GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

NEW DELHI

NOTIFICATION NO

72/2018, Dated: October 23, 2018

G.S.R 1054(E).- In exercise of the powers conferred by section 253 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.- (1) These rules may be called the Income-tax (10th Amendment) Rules, 2018.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962, -

"(i) in rule 47, in sub-rule (1) and sub-rule (2), for the words, brackets and figure "sub-rule (2)", the words, brackets and figure "sub-rule (3)" shall respectively be substituted;

(ii) in Appendix II, -

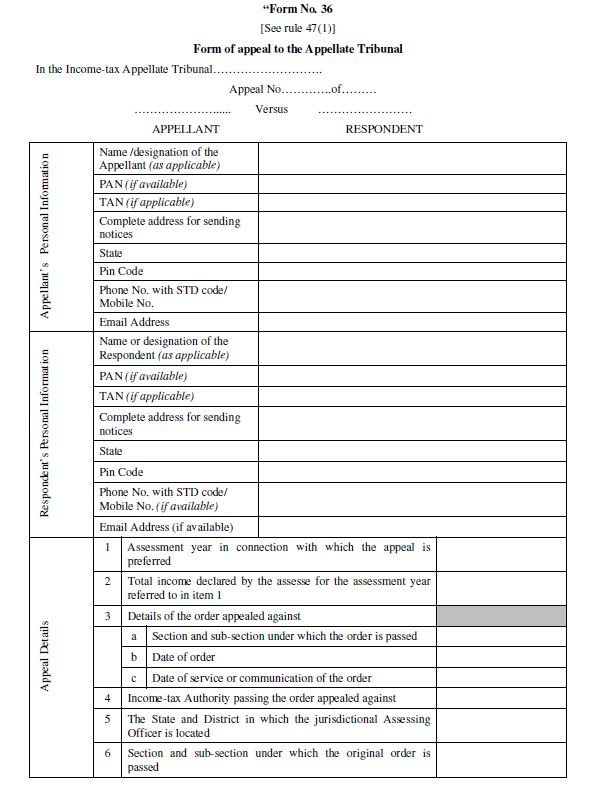

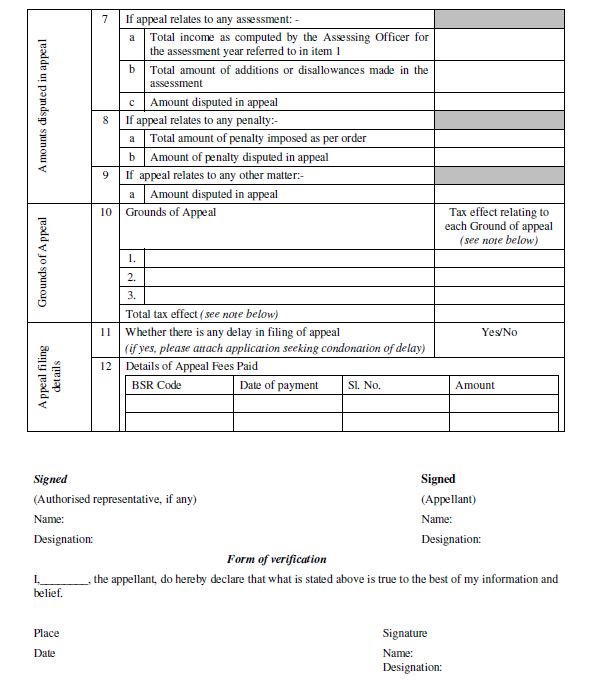

(a) for Form 36 and notes thereto, the following shall be substituted, namely:-

Notes:

1. The memorandum of appeal shall be in triplicate and shall be accompanied by-

(a) two copies (at least one of which should be a certified copy) of the order appealed against, two copies of the relevant order of the Assessing Officer, two copies of the grounds of appeal or the grounds of objection before the first appellate authority or the Dispute Resolution Panel, two copies of the statement of facts, if any, filed before the said appellate authority or the Dispute Resolution Panel, and also-

(i) in the case of an appeal against an order levying penalty, two copies of the relevant assessment order;

(ii) in the case of an appeal against an order under sub-section (3) of section 143 read with section 144A of the Income-tax Act, 1961, two copies of the directions issued under the said section 144A;

(iii) in the case of an appeal against an order under section 147 of the Income-tax Act, 1961, two copies of the original assessment order, if any;

(iv) in the case of an appeal against an assessment order made in pursuance of the directions of the Dispute Resolution Panel, the copy of Directions of the Dispute Resolution Panel.

(b) two copies of the relevant order where an appeal is against an order passed by a Principal Chief Commissioner or Chief Commissioner or a Principal Director General or Director General or Principal Commissioner or Commissioner or Principal Director or Director.

2. (A) The memorandum of appeal by an assessee under sub-section (1) of section 253(1) of the Income tax Act, 1961 shall be accompanied by a fee of, -

(a) where the total income of the assessee as computed by the Assessing Officer, in the case to which the appeal relates, is one hundred thousand rupees or less, five hundred rupees;

(b) where the total income of the assessee, computed as aforesaid, in the case to which the appeal relates is more than one hundred thousand rupees but not more than two hundred thousand rupees, one thousand five hundred rupees;

(c) where the total income of the assessee, computed as aforesaid, in the case to which the appeal relates is more than two hundred thousand rupees, one per cent. of the assessed income, subject to a maximum of ten thousand rupees;

(d) where the subject matter of an appeal relates to any matter, other than those specified in clauses (a), (b) and (c), five hundred rupees;

(e) no fee shall be payable in the case of a memorandum of cross-objections;

(f) an application for stay of demand shall be accompanied by a fee of five hundred rupees.

(B) The fee may be credited in a branch of the authorised bank or a branch of the State Bank of India or a branch of the Reserve Bank of India after obtaining a challan and the copy of the challan in triplicate shall be sent to the Appellate Tribunal with the memorandum of appeal.

(C) The Appellate Tribunal shall not accept cheques, drafts, hundies or other negotiable instruments for the purpose of payment of the fee.

3. The memorandum of appeal shall be written in English or, if the appeal is filed in a Bench located in any State notified by the President of the Appellate Tribunal for the purposes of rule 5A of the Income-tax (Appellate Tribunal) Rules, 1963, then, at the option of the appellant, in Hindi, and shall set forth, concisely and under distinct heads, the grounds of appeal without any argument or narrative and such grounds should be numbered consecutively.

4. The Appeal number and year of appeal shall be filled in by the office of the Appellate Tribunal.

5. In column's seeking Appellant's and Respondent's information, the relevant data, as applicable shall be filled in properly.

Illustration.- for instance in case the Department is Appellant or Respondent, as the case may be, the designation of the officer filing the Appeal and details pertaining to his office may be filled, if available.

6. The 'Tax effect' for the purpose of filling this Form shall be taken as the difference between the tax on the total income assessed and the tax that would have been chargeable had such total income been reduced by the amount of income in respect of the issues against which appeal is intended to be filed (i.e. disputed issues) including applicable surcharge and cess:

Provided that the tax shall not include any interest thereon, except where chargeability of interest itself is in dispute and in case the chargeability of interest is the issue under dispute, the amount of interest shall be the tax effect:

Provided further that in cases where returned loss is reduced or assessed as income, the tax effect shall include notional tax on disputed issues:

Provided also that in case of penalty orders, the tax effect shall be the quantum of penalty deleted or reduced in the order to be appealed against:

Provided also that while determining 'total tax effect' the tax effect on grounds, which forms part of the common grounds, such as where reopening of the case itself is under challenge, shall not be considered separately:

Provided also that where income is computed under the provisions of section 115JB or section 115JC of the Income-tax Act, 1961, the 'tax effect', shall be computed as per the following formula, namely: -

(A-B) + (C-D)

Where,

A = the total amount of tax as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called regular provisions);

B = the total amount of tax that would have been chargeable had the total income assessed as per the regular provisions been reduced by the amount of the disputed issues under regular provisions;

C = the total amount of tax as per the provisions contained in section 115JB or section 115JC;

D = the total amount of tax that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC was reduced by the amount of disputed issues under the said provisions:

Provided also that where the amount of disputed issues is considered both under the provisions contained in section 115JB or section 115JC and under regular provisions, such amount shall not be reduced from total amount of tax while determining the amount under item D.

7. If the space provided is found insufficient, separate enclosures may be used for the purpose.";

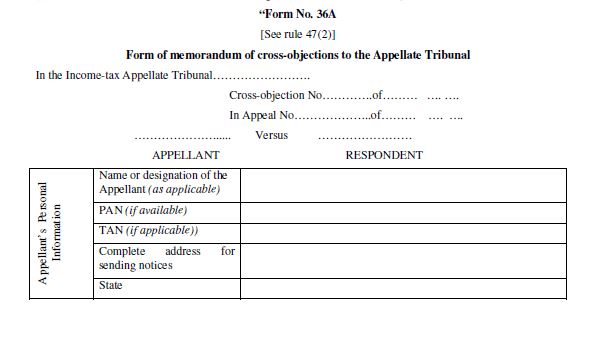

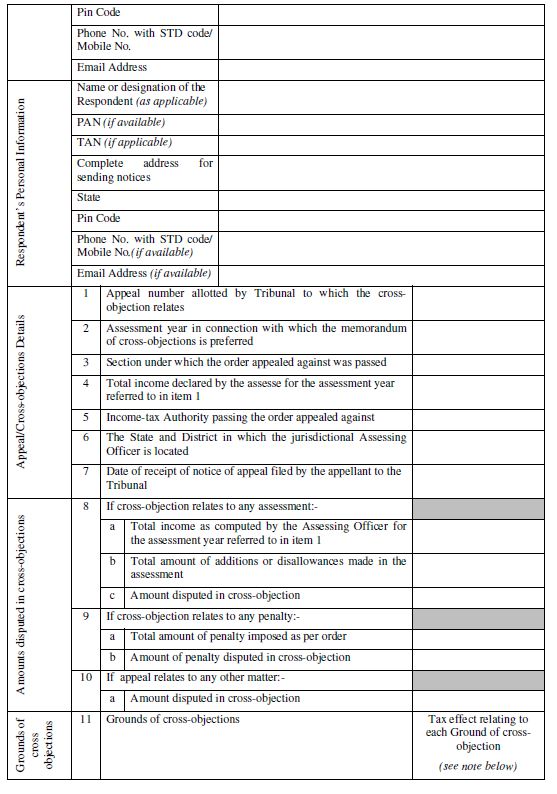

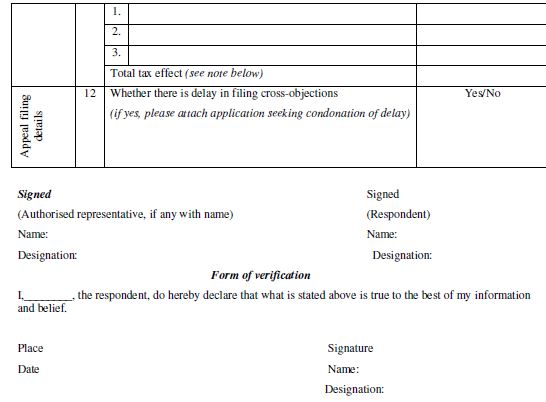

(b) for Form 36A and notes thereto, the following shall be substituted, namely:-

Notes:

1. The memorandum of cross-objections must be in triplicate.

2. The memorandum of cross-objections shall be written in English or, if the memorandum is filed in a Bench located in any State notified by the President of the Appellate Tribunal for the purposes of rule 5A of the Income-tax (Appellate Tribunal) Rules, 1963, then, at the option of the respondent, in Hindi, and shall set forth, concisely and under distinct heads, the cross-objections without any argument or narrative and such objections should be numbered consecutively.

3. The number and year of memorandum of cross-objections shall be filled in by the office of the Appellate Tribunal.

4. The Appeal number and year of appeal as allotted by the office of the Tribunal and appearing in the notice of appeal received by the respondent shall be filled in by the respondent.

5. In column seeking Respondents and Appellants information, the relevant data, as applicable, shall be filled in properly. Illustration.-for instance in case the department is Appellant or Respondent, as the case may be, the designation of the officer filing the cross-objections and details pertaining to his office may be filled, if available.

6. The 'Tax effect' for the purpose of filling this Form shall be taken as the difference between the tax on the total income assessed and the tax that would have been chargeable had such total income been reduced by the amount of income in respect of the issues against which croos-objection is intended to be filed (i.e. disputed issues) including applicable surcharge and cess:

Provided that the tax shall not include any interest thereon, except where chargeability of interest itself is in dispute and in case the chargeability of interest is the issue under dispute, the amount of interest shall be the tax effect:

Provided further that in cases where returned loss is reduced or assessed as income, the tax effect shall include notional tax on disputed issues:

Provided also that in case of penalty orders, the tax effect shall be the quantum of penalty deleted or reduced in the order to be cross-objected against:

Provided also that while determining 'total tax effect', the tax effect on grounds, which forms part of the common grounds of cross-objection, such as where reopening of the case itself is under challenge, shall not be considered separately:

Provided also that where income is computed under the provisions of section 115JB or section 115JC of the Income-tax Act, 1961, the 'tax effect', shall be computed as per the following formula, namely: -

(A-B) + (C-D)

Where,

A = the total amount of tax as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called regular provisions);

B = the total amount of tax that would have been chargeable had the total income assessed as per the regular provisions been reduced by the amount of the disputed issues under regular provisions;

C = the total amount of tax as per the provisions contained in section 115JB or section 115JC;

D = the total amount of tax that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC was reduced by the amount of disputed issues under the said provisions:

Provided also that where the amount of disputed issues is considered both under the provisions contained in section 115JB or section 115JC and under regular provisions, such amount shall not be reduced from total amount of tax while determining the amount under item D.

7. If the space provided is found insufficient, separate enclosures may be used for the purpose.".

[F. No. 370142/8/2018-TPL]

(Dr. T S Mapwal)

Under Secy.

Note: The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii) vide notification number S.O. 969(E), dated the 26th March, 1962 and last amended vide notification number S.O. 4213(E), dated 30th August, 2018. |