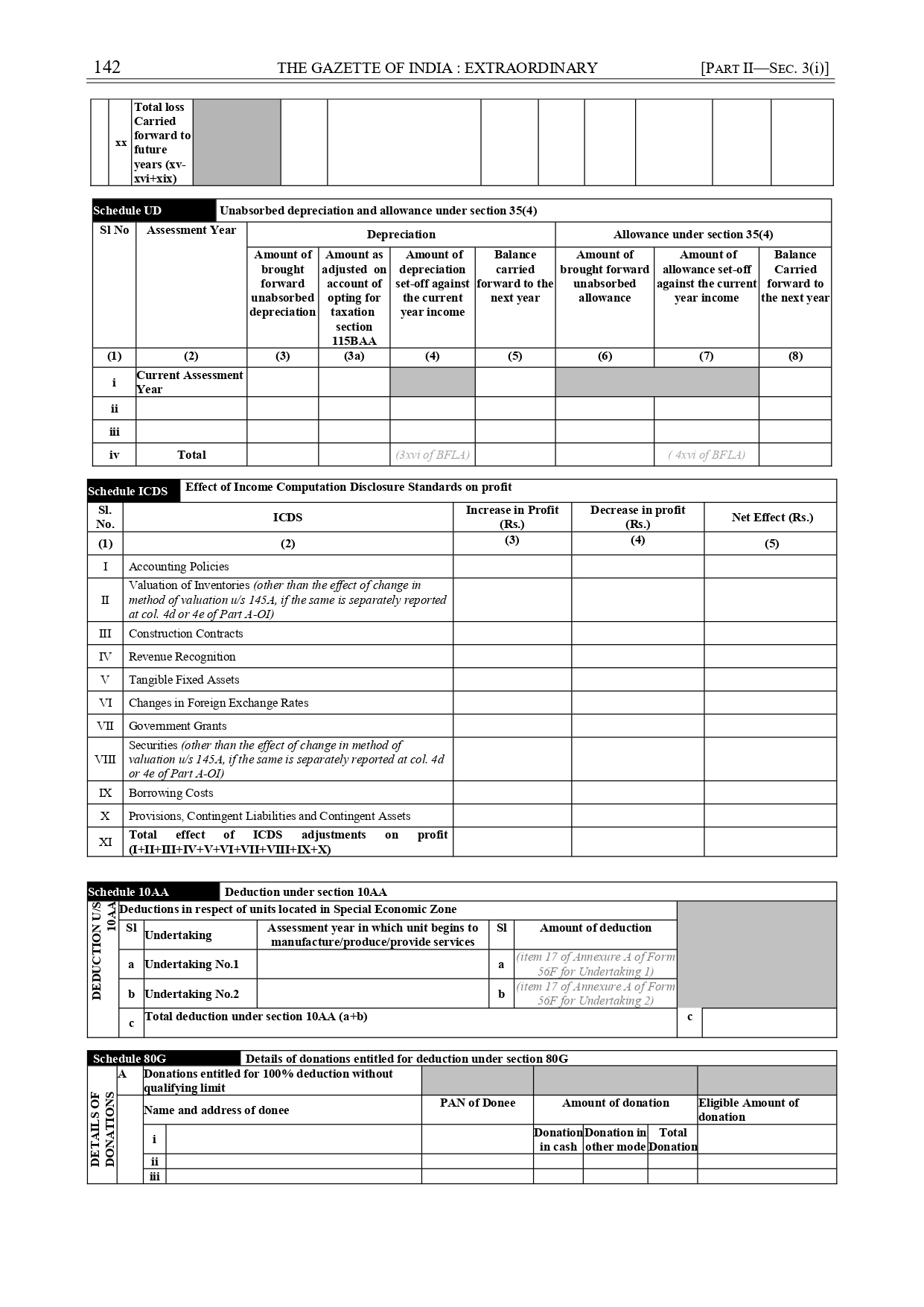

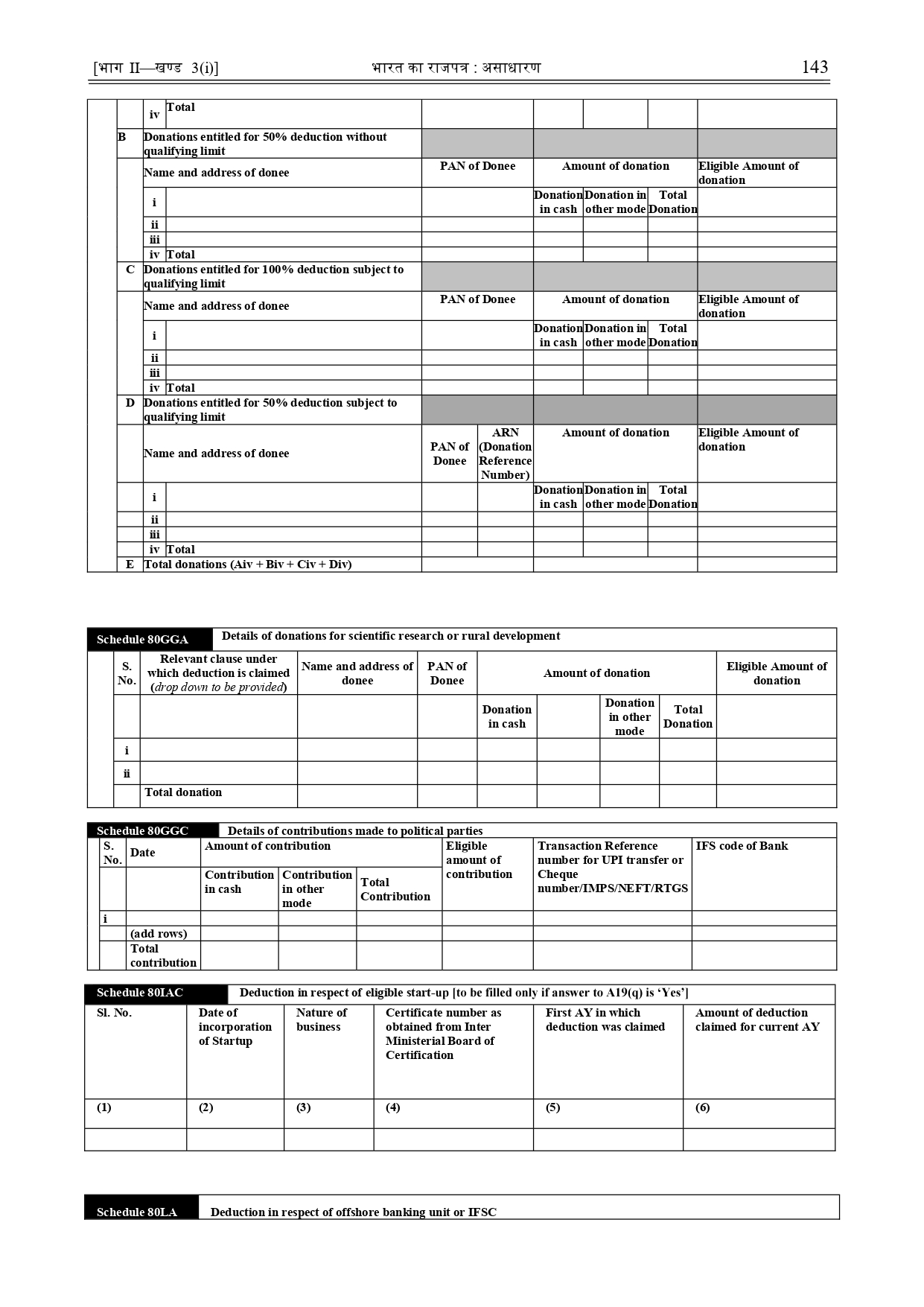

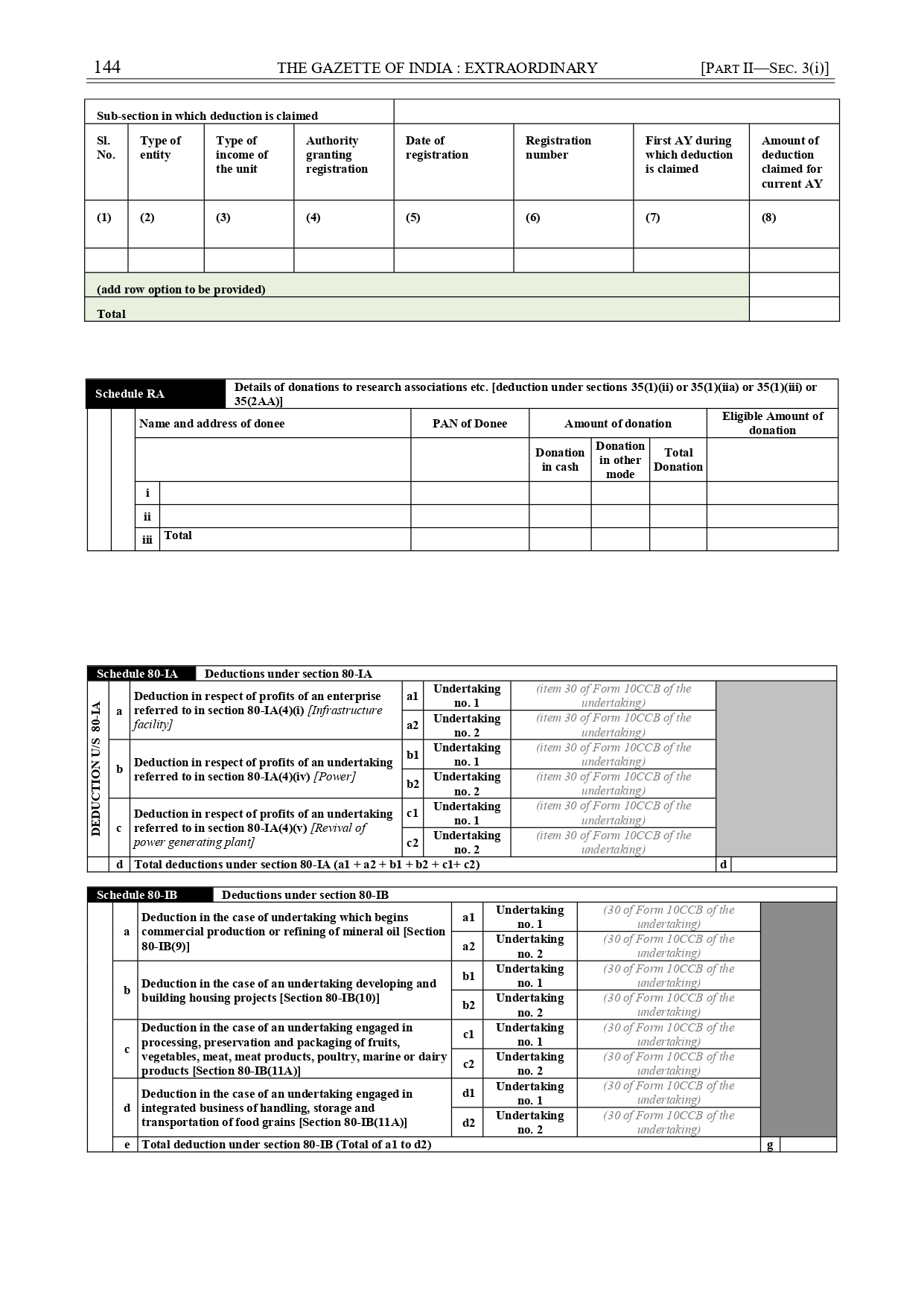

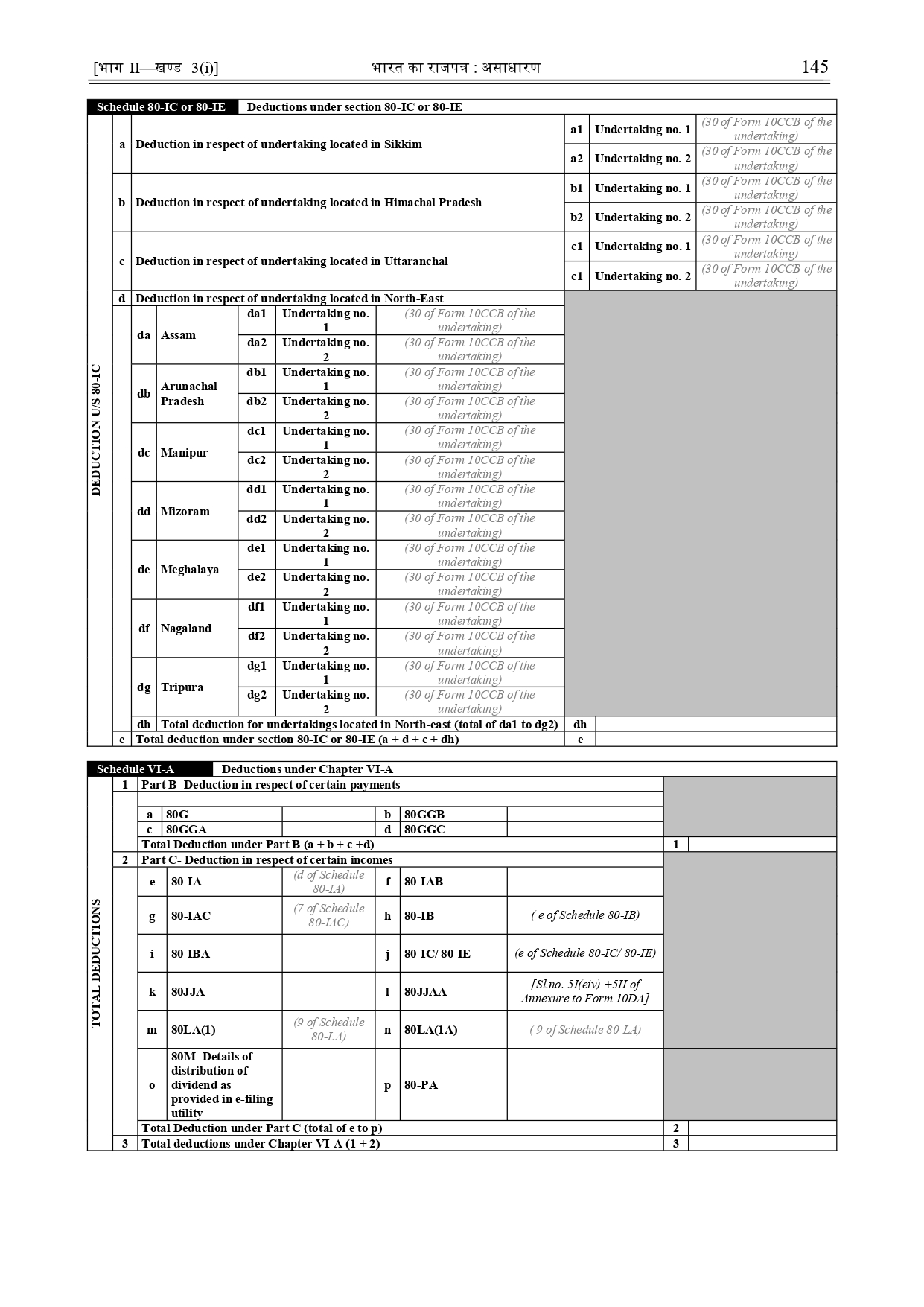

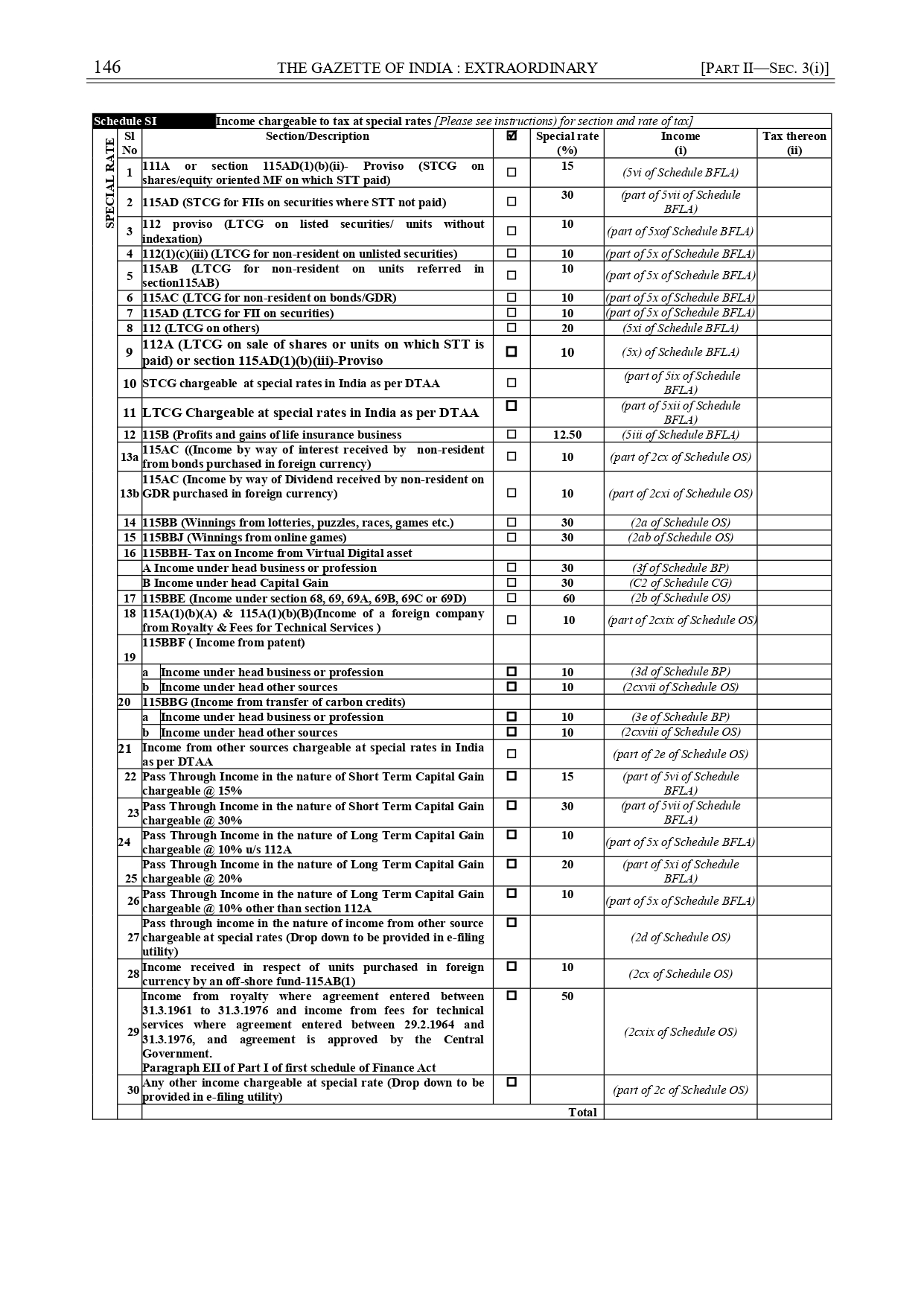

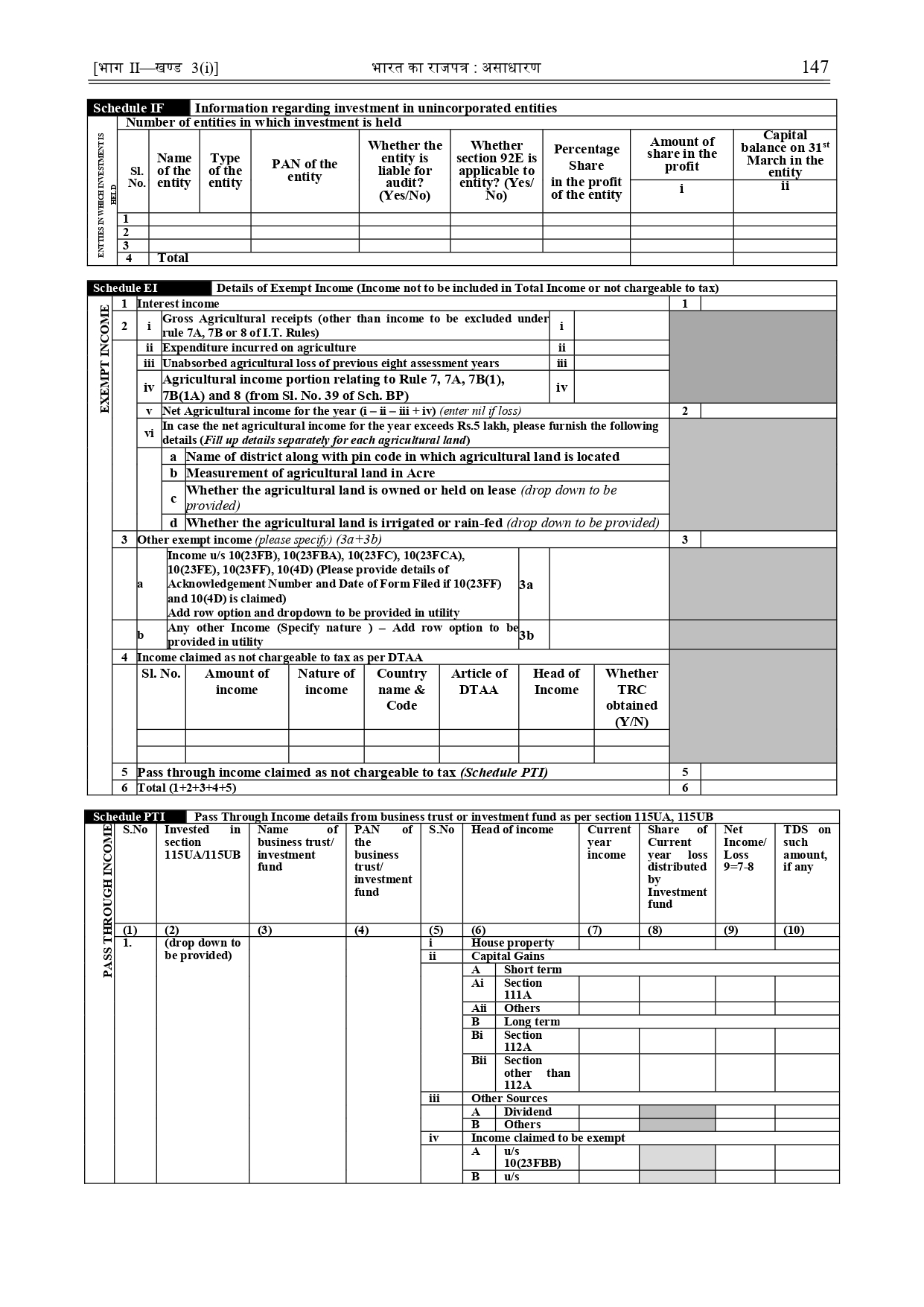

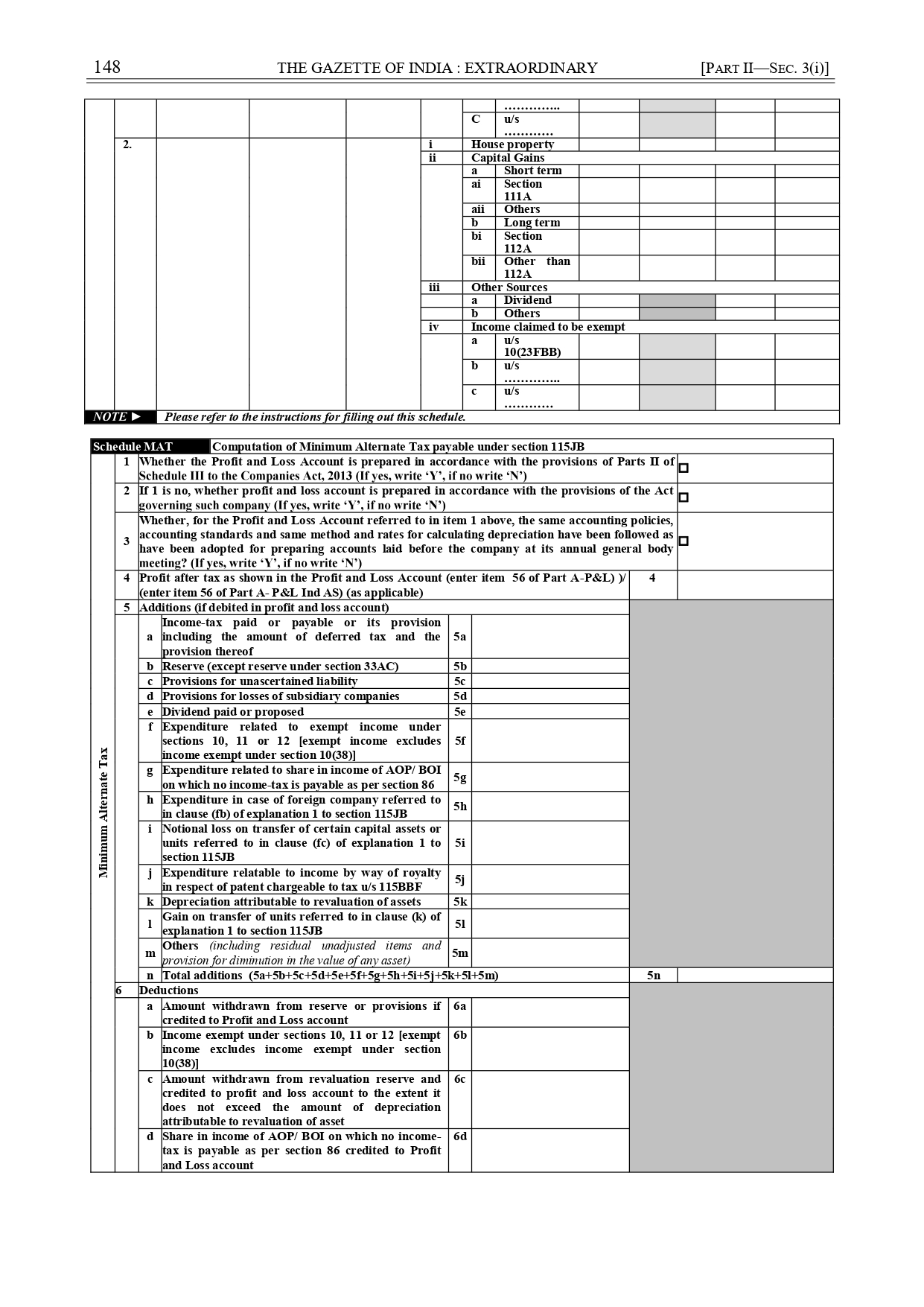

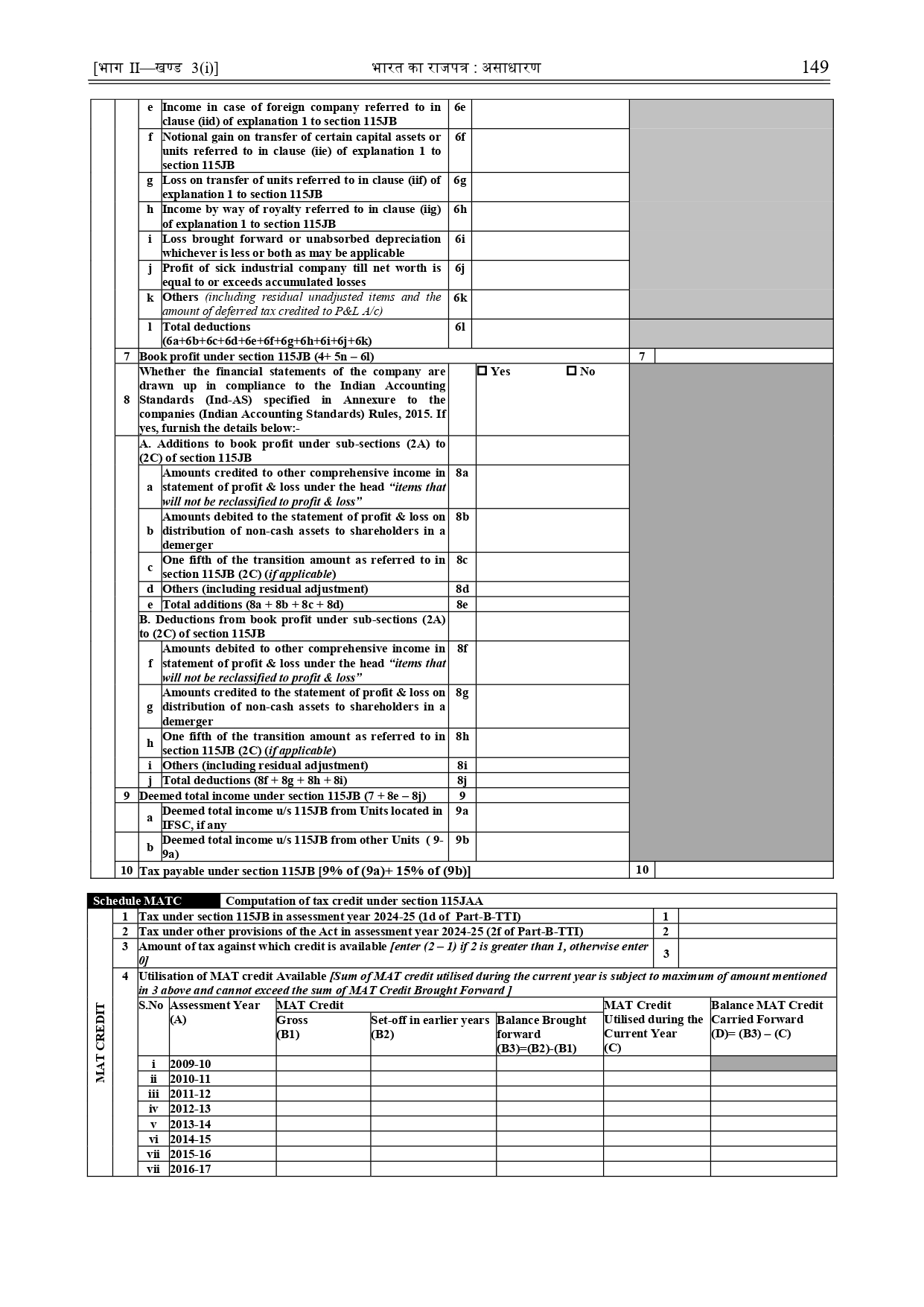

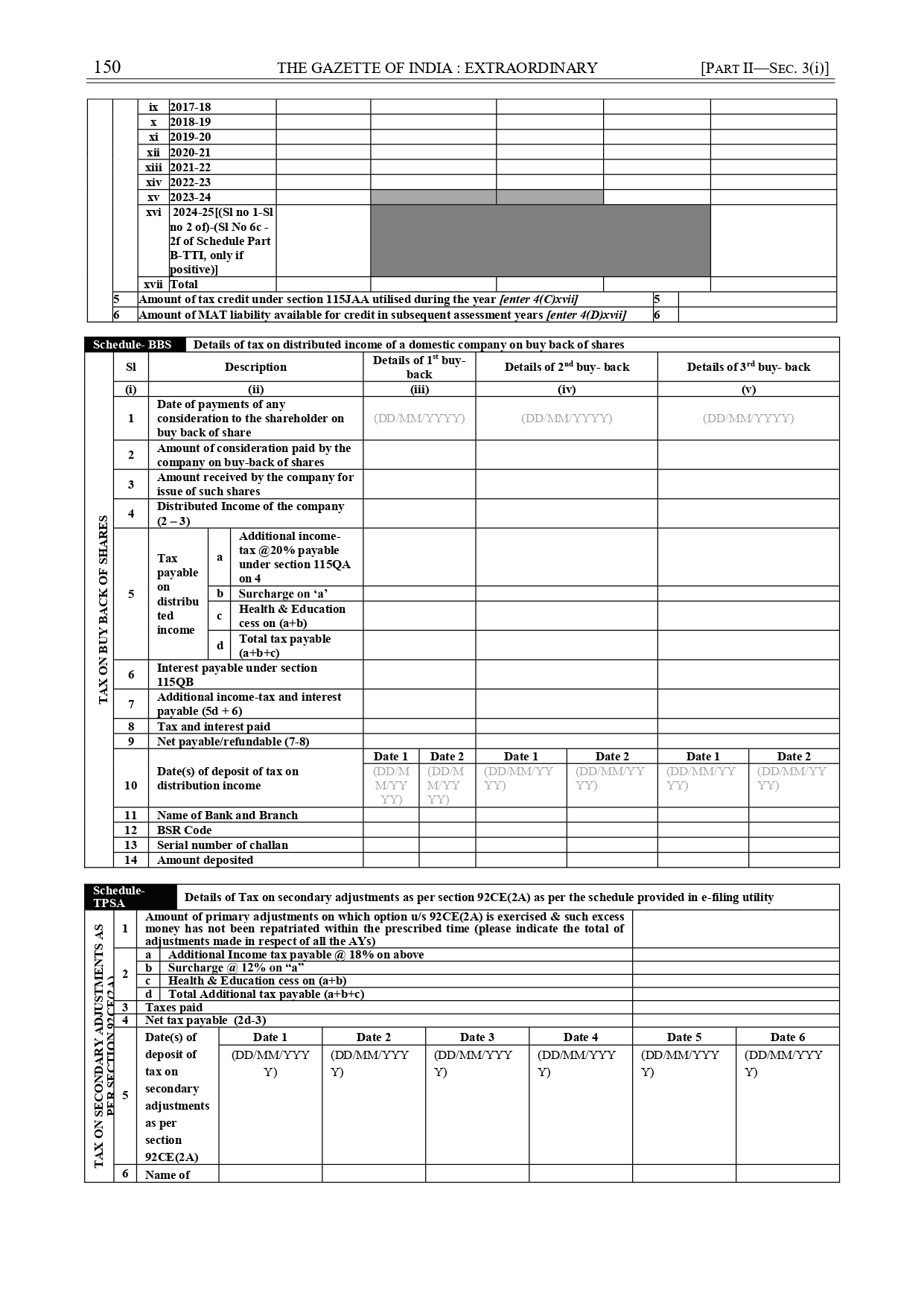

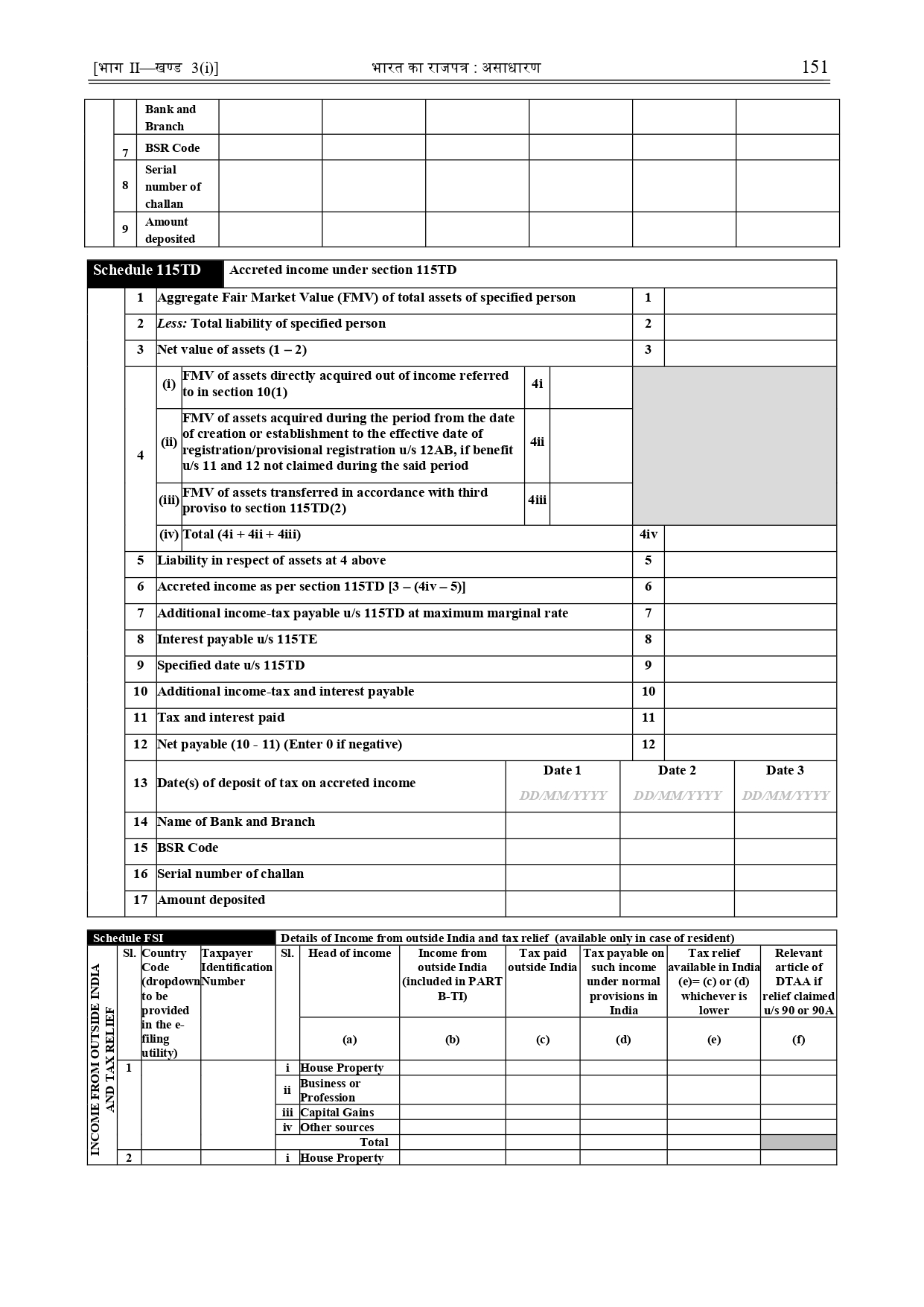

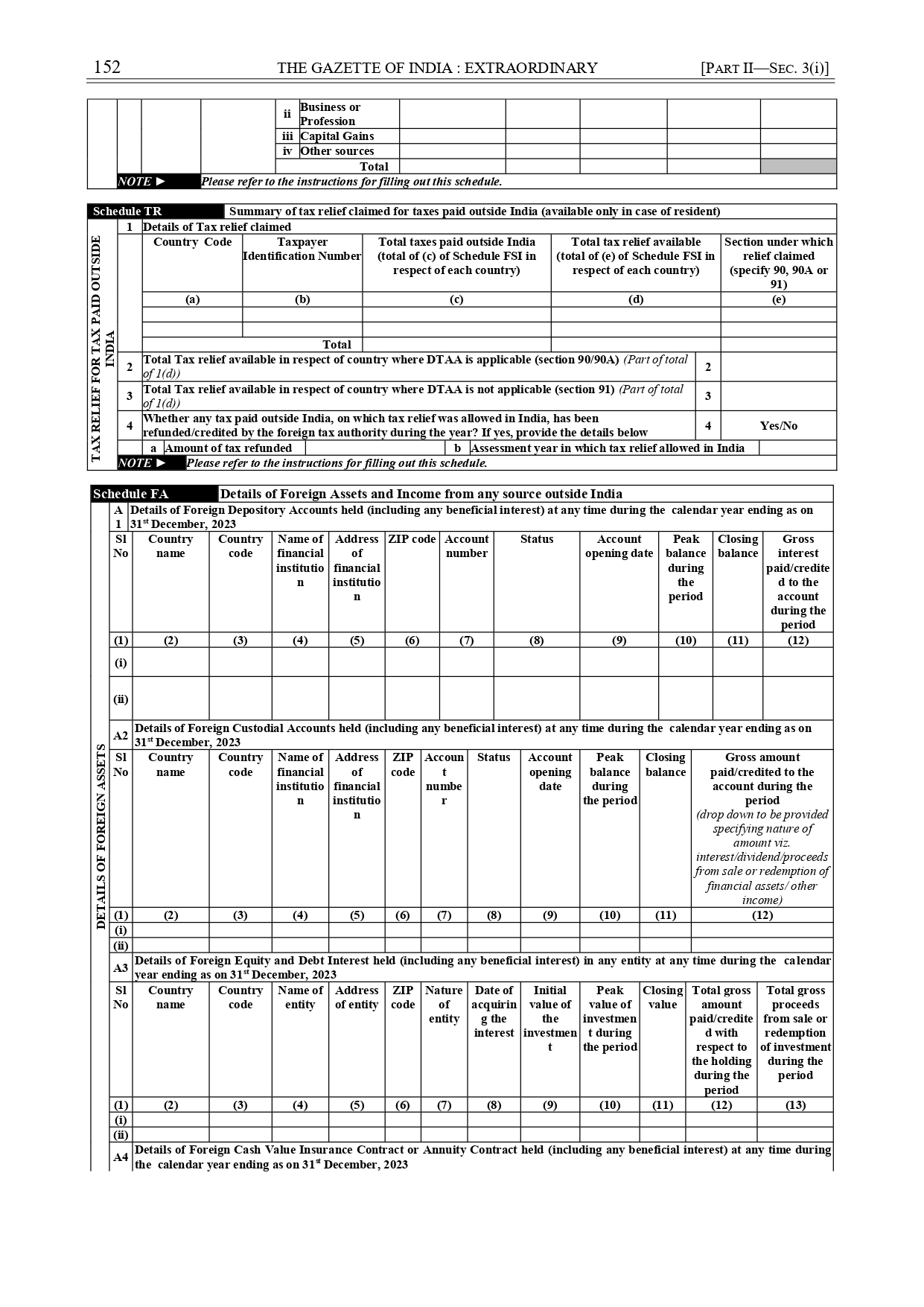

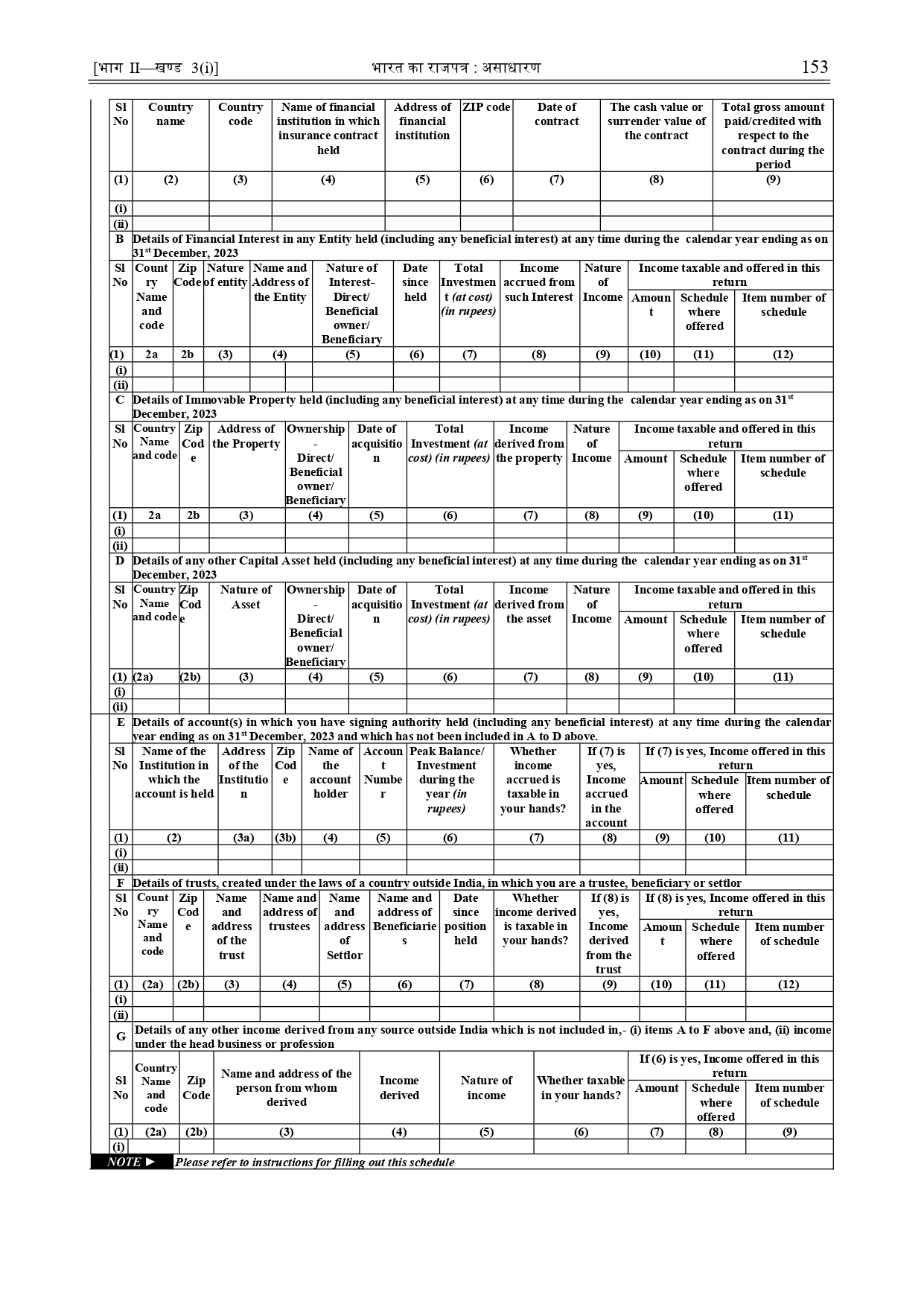

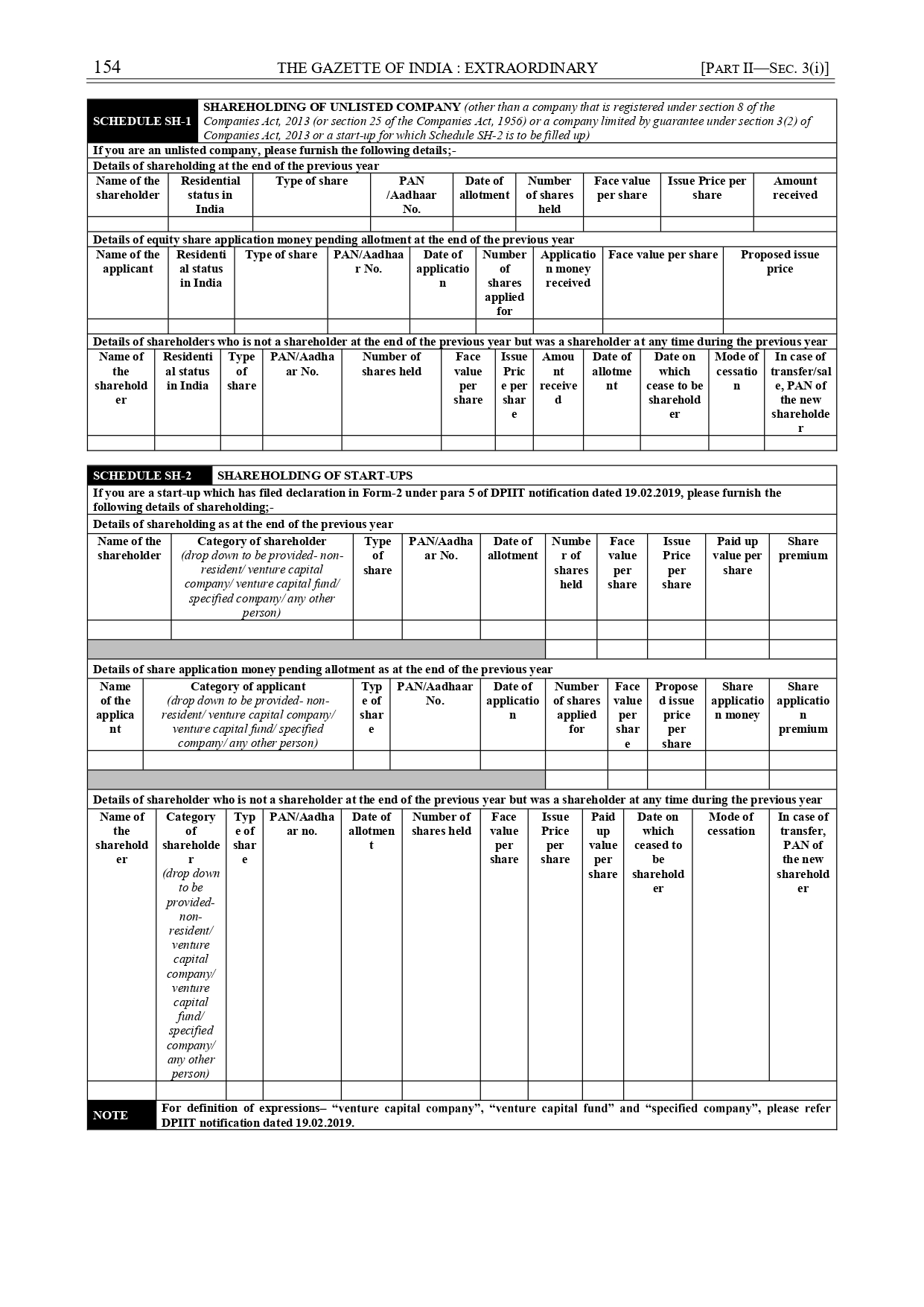

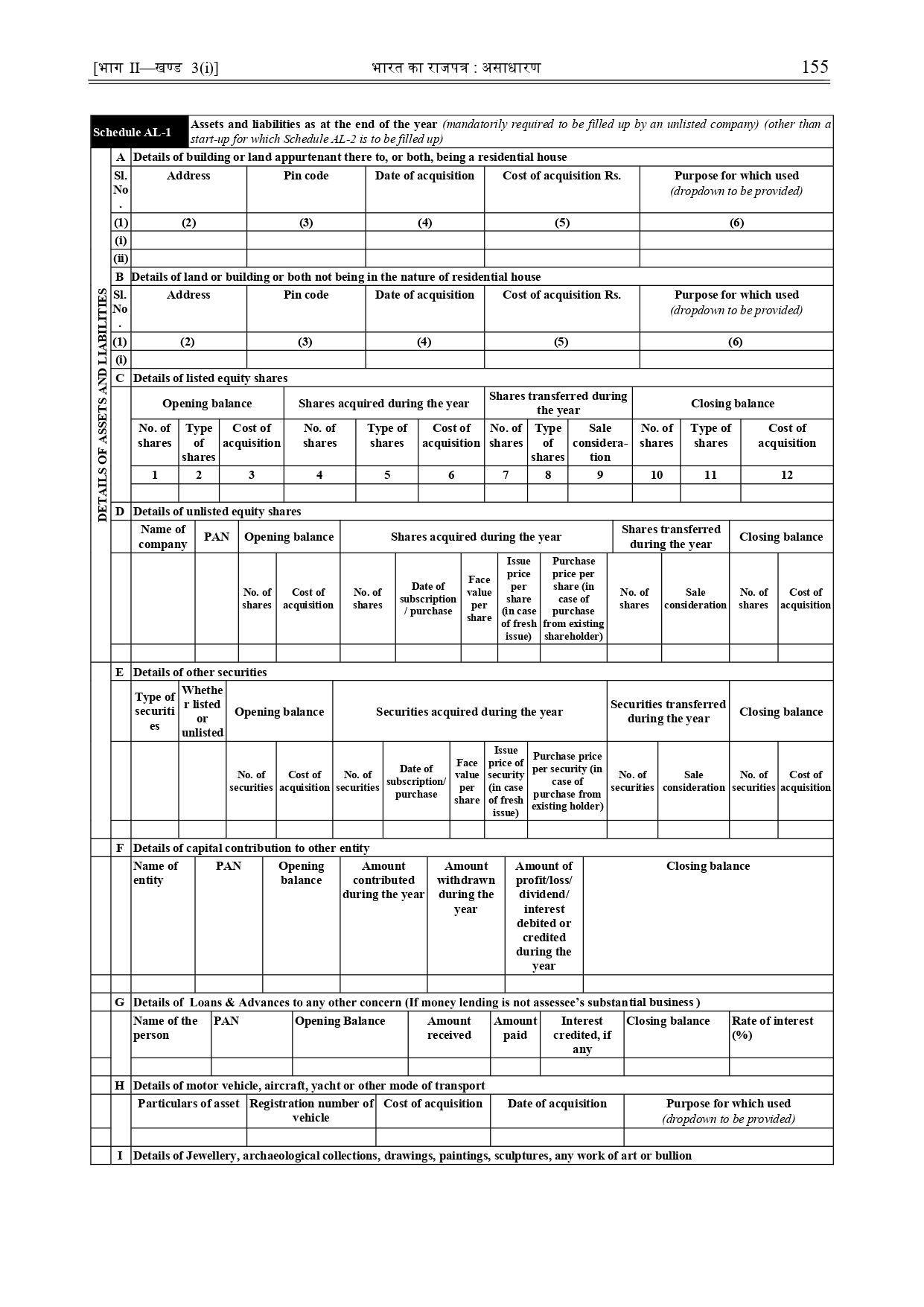

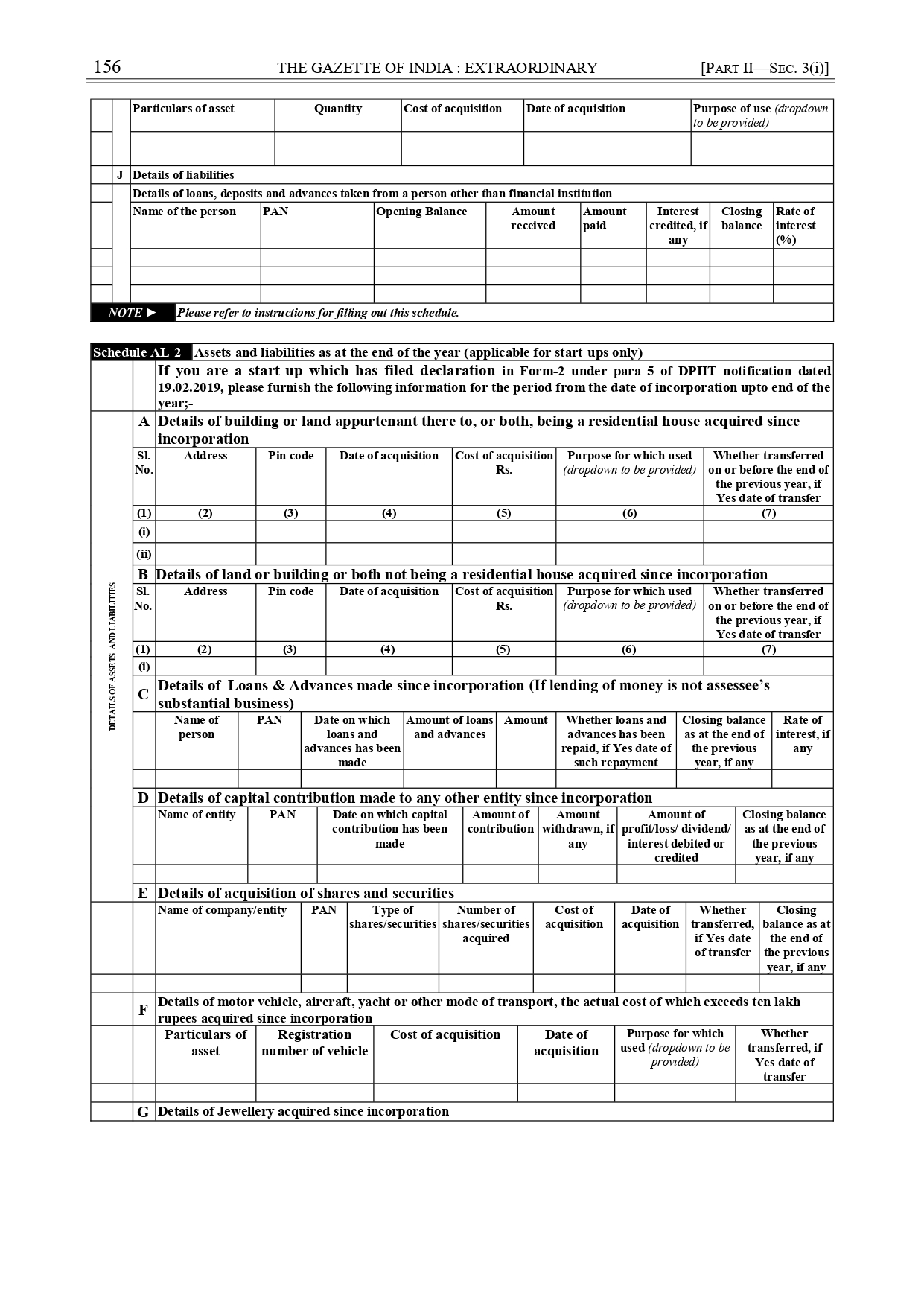

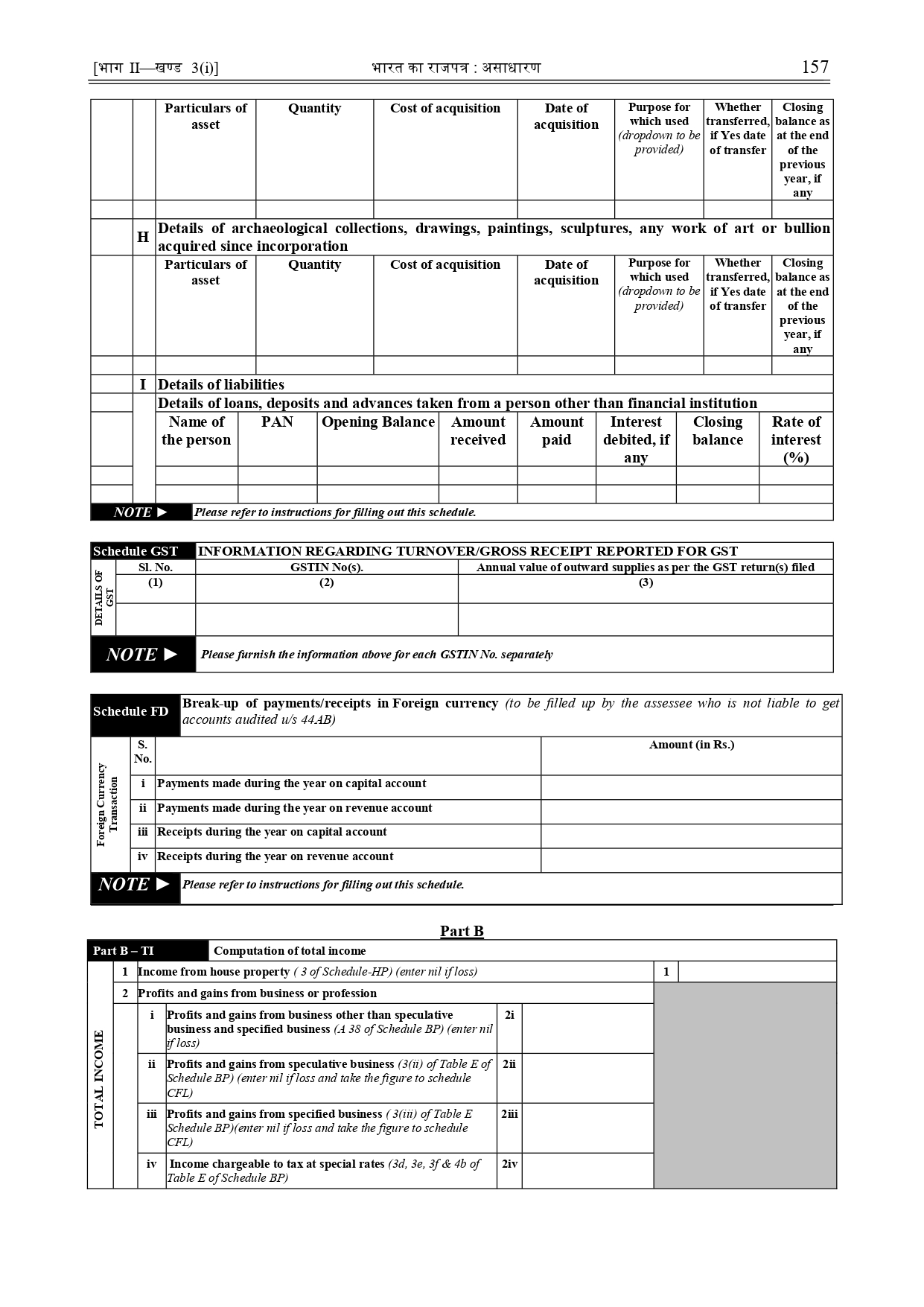

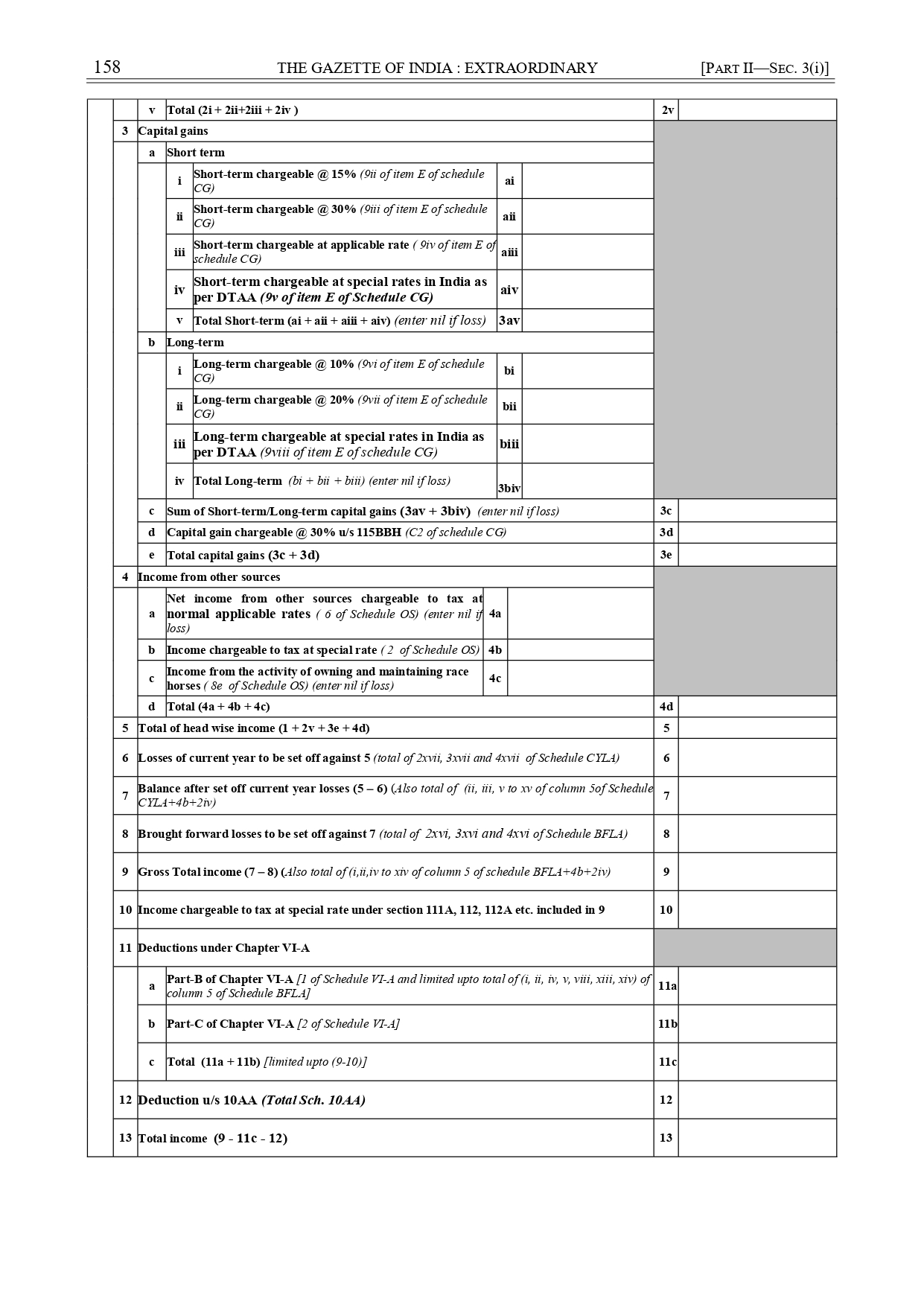

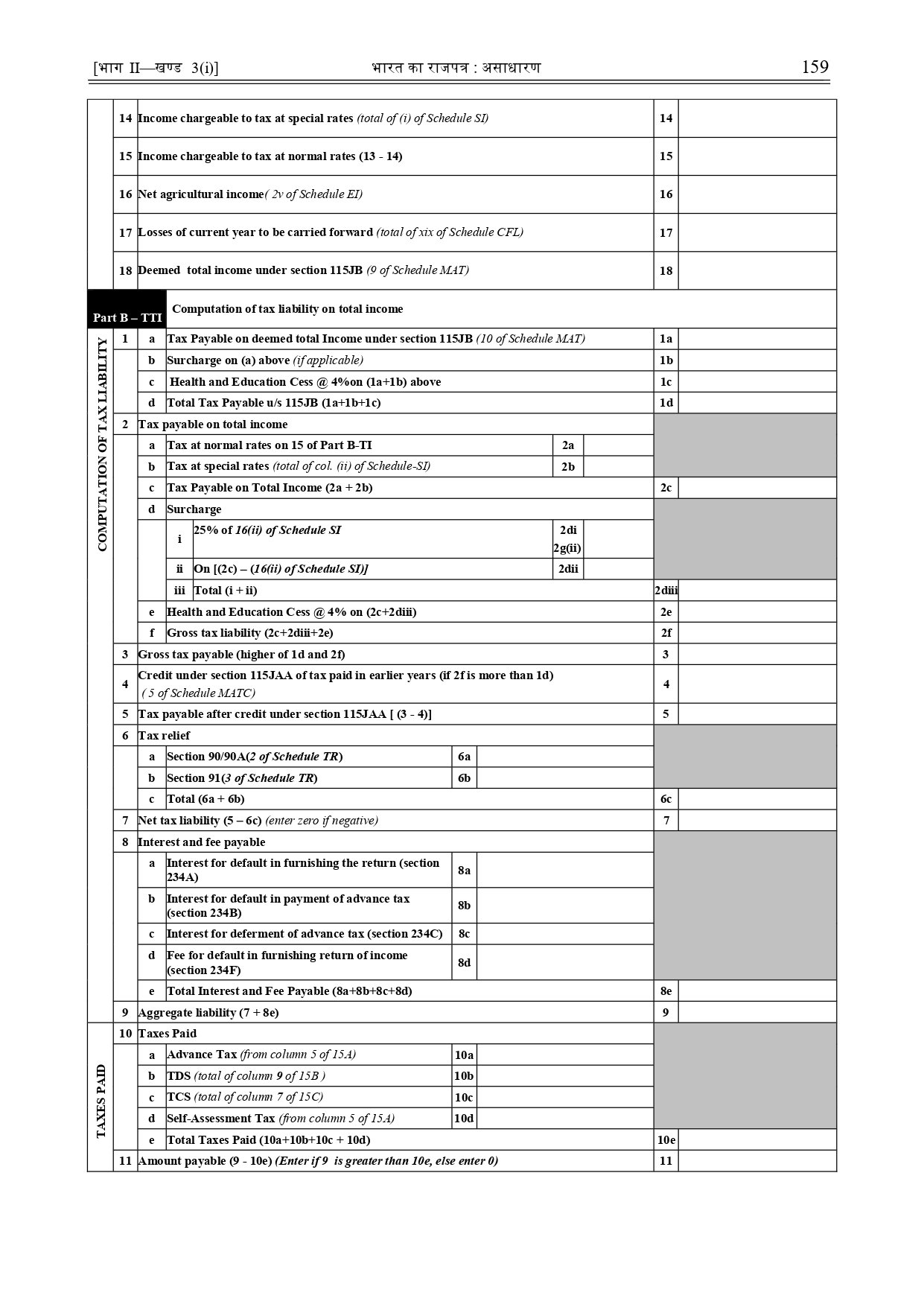

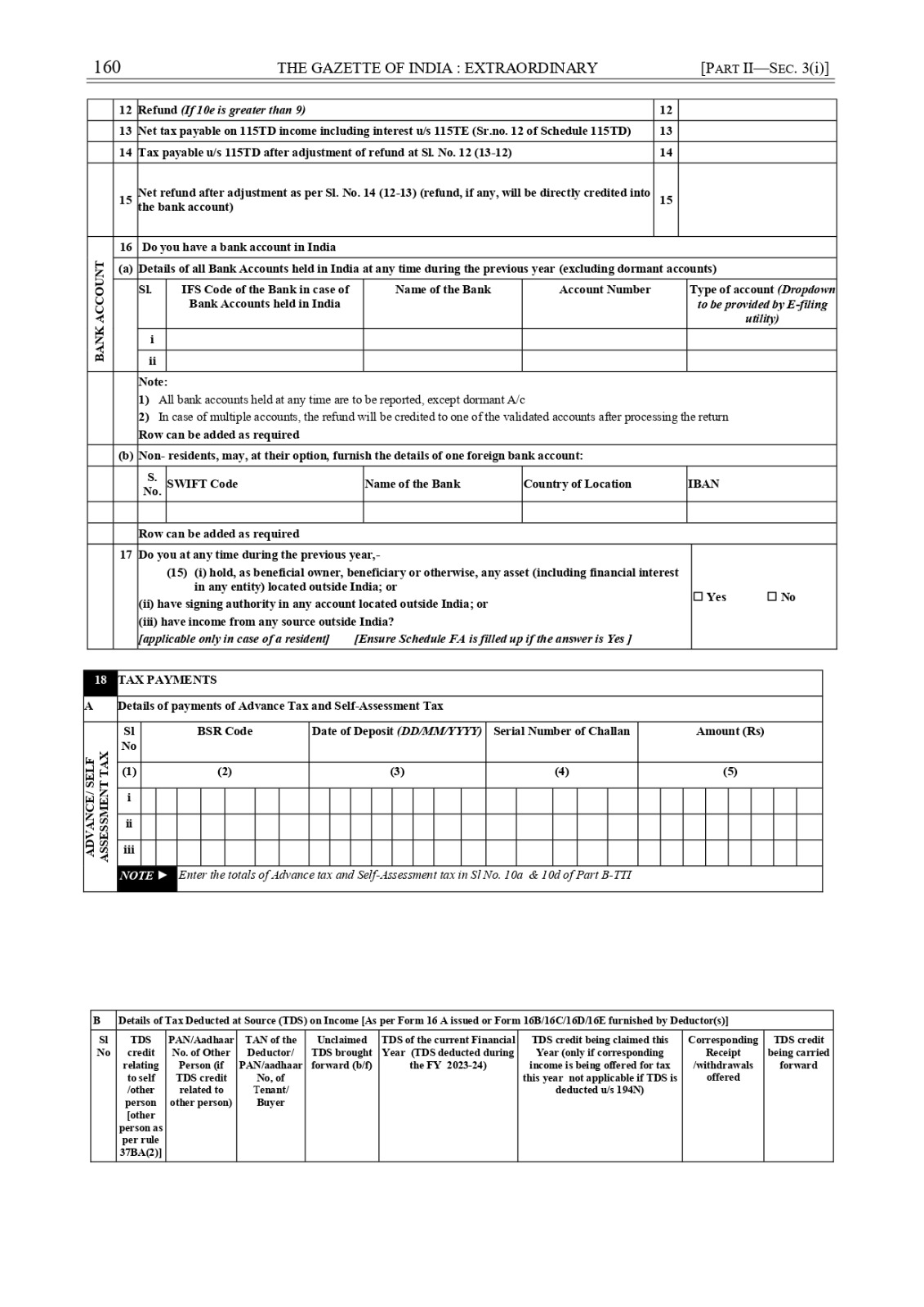

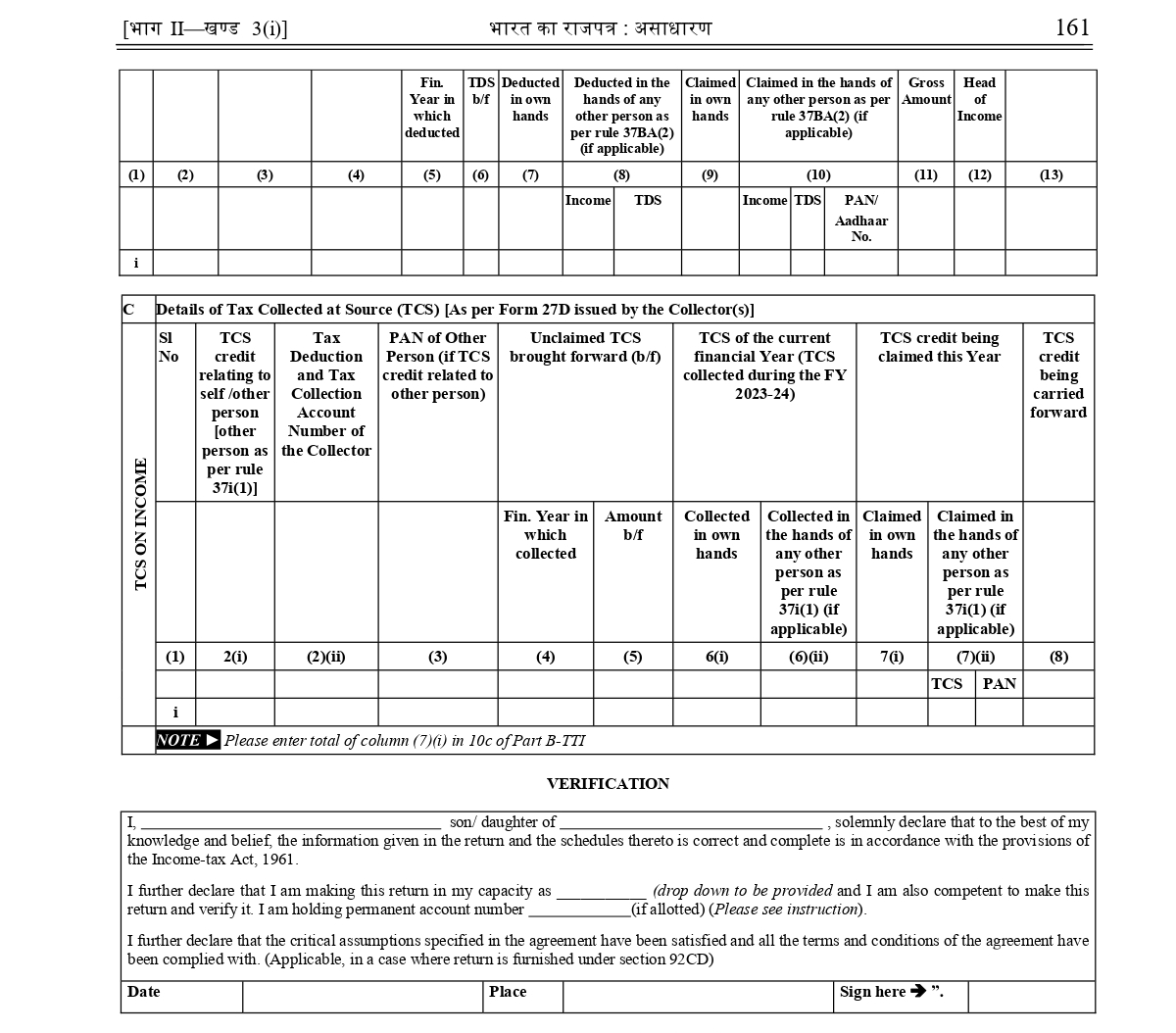

2. In the Income-tax Rules, 1962, in Appendix-II, for Form ITR-6, the following Form shall be substituted, namely:-

[F.No. 370142/49/2023-TPL]

(Surbendu Thakur)

Under Secy., Tax Policy and Legislation

Note:- The principal rules were published vide notification S.O. 969 (E), dated the 26th March, 1962 and last amended vide notification G.S.R. 908(E), dated the 22nd December, 2023 |